With a market cap of $23.6 billion, Equifax Inc. (EFX) is a global data, analytics, and technology company that provides information solutions to businesses, governments, and consumers across Workforce Solutions, U.S. Information Solutions, and International segments. It operates in multiple countries worldwide, offering services such as credit information and scoring, identity verification, fraud prevention, workforce verification, and human resources process automation.

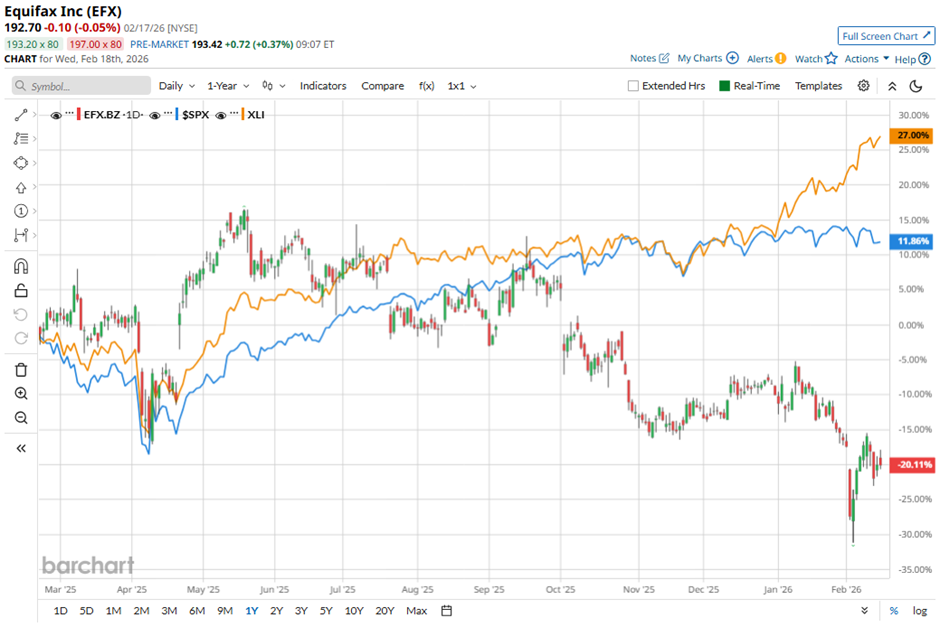

Shares of the credit reporting company have underperformed the broader market over the past 52 weeks. EFX stock has decreased 21.4% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 11.9%. Moreover, shares of the company are down 10.6%, compared to SPX's marginal decline.

In addition, shares of the Atlanta, Georgia-based company have also lagged behind the State Street Industrial Select Sector SPDR ETF's (XLI) 26.5% return over the past 52 weeks.

Shares of Equifax rose 3.4% on Feb. 4 after the company reported Q4 2025 revenue of $1.55 billion, up 9% year-over-year and $30 million above the midpoint of guidance, despite weak U.S. hiring and mortgage markets. Investor confidence was further boosted by strong segment performance, including 20% U.S. Mortgage revenue growth, 12% USIS growth, 9% Workforce Solutions growth, and a record Vitality Index of 17%, signaling accelerating new product innovation.

For the fiscal year ending in December 2026, analysts expect EFX's adjusted EPS to grow 11.2% year-over-year to $8.51. The company's earnings surprise history is promising. It beat the consensus estimates in the last four quarters.

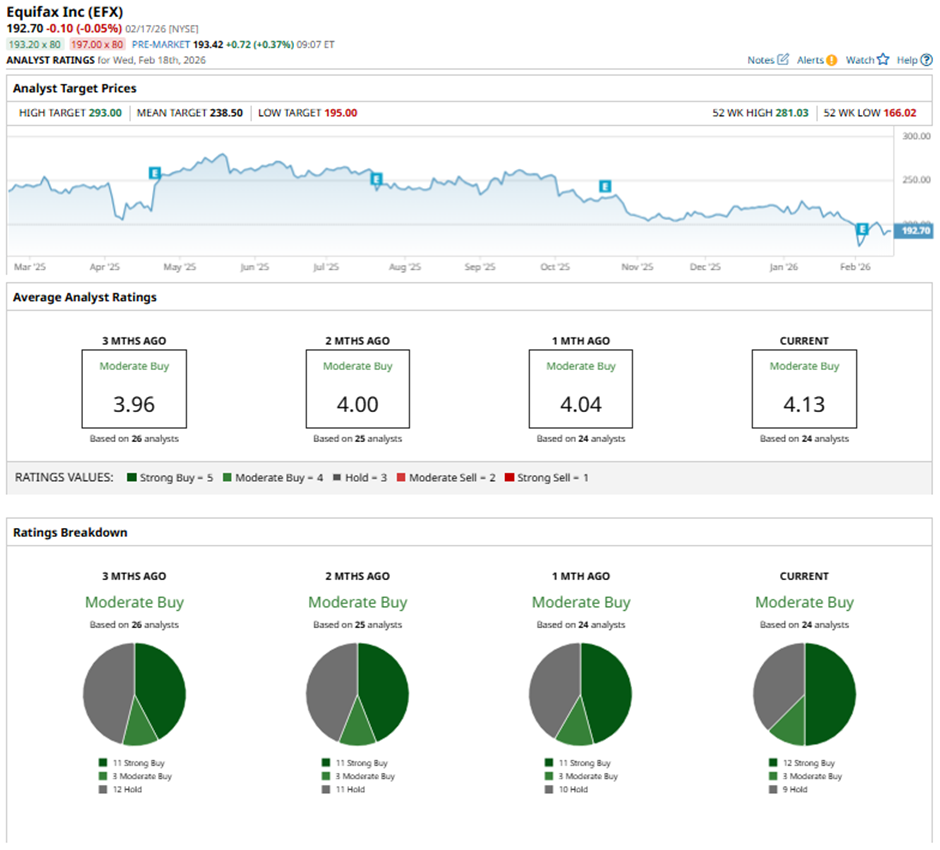

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 12 “Strong Buy” ratings, three “Moderate Buys,” and nine “Holds.”

On Feb. 5, BMO Capital cut Equifax’s price target to $195 and maintained a “Market Perform" rating.

The mean price target of $238.50 represents a premium of 23.8% to EFX’s current levels. The Street-high price target of $293 implies a potential upside of 52% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart