Kioxia (KXIAY), the Japanese memory giant that delivered a staggering 540% gain in 2025 as the best-performing stock in the world, just made another big call. On Feb. 11, Kioxia forecast sharply higher demand for NAND memory chips, quickly lifting sentiment across the memory sector. Sandisk (SNDK) jumped more than 8% the same day, pushing AI infrastructure names higher as investors took the news as a sign that demand for data storage remains strong.

The reason is pretty straightforward. Many memory analysts now expect demand to stay ahead of supply well into 2026 and beyond, and that backdrop has already helped SNDK shares rise more than 1200% over the past six months. Kioxia’s latest outlook fits right into that view, and it matters even more because the two companies are closely linked.

In January 2026, Kioxia and Sandisk extended their joint venture (JV) at the Yokkaichi and Kitakami flash memory plants through 2034, keeping their focus on AI-enabled smart manufacturing of advanced 3D NAND. In other words, when Kioxia’s outlook improves, it often points to the kind of market conditions that Sandisk can benefit from, too.

Still, even with all that momentum, Sandisk is currently about 17% below its recent high of $725, which puts the spotlight on timing. With Kioxia’s outlook adding fresh energy to the memory trade, is the pullback in Sandisk a buying opportunity? Or a warning that the easy gains are already behind us? Let’s find out.

Sandisk By the Numbers

Sandisk is a pure‑play flash memory and storage manufacturer selling NAND chips and SSD solutions for data centers, devices, and broader AI infrastructure. Over the past 12 months, SNDK stock has gone from a lightly followed memory cyclical to a clear market favorite, climbing roughly 1,180% in 52 weeks and about 154% year-to-date (YTD).

That run-up has pulled the valuation higher, too. Sandisk now trades at a forward price‑to‑earnings (P/E) multiple of about 27.3 times, which is noticeably above the sector median of roughly 23 times. That suggests investors are paying extra for what they believe is multi‑year, AI‑driven earnings growth.

The latest fiscal second‑quarter results show why the market has stayed positive. Revenue came in at about $3.02 billion, up 31% sequentially and above guidance. GAAP net income reached roughly $803 million, translating to $5.15 in diluted EPS.

Non‑GAAP EPS was $6.20, pointing to real margin improvement as AI data center demand lifts pricing and keeps factories running fuller. Data-center revenue alone jumped 64% sequentially, driven by hyperscalers, semi‑custom wins, and large technology customers rolling out AI at scale.

What Actually Powers the Upside?

Kioxia and Sandisk turning on Fab2 in Kitakami is one of the most direct reasons the story looks stronger. The new facility can produce eighth‑generation, 218‑layer 3D flash using CBA technology, and it is built specifically to meet AI-driven storage demand. Capacity will ramp in stages, with meaningful output anticipated in the first half of 2026.

The plant also includes an earthquake‑absorbing design, energy‑saving equipment, AI‑supported efficiency improvements, and a space‑efficient clean‑room layout, with part of the investment subsidized by the Japanese government. That helps Sandisk scale advanced NAND with better economics.

That capacity story ties into longer-term supply stability. Kioxia and Sandisk extended their Yokkaichi JV agreement through 2034, building on more than 25 years of collaboration, and they aligned the Kitakami JV to the same timeline. The goal is stable production of advanced 3D flash for AI workloads, and it also creates a clear cash commitment, since Sandisk will pay Kioxia $1.16 billion for manufacturing services and continued supply from 2026 to 2029.

On top of that, Sandisk is also pushing into new standards. Its memorandum of understanding (MOU) with SK Hynix to co‑define High Bandwidth Flash is aimed at standardizing a new memory class designed for AI inference, including the specs and ecosystem groundwork. So, Sandisk is not only supplying into the AI memory cycle but also helping shape where the technology goes next.

Wall Street’s Read on Sandisk Stock

For the current fiscal third quarter, management is guiding for revenue between $4.4 billion and $4.8 billion, with non‑GAAP diluted EPS expected in a wide but still eye-catching $12 to $14 range. On the Street’s side, the average earnings estimate is $5.55 for the current quarter, $8.35 for the next period, and $22.96 for fiscal 2026, which points to year-over-year (YOY) growth rates of roughly 1,025%, 41,650%, and 1,189%, respectively.

Those numbers help explain why analysts are still mostly positive, even after a huge run. Morgan Stanley analyst Joseph Moore recently reiterated a “Buy” rating and raised his price target to $690, which suggests 15% potential upside from current levels.

Cantor Fitzgerald analyst Christopher Muse was much more aggressive. Muse believes NAND prices could rise another 50% in Sandisk’s fiscal Q3, pushing gross margin toward about 67% and supporting a high $800 price target by the end of 2026.

