With a market cap of $26.5 billion, Constellation Brands, Inc. (STZ) is a leading producer, importer, and marketer of beer, wine, and spirits, offering a broad portfolio of well-known brands across the United States, Canada, Mexico, New Zealand, and Italy. It distributes its products through wholesale distributors, retailers, on-premise locations, and state alcohol beverage control agencies.

Shares of the wine, liquor and beer company have underperformed the broader market over the past 52 weeks. STZ stock has declined 6.3% over this time frame, while the broader S&P 500 Index ($SPX) has gained 11.9%. However, the stock is up 10.7% on a YTD basis, outpacing SPX’s marginal decrease.

Narrowing the focus, shares of the Rochester, New York-based company have lagged behind the State Street Consumer Staples Select Sector SPDR ETF’s (XLP) 9.4% rise over the past 52 weeks.

Shares of Constellation Brands climbed 5.3% following its Q3 2026 results on Jan. 7 as adjusted EPS of $3.06, topping consensus, despite a 10% year-over-year sales decline to $2.22 billion that still exceeded estimates. Investors were encouraged by stronger profitability metrics, including a 10-basis-point increase in operating margin to 38%, driven by favorable pricing and lower depreciation, even as volumes declined. The stock also benefited from management maintaining 2026 adjusted EPS guidance at $11.30 - $11.60, with a midpoint of $11.45, in line with Wall Street expectations.

For the fiscal year ending in February 2026, analysts expect STZ’s adjusted EPS to decline 15.6% year-over-year to $11.63. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on another occasion.

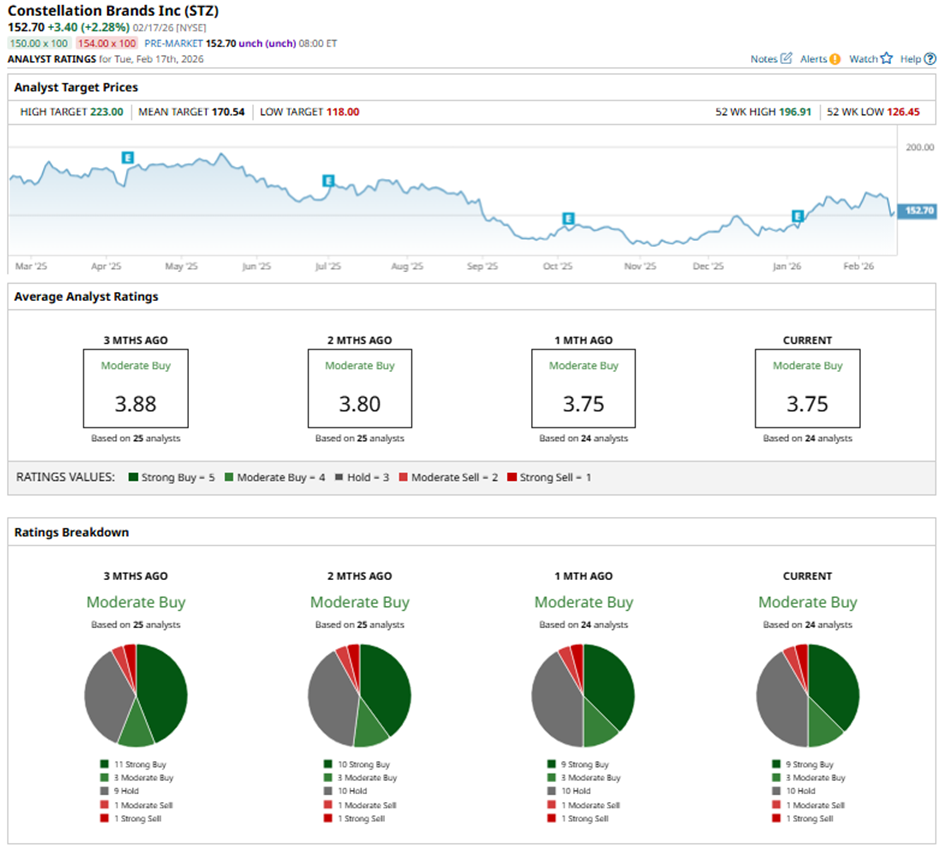

Among the 24 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on nine “Strong Buy” ratings, three “Moderate Buys,” 10 “Holds,” one “Moderate Sell,” and one “Strong Sell.”

On Jan. 12, Barclays raised its price target on Constellation Brands to $148 and maintained an “Equal Weight” rating.

The mean price target of $170.54 represents a premium of 11.7% to STZ’s current levels. The Street-high price target of $223 implies a potential upside of 46% from the current price.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- SoftBank Just Sold $3.6 Billion Worth of Nvidia Stock. Should You Ditch NVDA Too?

- Is It Too Late to Chase Masimo Stock on Major Danaher News?

- Warren Buffett Regrets Relearning This Lesson About Investing: It’s Important to Find Businesses ‘Where Tailwinds Prevail Rather Than Headwinds’

- Goldman Sachs Is Pounding the Table on This 1 Rare Earths Stock: New Price Target Implies 50% Upside