Effectv’s analysis shows some marketers reduce advertising during the summer, despite the strong, continued consumption across all seasons.

Effectv today released the results of new research examining summer television viewership and advertising trends. Chief among the findings was this: Marketers that maintain TV advertising during the summer months, a period when advertisers have traditionally pulled back, may see a significant boost in their brand’s share of voice.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230601005228/en/

(Graphic: Business Wire)

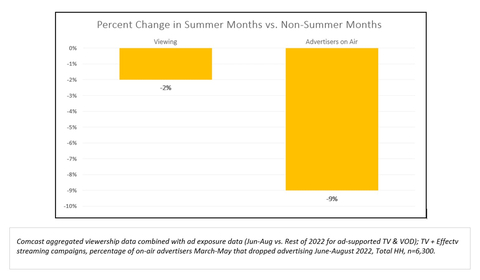

Insights from aggregated viewership data show a mere 2% difference in ad-supported time spent viewing content for the summer months. However, despite this strong and consistent consumption, Effectv found that nearly 1 in 10 advertisers choose to go dark in the summer months.

The research reveals that advertisers who stay on air in the summer months can reap additional share of voice, as some of their competitors choose to go off air. In fact, the study shows that advertisers on average can increase share of voice in their market by 36% by staying on through the summer. The benefit of higher share of voice by staying on air was found across categories, with jumps particularly evident in the events (78%), travel (61%) and political (26%) sectors.

Share of voice represents the share of advertising a brand has compared to others in the category and market. At lower levels of competitive advertising, recall of advertising messages increases – a clear advantage for brands that stay on air consistently. Furthermore, market share for advertising brands accelerates when competitors stop advertising while market share of any brand declines rapidly when they stop advertising. 3

“Data shows that TV viewing remains relatively flat into the summer, but a disproportionate number of advertisers pull back on their campaigns unnecessarily,” said Travis Flood, Executive Director of Insights, Comcast Advertising. “The days of sleepy summer reruns have been over for years as cable TV and streaming services provide premium content all year long for viewers. Advertisers should follow the data and reach their audience when they are watching throughout the year.”

Sources:

- Comcast aggregated viewership data combined with ad exposure data (Jun-Aug vs. Rest of 2022 for ad-supported TV & VOD); TV + Effectv streaming campaigns, percentage of on-air advertisers March-May that dropped advertising June-August 2022, Total HH, n=6,300.

- Comcast aggregated viewership data combined with ad exposure data from TV + Effectv streaming campaigns, 2022, Total HH, n=4,300, Summer= June – August. Non-Summer=Jan. – May & Sept. – Dec.

- De Canha, N., M. Ewing, and A. Tamaddoni. “The Impact of Advertising on Market Share: Controlling for Clutter, Familiarity, and Goodwill Decay.” Journal of Advertising Research 60, 1 (2020): 87–103.

About Effectv

Effectv, the advertising sales division of Comcast Cable, helps local, regional and national advertisers use the best of digital with the power of TV to grow their business. It provides multi-screen marketing solutions to make advertising campaigns more effective and easier to execute. Headquartered in New York with offices throughout the country, Effectv has a presence in 66 markets with nearly 35 million owned and represented subscribers. For more information, visit www.effectv.com.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230601005228/en/

Contacts

Media

Elaine Wong

elaine_wong@comcast.com