Many see the beginning of the new year as the ideal moment to reflect on long-term goals and start making positive changes. Of these deliberations, personal financial planning is often recognized as both the most important and stressful.

This year investors are likely to find the process even more brooding than usual following 2022’s developments: the Dow, NASDAQ, and S&P 500 averaged losses of over 18%; the international geo-political stage produced more causes for concern than any in recent history; and inflation remained at least 7.1% higher than it was in 2021 according to the Consumer Price Index (CPI).

With several prominent experts projecting a record-setting year for gold, there may have never been a better time to diversify with precious metals.

For more information about the benefits of investing in gold, request a free wealth protection kit from Direct Bullion USA.

Alternatively, here are three reasons that experts are projecting gold to reach all-time highs.

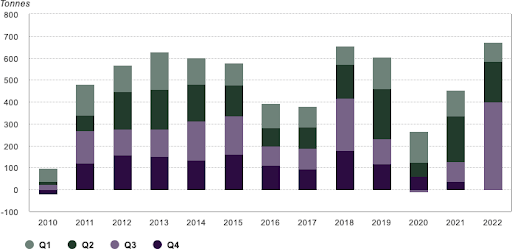

1. Central Bank Gold Buying Just Reached an All-Time Quarterly Record

The World Gold Council reported that global central bank purchases leapt to almost 400 tons in the third quarter of 2022. This represents the largest single quarter of demand for gold ever. Equally as important, it lifted the year-to-date total of purchases to 673 tons: the highest of any full year since 1967, when the U.S. dollar was actually backed by gold.

In 1967, European central banks bought massive volumes of gold from the U.S., leading to a run on the price and the collapse of the London Gold Pool of reserves. That hastened the eventual demise of the gold standard, and made the U.S. dollar the main reserve asset of most countries in the world.

Ironically, the message these central banks are now sending by putting a larger share of their reserves in gold is that they don’t want to rely on the dollar as their primary reserve asset. Like many Americans, they are also losing faith in it.

2. Weakening U.S. Dollar

Gold prices and the value of the U.S. dollar are generally inversely related. This means that a stronger dollar tends to keep the price of gold lower and more controlled, while a weaker dollar tends to drive the price of gold higher. This is also why gold is perceived as one of the few ultimate hedges against inflation, when prices rise and the value of the dollar falls. As inflation increases, so does the price of gold.

It’s no secret that the dollar has been weakening recently, as seen by central banks’ newfound preference for gold.

According to senior analysts at Wells Fargo, the dollar is expected to depreciate significantly during the second half of 2023 as monetary policy eases in the United States.

3. A Dovish Federal Reserve

The Federal Reserve and its chairman — Jerome Powell — were very aggressive with rate hikes for the majority of 2022. The aggressive interest-rate campaign sent the dollar soaring and hurt gold in the process, but fortunately, that script has flipped in recent months.

While the Fed implemented burdensome 75 basis point hikes for the majority of 2022, they reduced the amount to 50 basis points for the final hike of the year. Moreover, several notable Federal Reserve board members, including Vice Chair Lael Brainard, have expressed their belief in lowering or pausing rate hikes as the next step toward fixing the economy. Many successful investors believe that these factors indicate lower hikes for the foreseeable future.

Lower rates have historically increased demand for gold bullion in comparison to interest-bearing assets, as shown by gold surging to an eight-month high following the 50-point hike. This is yet another reason to have high expectations for the performance of precious metals this year.

Takeaways

Many of the most influential investors in the world are bullish about the price of gold in 2023, and the reasons are clear.

Before investing in gold, it is important to learn about the market and stay up-to-date with current trends to gain a better overall understanding. Though gold is considered one of the most dependable long-term investments,

investors should start by setting financial goals and weighing the pros and cons.

To speak with an expert and request a free gold buyers guide, call Direct Bullion USA at 1-800-757-7050 or visit https://directbullionusa.com/.

Media Contact

Company Name: Direct Bullion USA

Contact Person: Samuel O'Brien, President

Email: Send Email

Phone: (800) 757-7050

Country: United States

Website: http://www.directbullionusa.com/