Automobile retailer AutoNation (NYSE: AN) stock is trading up 4.1% for 2022 in the 2022 bear market. The auto retailer saw its quarterly profits hit all-time highs as it rose 34% for fiscal Q2 2022. The global chip shortage and supply chain constraints caused new vehicle sales to fall (-14%) but bolstered used car sales to rise by 13%. However, gross profits on new car sales increased 47%. The Company is seeing strength move away from entry-level $20,000 and under vehicles to the mid and premium tier vehicles. Its finance and insurance (F&I) teams have driven margin growth, and the acquisition of CIG Financial is expected to bring significant upside. The optional products, including service plans and extended warranties, continue to add to the bottom line. Unlike online auto retailer Carvana (NASDAQ: CVNA), AutoNation is profitable. It also trades at just 4.8X forward earnings versus competitor CarMax (NYSE: KMX) stock trading at $17.6X forward earnings. Prudent investors seeking exposure in the retail automobile segment can look for opportunistic pullbacks in shares of AutoNation.

Q2 Fiscal 2022 Earnings Release

On July 21, 2022, AutoNation released its fiscal second-quarter 2022 results for the quarter ending June 2022. The Company reported an adjusted earnings-per-share (EPS) profit of $6.48 excluding non-recurring items versus consensus analyst estimates of $6.22, beating estimates by $0.26. Revenues fell by (-1.6%) year-over-year (YOY) to $6.87 billion missing analyst estimates of $6.97 billion. While new vehicle revenues fell (-14%), used vehicle revenues grew 13%. New vehicle gross profit rose 47%, while used vehicle gross profit fell (-14%). Customer financial services gross profit grew 16% to $2.72 billion. The Company authorized an additional $1 billion stock buyback and announced its plan to acquire CIG Financial. AutoNation CEO Mike Manley commented, "AutoNation Associates delivered outstanding performance across all of our business sectors, leveraging our customer focus, digital capabilities, cost discipline, and capital allocation to produce record results. I am particularly pleased with our After-Sales penetration, with gross profit increasing 11% compared to last year. This is a key profit driver that has been a particular area of focus since my arrival, and that has been structurally embedded in the organization. Additionally, today, we announced our agreement to acquire CIG Financial, an auto finance company. This acquisition addresses a key strategic next step in the evolution and expansion of our customer relationships, particularly for our used vehicle business,"

Conference Call Takeaways

CEO Manley elaborated on the quarterly performance that despite a flat YoY revenue, the Company was able to grow operating income by 5% to $558 million, and EPS was a record $6.48. Low inventory of new automobiles led to the 25% volume drop, but margins were substantially boosted by 47% YoY. Used car revenue rose 13%, but the volume dropped (-4%). Tight inventory resulted in volume reduction with entry-level vehicles priced at $20,000 or less. Mid and premium used vehicles had strong demand and rising YoY volume. Historically 40% of its sales have been in the entry-level vehicles, but the trend is favoring mid to premium level is seeing the strength. The Company improved on its used car margins, and its F&I teams continue to prove to be the best in the business. The penetration of optional products, including service plans and extended warranties, is driving performance. The acquisition of CIG Financial will bring significant upside. The Company gets 90% of its user inventory sourced from trade-ins, lease returns, and its “we will buy your car” program. The Company plans to open a new AutoNation USA store in Georgia in Q3 with plans to have 130 of these stores in the U.S. by 2026.

