- 1-in-4 High School Parents Believe One Full Year of College Will Cost $5,000 or Less

- Nearly 2/3 of College Graduates and Parents Report Sticker Shock Over Loan Balances

- Fidelity Offers Resources, Insights, for Families Planning their College Journey

As millions of families prepare to send students back to another uncertain year of school this fall, has the rising cost of college put a damper on pre-pandemic dreams? According to Fidelity Investments, a leading provider of college savings and student loan debt solutions to individuals and plan sponsors, 6-in-10 college-bound high school students say the pandemic has shaped their view of the role of higher education. The 2021 College Savings and Student Debt Study reveals that members of this young generation are wary of the high price tag for college with 4-in-10 rating cost as “most important” when asked specifically how important it is in choosing where and how to pursue higher education.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210810005181/en/

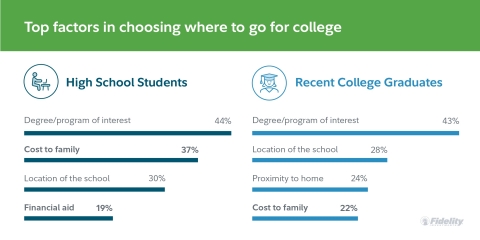

Fidelity study shows high school students rate cost as a higher priority than recent college graduates (Graphic: Business Wire)

The study, which analyzes families’ financial behaviors and attitudes around higher education, also finds parents increasingly willing to put their own financial wellness second to helping their children achieve the dream of college. In fact, parents of high schoolers are more likely than those of recent graduates to say they plan to or have taken out federal PLUS loans, a type of education debt that’s increasingly weighing down Boomers and Gen-X.

“Covering the cost of college can be overwhelming, which is why it’s so critical to save as early as possible,” said Rita Assaf, vice president of Retirement and College Leadership at Fidelity Investments. “As young people see other generations struggle with the burden of student debt, they have clearly grown increasingly aware of how it can impact financial security. Families can take the first step together by sitting down to discuss how they’ll save and pay for college.”

Gen-Z Determined to Balance College Costs with Long-Term Goals

What value do today’s high school students see in higher education? More than half (53%) say getting a job that pays enough to support their long-term goals is among their top priorities, much higher than recent graduates, where only 42% of grads said the same. In addition, high schoolers are motivated to secure a job in a field they are interested in or passionate about (55%) and want to set themselves up for a solid and stable career (51%). Nearly one quarter (23%) say getting a job that allows them to give back to their community or the world is a top goal.

Offering encouragement that the next generation is open to lower-cost educational settings, 8-in-10 high schoolers say they believe a community college would help them achieve their goals, and over 90% say a public in-state college would do the same. Whether this awareness will translate into different enrollment decisions remains to be seen, but prospective college-goers are increasingly considering how their higher education will impact their families; while recent graduates say how much it will cost their family was the fourth most important factor in choosing a college, today’s high school students give it a much higher ranking.

Many Families Unprepared to Handle Rising Cost of College

Although many high school students increasingly worry about how much their education will cost, the study reveals staggering disconnects between expectations of costs and reality. Part of this may be the result of parents using their own college experience as a benchmark for future costs (as more than a quarter of high school parents say they do), despite the fact college pricing has far outpaced inflation over the last decade. On average, high school parents expect the annual cost of college to be $22,257 (for tuition, room and board, books, and fees), far lower than the College Board’s 2020 report. Even more concerning, one-in-four high school parents believe the full sticker price for one year of college will be $5,000 or less, and 38% of high school students say the same.

This underestimation is also reflected in how much debt students and parents expect to carry once they graduate. Estimates for student debt by those not yet in college fall far below the national average1; four-in-ten high school students who plan to take loans expect they’ll have a balance of $5,000 or less by the time they graduate, and more than a quarter (27%) of high school parents say they’ll have similarly low parent loan balances.

What’s more, many high school parents (37%) confess they simply haven’t started saving for their child’s education just yet. The good news is, among those who have started saving, most started by the time their child was six years old, with a median age of 5. Saving while children are young is wise, as contributions have more time to potentially grow. Families saving in a dedicated college savings account such as a 529 say they feel “grateful to have saved some money toward college,” and “optimistic that my child will be able to pursue higher education thanks to the savings.”

The Ultimate Hangover: When the Post-Grad Debt Sets In

Students and parents both admit that loans play a major role in financing higher education; in fact, 49% say they anticipate taking or did take on debt (student loans, Federal PLUS loans, or other parent loans) to pay for the cost of college. Nearly one-third of recent college graduates say they don’t know how long it will take to repay these loans.

When it comes to parents taking on debt to finance their child’s education, the study reveals an increasing willingness to take on PLUS loans (26% of high school parents plan to use them, vs. just 18% of parents of recent graduates). For those considering the use of these loans, it’s important to review how this debt could impact their financial future, since PLUS loans often carry higher interest rates than traditional student loans. In fact, nearly three-quarters (72%) of parents said the final balance of their Federal PLUS loans was higher than expected. When the bill comes due, nearly three-quarters of those familiar with PLUS loans say it will impact their ability to save for retirement as well as their ability to pay down other debt like credit cards, mortgages, or auto loans.

