Feeling Hesitant to Negotiate? Only 42% of Young Professionals Negotiated Last Job Offer, Yet Nearly Nine-in-Ten Had Success

Fidelity’s 2022 Career Assessment Study Reveals More Job Change is Imminent and Young Professionals Are Seeking Higher Salaries/Promotion, Increased Retirement Savings, More Flexibility

Most Upcoming College Graduates Are ‘Excited’ & 61% Value Quality of Work Life Over Financial Benefits

It’s no secret that the last two years of the pandemic have caused many Americans to reassess their lives – everything from health, family, financial situation and careers. Fidelity Investments®, in its commitment to helping its customers achieve their financial goals at every life stage, today shares results of its 2022 Career Assessment Study. The study examines how working professionals are evaluating their next career move, the employer benefits that are most meaningful, and how they balance monetary benefits versus quality of work life.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220504005021/en/

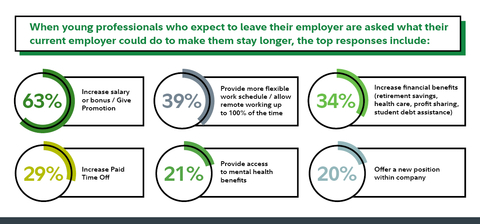

Top responses from young professionals who expect to leave their employer when asked what their current employer could do to make them stay longer, according to Fidelity's 2022 Career Assessment Study. (Graphic: Business Wire)

The study reveals that six-in-ten (61%) young professionals – those 25-35 years old – have undergone a job change in the last two years, or they plan to make a move in the next two years. That breaks down to roughly one third (37%) who have been in their current position for two years or less and almost half (44%) who expect to be at a different company within the next two years.

“Young professionals are more diverse than previous generations and their approach to life, work and money is unique, especially as they face external events from market volatility to inflation – many for the first time in their adult lives,” said Kelly Lannan, senior vice president, Emerging Customers, Fidelity Investments. “It’s therefore no surprise this group looks at the workplace in a new light. Of course, financial benefits will always be important, but there’s also a heightened expectation from younger professionals to have more paid time off, schedule flexibility and meaningful work – and they’re not afraid to make a change to attain that expectation.”

While salary is typically the most important factor when a person is assessing a job offer -- the other top three financial considerations reported by young professionals include: Medical benefits (54%); Retirement savings (49%); Bonus (34%). When it comes to non-financial benefits that young professionals would prioritize in a job offer, they include: Paid time off (59%); Schedule flexibility / Remote work (65%); Professional development (28%).

College Students Future Career Outlook is Optimistic

For upcoming college graduates, those in the class of 2022 or 2023, nearly half (45%) are feeling excited about their approaching graduation. In fact, 44% expect to land a job that meets most of their requirements and another 22% expect to land their dream job. Like their more experienced peers, these college students prioritize the following financial considerations (aside from salary) when evaluating a job: 1) Medical benefits/health care (70%); 2) Retirement savings (54%); 3) Bonus opportunities (31%); and 4) Student debt assistance (25%).

Yet, ultimately a much greater percentage of college students (61%) than working professionals (48%) report they value factors improving their overall quality of work life versus financial benefits when evaluating a job offer.

“The last two years have been a pivotal time for many life decisions, and many young working professionals are still assessing their current job – they are prioritizing increased salary, flexibility at work and financial benefits like retirement savings,” added Lannan. “However, current college students are putting a greater emphasis on their quality of work life when they are thinking about their career moves after graduation. At Fidelity, we understand that money touches all aspects of a person’s life, so while it’s important to feel like a company is the right cultural fit, and there’s access to professional development opportunities, it still remains critical to understand the financial implications of leaving or staying at a job.”

Ready to Hop to the Next Job? 3 Money Tips to Keep Your Finances Moving Forward, Too

- Consider benefits beyond salary: Of course, salary and bonus opportunities are critical when considering the total financial package of an offer, but don’t forget about factors such as access to a retirement savings plan and employer match; student debt assistance; health and medical insurance; and even the cost of living if the job requires a relocation. Fidelity’s Evaluate a Job Offer calculator helps quantify these factors for those assessing whether they should stay in their current position or move to a new job.

