- New model brings stock market analysis to the next level

- Provides comprehensive examination of past, present, and future of US equities market

- Today Oliver Wyman CEO Nick Studer will be at the New York Stock Exchange to discuss the model and to participate in the ringing of the closing bell in honor of Marsh McLennan’s 150th anniversary

The Oliver Wyman Forum, Oliver Wyman’s research and leadership community, today introduced the Holistic Market Model, providing the most comprehensive analysis of the US stock market ever developed. Oliver Wyman is a business of Marsh McLennan (NYSE: MMC).

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20211026006002/en/

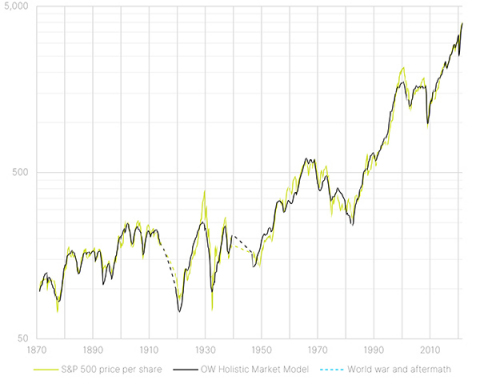

Oliver Wyman’s Holistic Market Model of S&P 500 real price per share 2020 $, January 1871–June 2021 (Graphic: Business Wire)

The research was conceived and led by Jacques Cesar, a former managing partner of Oliver Wyman. It combines finance, accounting, analytics, economics, history, and sociology to crack the code of the stock market’s ups and downs over the past 150 years more accurately than anything before it.

The HMM answers two fundamental questions:

- Which forces, and in what combination, have driven the stock market over the past 150 years?

- How will changes to those forces determine where equity prices go next?

Most important, it calculates how changes in inflation, taxation, interest rates, income inequality, market psychology, and other drivers will determine future market levels.

The model also represents a major leap forward from the Capital Asset Pricing Model (CAPM), as well as the Cyclically Adjusted Price/Earnings ratio (CAPE) and other common gauges of equity valuation developed over many decades.

“This work exemplifies Oliver Wyman’s ability to create breakthroughs in the most challenging problems facing business, finance, and society,” said Nick Studer, President and CEO of Oliver Wyman.

A series of five white papers to be unveiled today and over the next few months will lay out the work, which has led to numerous insights into market behavior and the limitations of traditional approaches. Key findings include:

- Equity market valuations just before the COVID-19 pandemic were elevated, but not extreme.

- Corporate profit margins are near a 100-year high.

- The CAPM can be made to work in practice – but only with major modifications. The HMM is its natural successor because it both makes the CAPM work and dramatically broadens its scope.

- Explaining stock market performance can be done without using the apparatus of modern finance. Surprisingly, 19th century economic tools based on supply and demand also do the job.

- Equity prices have been high in recent years not because of rampant speculation but because of historically unusual and favorable conditions.

- The ballot box will largely determine whether or not equities return to their baseline historical trend over the long term.

“Anyone interested in drilling down into the US stock market will benefit from close study of the HMM and the thinking behind it,” said John Romeo, Managing Partner of Oliver Wyman and Head of the Oliver Wyman Forum.

Cesar, the author of the five white papers, notes that different parts of the research will interest different communities. For example, the academic community will be most interested in the reengineering of the CAPM and its extension into the much broader HMM. Treasury and Federal Reserve officials will be most interested in the quantification of the linkage between tax and monetary policy and equity prices. Investors and money managers will focus on how the work can help them position their portfolios more skilfully by framing future uncertainty better.

About the Oliver Wyman Forum

The Oliver Wyman Forum is committed to bringing together leaders in business, public policy, social enterprises, and academia to help solve the world’s toughest problems. The Oliver Wyman Forum strives to discover and develop innovative solutions by conducting research, convening leading thinkers, analyzing options, and inspiring action on three fronts: Reframing Industry, Business in Society, and Global Economic and Political Change. Together with our growing and diverse community of experts, we think we can make a difference. For more information, visit www.oliverwymanforum.com.

About Oliver Wyman

Oliver Wyman is a global leader in management consulting. With offices in 60 cities across 29 countries, Oliver Wyman combines deep industry knowledge with specialized expertise in strategy, operations, risk management, and organization transformation. The firm has more than 5,000 professionals around the world who work with clients to optimize their business, improve their operations and risk profile, and accelerate their organizational performance to seize the most attractive opportunities. Oliver Wyman is a business of Marsh McLennan [NYSE: MMC]. For more information, visit www.oliverwyman.com. Follow Oliver Wyman on Twitter @OliverWyman.

View source version on businesswire.com: https://www.businesswire.com/news/home/20211026006002/en/

Contacts

PR Contact:

Patricia Romero

Mobile: | +44 (0) 7825 193311

patricia.romero@oliverwyman.com