“Fidelity’s Student Debt Tool data shows us time and again that education debt is not just a problem for younger generations; in fact, Baby Boomers have the highest average balance with $57,0002,” said Jesse Moore, Head of Student Debt at Fidelity. “Before taking out debt to finance their child’s education, parents should carefully consider how repayment will fit into their day-to-day budget and how it could impact long-term goals such as retirement.”

Financial Security is Top Priority for Parents and Students Alike; Advisors Can Help

Nearly half of all respondents (46%) claim “financial security for myself and/or my family” is their most important financial priority, and approximately one-quarter of high school students and one-in-five recent grads identified “living debt free” as most important. With these goals in mind, creating a financial plan incorporating the cost of higher education and student loan repayment is an important step for students and families planning their college journey. For those looking for input from others, financial professionals can play a key role, providing resources and insights to establish more accurate goals for college savings and develop a strategy for debt as part of the college financing equation.

“Advisors should help bring families together to discuss these important topics, because paying for college has a tremendous impact on the whole household’s financial picture,” said Ron Hazel, vice president of Fidelity Advisor 529 and individual retirement products. “While it’s never too late to start, planning for a child’s education while they’re young can help families feel more confident in meeting their college savings goals.”

The study reveals important differences when it comes to preparedness to meet the cost of college between those working with an advisor and those without one. One key difference: those with an advisor are far more likely to have already started saving for their child’s future education.

Fidelity Offers Resources to Make Higher Education Achievable

Fidelity studies have consistently shown saving in a dedicated account like a 529 is correlated with better outcomes and higher likelihood of meeting college savings goals3. Simple steps such as saving where you’re spending by using a rewards credit card that earns cash back towards a college savings account, enlisting family and friends to gift into a child’s 529, and automating monthly contributions could also help families stash away more cash before their children are ready to enroll in college.

To help all families plan and pay for the college journey, Fidelity offers resources, including:

- A College Savings Calculator to see if you’re on track to meet your goals, and a Student Debt Tool that allows borrowers to have a singular view of federal and private loan options by aggregating all of their student debt loans in one place, along with options available for repayment.

- A college hub with resources and insights for every step of the journey, from saving while children are young, to applying to college and estimating costs, to dealing with debt.

- A Student Debt Benefits program that allows employers to design a program that best serves the needs of their specific workforce, which can help with recruiting, improve retention and boost productivity. This program includes Student Debt: Direct℠, which helps employees with monthly payments toward their loans—now tax free and integrated with Tuition Reimbursement based on client need; and Student Debt: Retirement℠, which allows employers to make 401(k) contributions based on student loan payments.

- Additionally, Fidelity’s Planning and Guidance Center makes it simple to track progress against multiple financial goals, including saving for college or paying down debt.

- Viewpoints articles to evaluate The Cost of College and a Guide for Student Loans.

- Appointments at Fidelity’s more than 200 nationwide investor centers or by calling 800-FIDELITY.

- Fidelity’s associates have access to our Student Debt Program; since it began in 2016, more than 12,000 Fidelity employees have saved $58 million in principal plus about $27 million in interest payments with an average savings of $7,000 per person.

About the Fidelity Investments 2021 College Savings and Student Debt Study

This study presents findings of an online survey among a sample of 4,004 respondents who are 15 years of age or older and either a current high school student in grades 10-12, a recent graduate of an undergraduate program, a parent of a high school student in grades 10-12, or a parent of a recent graduate. Fielding for this survey was completed between May 27, 2021 and June 25, 2021 by Engine Insights, which is not affiliated with Fidelity Investments. For more information, a fact sheet can be found on Fidelity.com.

About Fidelity Investments

Fidelity’s mission is to inspire better futures and deliver better outcomes for the customers and businesses we serve. With assets under administration of $11.0 trillion, including discretionary assets of $4.1 trillion as of June 30, 2021, we focus on meeting the unique needs of a diverse set of customers: helping more than 35 million people invest their own life savings, 22,000 businesses manage employee benefit programs, as well as providing more than 13,500 wealth management firms and institutions with investment and technology solutions to drive growth. Privately held for 75 years, Fidelity employs more than 47,000 associates who are focused on the long-term success of our customers. For more information about Fidelity Investments, visit www.fidelity.com/about-fidelity/our-company.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

500 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

200 Seaport Boulevard, Boston, MA 02110

990490.1.0

© 2021 FMR LLC. All rights reserved.

______________________________

1 College Board’s 2020 Trends in Higher Education Series shows an average of $28,800 in debt for graduates of four-year public and private colleges and universities

2 Fidelity Student Debt Tool data, as of June 30, 2021

3 2020 Fidelity College Savings Indicator Study

View source version on businesswire.com: https://www.businesswire.com/news/home/20210810005181/en/

Contacts

Corporate Communications

(617) 563-5800

fidelitycorporateaffairs@fmr.com

Deanna Spaulding

617-563-8359

Deanna.spaulding@fmr.com

Follow us on Twitter @FidelityNews

Visit About Fidelity and our online newsroom

Subscribe to email alerts for news from Fidelity