- Negotiate your next job offer: According to the study, 58% of young professionals accepted their current job offer without negotiating, yet for those that did negotiate, a resounding 87% got a least some of what they asked. It can be tough for people to advocate for themselves, but Fidelity suggests candidates focus on the skills and value they bring to the organization.

-

Don’t forget about your 401(k): When leaving a job for a new one, many professionals have four options for the 401(k) or 403(b) retirement savings their former employer offered:

- Rollover, meaning move money from an old 401(k) to an IRA (Individual Retirement Account)

- Rollover – moving money from an old 401(k) – to a new workplace retirement savings plan

- Keep it in former employer’s plan

- Cash out

According to the young professionals in Fidelity’s Career Assessment Study, of those who had a workplace retirement savings plan, 30% opted to cash out, meaning they could have faced a 10% withdrawal penalty and the money would have been subject to state and federal taxes since they were younger than age 59 ½.

Fidelity encourages professionals to first understand these options and take a look at this comparison chart to determine which option may be the best fit for their individual situation.

Choosing to Stay at Your Current Company? 3 Tips for Moving Your Career Forward

Fidelity’s Life Event resources has a Networking and Career Moves section full of rich content for professionals looking to get ahead. For those people who have decided to stay at their current job, it doesn’t mean they have to be content with the status quo. Here are three moves to keep careers moving forward.

- Track Your Wins: For those seeking a promotion, start gathering evidence on the reasons they are qualified for a more advanced position. Build a portfolio of this work and have specific examples of meeting a goal and driving business results. Don’t forget to highlight any praise that was received.

- Be a Team Player: Having strong professional references from peers and managers can go a long way in getting ahead at work. Volunteer to take on new tasks that will stretch skills, show initiative and be proactive on offering solutions to make improvements.

- Be Vocal: It may sound obvious, but professionals should let management know they are interested in moving up. They should suggest an opportunity they have researched and let others know their interest and start networking with the right people.

More Fidelity Resources for Those Assessing a Career Move

- Check out Fidelity’s Life Events hub, an online experience designed to support professionals during life’s big moments. The Job Change section offers resources to help take the next step in a career or navigate a job change successfully.

- Have an old 401(k) from a former employer that you don’t know what to do with? Consider and compare these options to find the one that makes sense depending on your specific situation and needs.

- Starting a new job? Professionals may be leaving money behind – so read this Fidelity Viewpoints article Starting a new job? Make these money moves to stay informed.

Learn more about how Fidelity is helping the next generation of customers with education, products & services, and opportunities to join money conversations on TikTok, Instagram, Reddit and other channels. Fidelity is also providing new career opportunities to thousands, including entry-level positions, hiring more than 16,600 new associates in 2021. The firm will continue its focus on recruiting new talent in 2022.

About Fidelity’s 2022 Career Assessment Study

This study presents the findings of a national online survey among a sample of 1,524 U.S. adults ages 25-70 who currently work either full or part time. Additionally, 204 college students graduating in 2022 or 2023 were also surveyed. Interviewing for this CARAVAN® survey was conducted March 8-14, 2022 by Engine Insights which is not affiliated with Fidelity Investments. The results of this survey may not be representative of all adults meeting the same criteria as those surveyed for this study.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.3 trillion, including discretionary assets of $4.2 trillion as of March 31, 2022, we focus on meeting the unique needs of a diverse set of customers. Privately held for over 75 years, Fidelity employs more than 57,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Investments and Fidelity are registered service marks of FMR LLC.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 02110

1024419.1.1

©2022 FMR LLC. All rights reserved.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220504005021/en/

Contacts

Contact for Media Only:

Corporate Communications

(617) 563-5800

FidelityMediaRelations@fmr.com

Lauren Zinn

(401) 292-9861

lauren.zinn@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity