Teladoc and UnitedHealthcare Rank Highest in Respective Segments

By all accounts, telehealth has transformed healthcare delivery over the past 18 months as droves of patients have adopted the technology as a safe, immediate and convenient way to access care. However, with telehealth utilization surging 36% among survey respondents during the past year, the industry has begun to experience some growing pains. According to the J.D. Power 2021 U.S. Telehealth Satisfaction Study,SM released today, service limitations, difficulty accessing care and inconsistent care are some of the headwinds the telehealth industry is confronting as it matures.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210930005178/en/

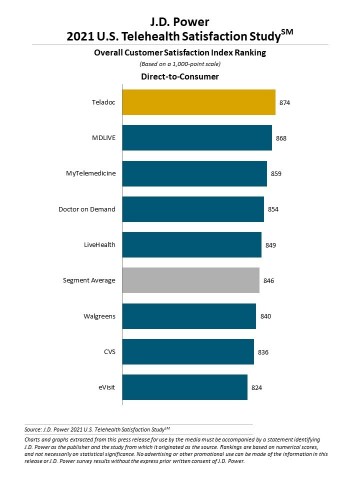

J.D. Power 2021 U.S. Telehealth Satisfaction Study (Graphic: Business Wire)

“It’s impossible to ignore that 36% of the healthcare customers we measure within our research have used telehealth services this year—which is four times higher than a year ago,” said James Beem, managing director of global healthcare intelligence at J.D. Power. “However, digging deeper into the research, it’s clear that customer satisfaction has declined during the same period, with many users citing limited access to the services they need and inconsistencies in the care they receive. As the industry grows, it is critical to address these challenges.”

Following are some key findings of the 2021 study:

- Telehealth adoption spikes across all generations in 2021: Overall, 36% of patients have accessed telehealth services during the past year, up from just 9% in 2020 and 7% in 2019. Usage is consistent across all generational groups, with the highest usage among members of Generation Y and Pre-Boomers.1

- Convenience, speed and safety drive utilization: The top reasons for telehealth utilization are convenience (57%); ability to receive care quickly (47%); and safety (36%).

- Patient satisfaction declines as pain points emerge: Overall satisfaction with both direct-to-consumer and payer-sponsored telehealth services decline in 2021 from 2020. The most frequently cited barriers encountered by patients are limited services (24%); lack of awareness of costs (15%); confusing technology requirements (15%); and lack of information about providers (15%).

- Uneven care for higher-risk patients: Overall satisfaction is 85 points lower (on a 1,000-point scale) among patients with the lowest self-reported health status than among patients who consider themselves to be in excellent health. Similarly, healthier patients are more likely than less healthy patients to understand the information provided during the visit; say they receive clear explanations; perceive that their visits are highly personalized; and obtain high-quality diagnoses.

Study Rankings

Teladoc ranks highest in telehealth satisfaction among direct-to-consumer brands, with a score of 874. MDLIVE (868) ranks second and MyTelemedicine (859) ranks third.

UnitedHealthcare ranks highest among payers of health plan-provided telehealth services with a score of 868. Humana (865) and Kaiser Foundation Health Plan (865) rank second in a tie.

The J.D. Power U.S. Telehealth Satisfaction Study, now in its third year, measures customer satisfaction with their telehealth service experience based on four factors (in order of importance): customer service (42%); consultation (28%); enrollment (19%); and billing and payment (11%). The study is based on responses of 4,676 healthcare customers who used a telehealth service within the past 12 months. It was fielded in June-July 2021.

For more information about the 2021 U.S. Telehealth Satisfaction Study, visit https://www.jdpower.com/business/resource/us-telehealth-study.

To view the online press release, please visit http://www.jdpower.com/pr-id/2021122.

About J.D. Power

J.D. Power is a global leader in consumer insights, advisory services and data and analytics. A pioneer in the use of big data, artificial intelligence (AI) and algorithmic modeling capabilities to understand consumer behavior, J.D. Power has been delivering incisive industry intelligence on customer interactions with brands and products for more than 50 years. The world's leading businesses across major industries rely on J.D. Power to guide their customer-facing strategies.

J.D. Power has offices in North America, Europe and Asia Pacific. To learn more about the company’s business offerings, visit JDPower.com/business. The J.D. Power auto shopping tool can be found at JDPower.com.

About J.D. Power and Advertising/Promotional Rules: www.jdpower.com/business/about-us/press-release-info

1 J.D. Power defines generational groups as Pre-Boomers (born before 1946); Boomers (1946-1964); Gen X (1965-1976); Gen Y (1977-1994); and Gen Z (1995-2004). Millennials (1982-1994) are a subset of Gen Y.

View source version on businesswire.com: https://www.businesswire.com/news/home/20210930005178/en/

Contacts

Media Relations Contacts

Geno Effler, J.D. Power; West Coast; 714-621-6224; media.relations@jdpa.com

John Roderick; East Coast; 631-584-2200; john@jroderick.com