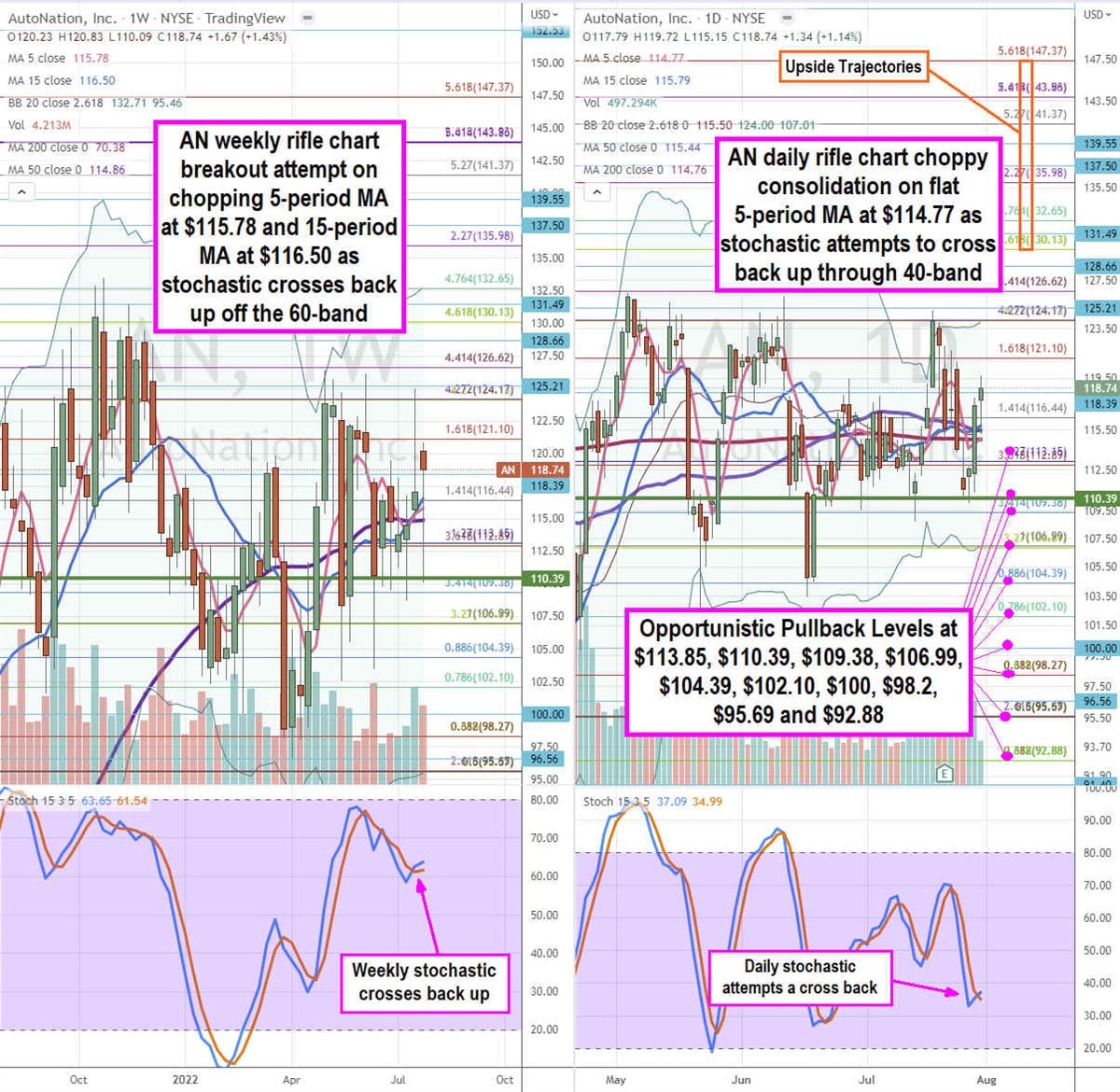

AN Opportunistic Pullback Levels

Using the rifle charts on the weekly and daily time frames provides a precise view of the landscape for AN stock. The weekly rifle bottomed out near the $98.27 Fibonacci (fib) level. The weekly rifle chart reversed quickly back into an uptrend as the stochastic coiled back up through the 20-band to trigger a weekly market structure low (MSL) buy signal on the breakout through $110.39. The weekly rifle chart is choppy now, with the 5-period moving average (MA) at $115.78, 15-period MA at $116.50, and the 50-period MA at $114.86. The weekly Bollinger Bands (BBs) sit at $132.71 and $95.46, respectively. The daily rifle chart also has a choppy flat chart with the 5-period MA at $114.77, 15-period MA at $115.79, 50-period MA at $115.44, and the 200-period MA at $114.75. Basically, there is a cluster of bumpers in the $114 to $117 range. The daily stochastic is attempting to cross up of the 30-band. Prudent investors can look for opportunistic pullbacks at the $113.85, $110.39 weekly MSL trigger, $109.38 fib, $106.99 fib, $104.39 fib, $102.10 fib, $100.00, $98.27 fib, $95.69 fib, and the $92.88 fib level. Upside trajectories range from the $130.13 fib level up to the $147.37 fib level.