Williams-Sonoma, Inc. (WSM), headquartered in San Francisco, California, operates as an omni-channel specialty retailer of various products for home. With a market cap of $25.5 billion, the company retails cooking and serving equipment, home furnishings, and home accessories through retail stores, mail order catalogs, and e-commerce.

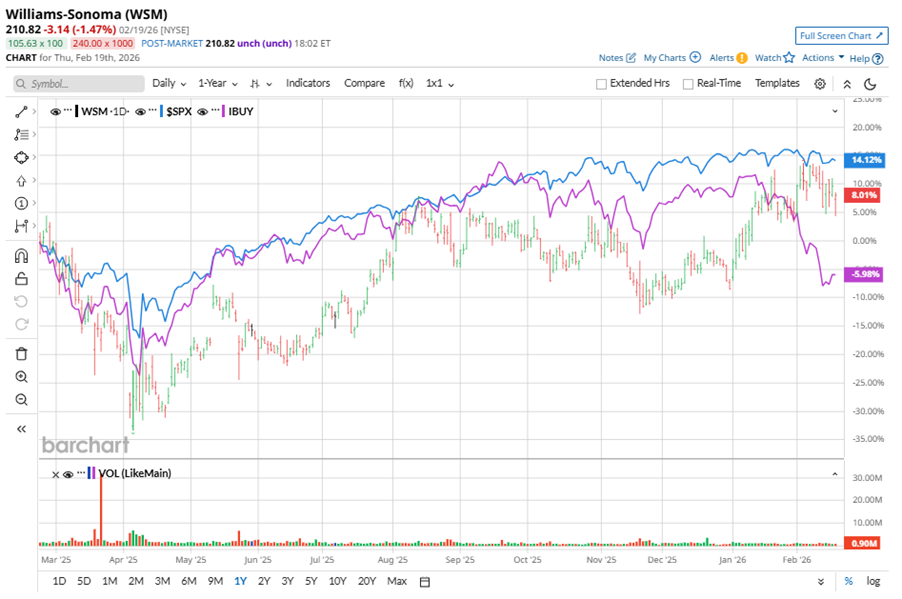

Shares of this multi-channel specialty retailer have underperformed the broader market over the past year. WSM has declined 1.3% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 11.7%. However, in 2026, WSM’s stock rose 18.1%, surpassing the SPX’s marginal rise on a YTD basis.

Looking closer, WSM’s outperformance is apparent compared to the Amplify Online Retail ETF (IBUY). The exchange-traded fund has declined about 11.9% over the past year. Moreover, the stock’s gains on a YTD basis outshine the ETF’s 12.7% losses over the same time frame.

On Nov. 19, 2025, WSM shares closed down more than 3% after reporting its Q3 results. Its EPS of $1.96 exceeded Wall Street expectations of $1.87. The company’s revenue was $1.88 billion, surpassing Wall Street forecasts of $1.85 billion.

For fiscal 2025, ended in January, analysts expect WSM’s EPS to decline 1% to $8.70 on a diluted basis. The company’s earnings surprise history is impressive. It beat the consensus estimate in each of the last four quarters.

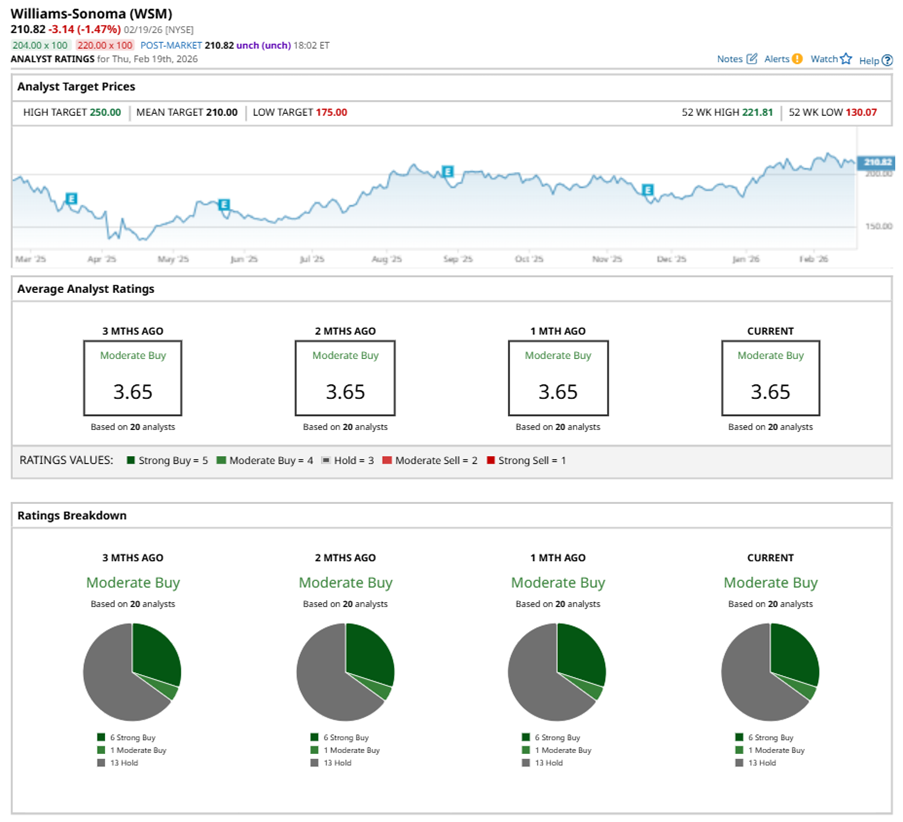

Among the 20 analysts covering WSM stock, the consensus is a “Moderate Buy.” That’s based on six “Strong Buy” ratings, one “Moderate Buy,” and 13 “Holds.”

The configuration has been consistent over the past three months.

On Jan. 29, Zelman upgraded WSM to a “Neutral” rating with a $205 price target.

While WSM currently trades above its mean price target of $210, the Street-high price target of $250 suggests an upside potential of 18.6%.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Down 24% in 2026, Where Is Palantir Stock Headed Next and Should You Buy PLTR Here?

- As Meta and Nvidia Announce a Huge, Multi-Year Partnership, Which Is the Better Stock to Buy?

- Palo Alto Networks Stock Has Tanked But Its Free Cash Flow is Strong - Time to Buy PANW?

- 1 Analyst Thinks This Stock is The "Godfather of AI"