Palantir (PLTR) stock, which was once viewed as one of the market’s most unstoppable AI plays, has pulled back sharply. Shares are down about 25% year-to-date (YTD) and now trade about 35% below their 52-week high despite the company’s solid performance.

The recent weakness in PLTR stock is due to two primary concerns. First, valuation. For much of the past two years, Palantir commanded a premium valuation. Its extremely high valuation compared to peers weighed on investors’ sentiment.

At the same time, a new concern emerged from the rapid rise of AI agents for the broader software ecosystem. Investors fear that powerful AI agents could hurt the prospects of software vendors like Palantir.

So far, however, the company’s business momentum and solid outlook tell a different story. Palantir continues to post accelerating revenue growth, supported by strong demand for its AI Platform (AIP) across both government and commercial customers. Rather than being displaced by AI agents, Palantir appears to be positioning itself as an enabler, helping organizations deploy and operationalize AI at scale within complex, regulated environments.

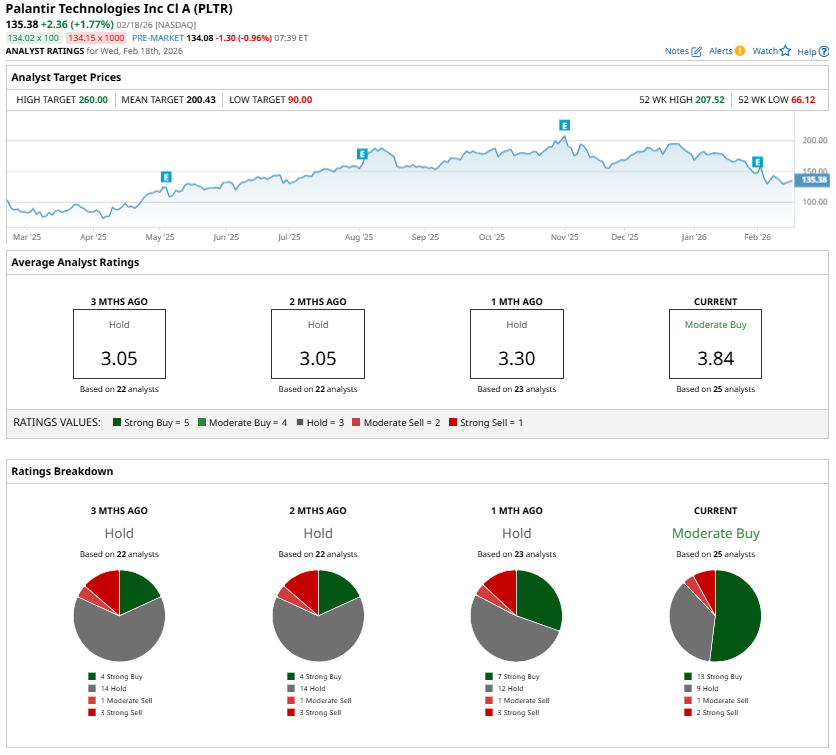

Further, Palantir's stock has gotten cheaper due to the recent selloff, easing some valuation concerns and improving the risk-reward profile. Also, analysts’ sentiment toward PLTR stock improved, supporting its investment case.

Palantir’s Outlook Indicates Solid Growth in 2026

Palantir entered 2026 with strong operating momentum, reflecting accelerating revenue growth, expanding margins, and significant demand for its AIP.

After delivering 56% year-over-year (YoY) revenue growth in 2025, the company has guided 2026 revenue between $7.182 billion and $7.198 billion. At the midpoint, the guidance implies 61% YoY growth, indicating further acceleration.

The key growth driver for Palantir will once again be its U.S. segment. The company’s U.S. commercial revenue surged 137% YoY in the fourth quarter, while U.S. government revenue expanded 66%. The commercial segment reflects increasing enterprise adoption of AIP for production-grade AI deployments.

Palantir is likely to benefit from the expanding wallet share among existing clients and strong new customer acquisition. During 2025, Palantir closed $4.3 billion in U.S. commercial total contract value bookings, a 161% increase from the prior year. Remaining deal value in the U.S. commercial business climbed 145%, indicating significant growth ahead. Customer count in the U.S. commercial reached 571, up 49% YoY.

Looking ahead, U.S. commercial revenue is projected to exceed $3.144 billion in 2026, implying growth of at least 115%. Meanwhile, the U.S. government segment is expected to benefit from continued execution on existing programs and incremental contract awards.

Importantly, Palantir’s strong revenue growth is translating into solid margins. In the fourth quarter, the company generated $798 million in adjusted operating income, representing a 57% margin. For 2025, adjusted operating income reached $2.3 billion, with a 50% margin, an expansion of 1,100 basis points from 2024. Adjusted free cash flow also totaled $2.3 billion, translating to a 51% margin and 82% YoY growth.

The strong demand and solid margins indicate that Palantir is still in a high-growth phase and is likely to expand margins and generate strong cash flow.

Will Buying the Dip in PLTR Stock Pay Off?

Palantir continues to deliver strong growth supported by expanding commercial adoption and sustained government demand. While the stock’s valuation remains elevated, the recent decline has meaningfully eased some concerns. PLTR stock trades at a price-to-sales ratio of 70.84, which is significantly below its prior peak levels.

Wall Street sentiment has also turned more constructive. Just one month ago, seven analysts rated the stock a “Strong Buy.” That number has now increased to 13, reflecting growing confidence in the company’s execution and long-term positioning in the AI space. The average analyst price target is $200.43, implying roughly 48% upside from current levels.

Overall, Palantir’s strong growth trajectory, easing valuation concerns, improving analysts’ sentiment, and notable upside potential indicate that buying the dip could pay off.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- 2 Tech Bets Cathie Wood is Quietly Trimming Right Now: Should You Too?

- Super Micro Computer Stock Is Pushing Above Its 50-Day Moving Average. Should You Buy SMCI Here?

- Where Is Walmart Stock Headed Next After Q4 Earnings? What Barchart Options Data Says.

- Billionaire Hedge Fund Tiger Global Is Betting Big on This 1 Stock