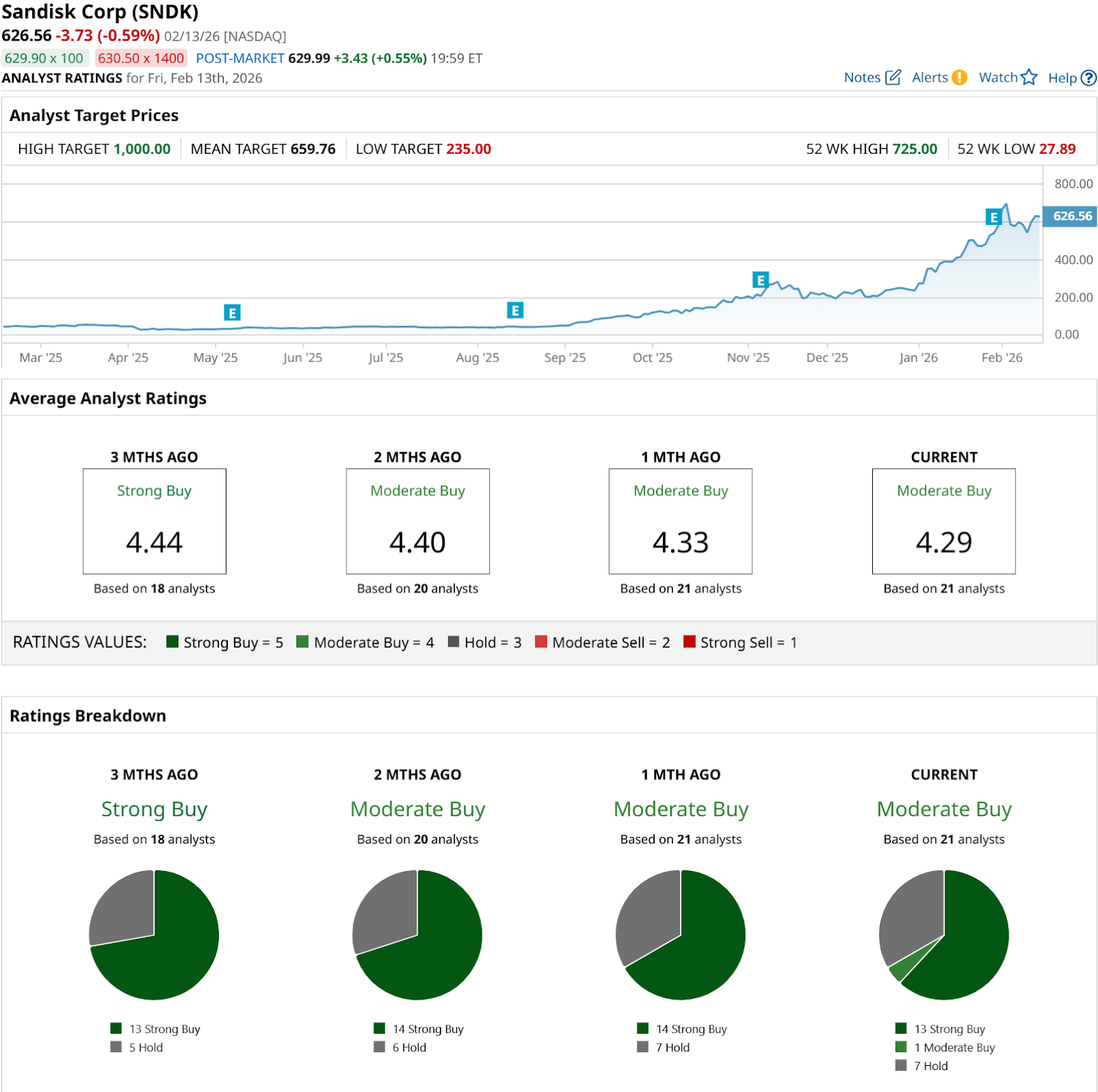

Overall, 21 analysts with coverage rate SNDK stock as a consensus “Moderate Buy." The average price target of $659.76 implies roughly 10% potential upside from here.

Conclusion

In the near term, Sandisk still looks buyable here, but it is no longer a blunt “set it and forget it” memory trade. The Kioxia‑driven tight‑supply story, Fab2 ramp, and High Bandwidth Flash roadmap all argue that earnings and margins can keep surprising to the upside, which supports SNDK stock grinding higher rather than collapsing. At the same time, with shares already up more than 1,100% in a year and trading at a premium multiple, the risk of sharp pullbacks around pricing headlines or guidance resets is real.

All told, the odds still favor Sandisk trending higher over the next 12 to 24 months, but investors should expect a bumpier path and size positions accordingly.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Moderna Jumps Above 20-Day Moving Average on FDA Flu Vaccine Review. Should You Buy MRNA Stock Here?

- This Is the Cloud’s Olympic Moment. Will It Medal or Bust?

- Cadence Stock Is Challenging Its 50-Day Moving Average After Earnings. Should You Buy CDNS Here?

- Warren Buffett Says This One Thing Is What Makes a Good Money Manager: ‘We Are Here to Make Money With You, Not Off You’