BYD (BYDDY) seems not to be the only one in the fiercely competitive world of electric vehicles (EV) that Tesla (TSLA) has to be mindful of. With its millionth vehicle recently completing production, Chinese EV manufacturer Nio (NIO) is also making significant strides. Not one to rest on its laurels, CEO William Li's assertions signal that the company has just started when he outlined its plans to exceed 10,000 stations by 2030 and scale global operations while maintaining annual sales growth of 40% to 50%.

About Nio

Founded in 2014, Nio's core business is designing, manufacturing, and selling electric vehicles, particularly smart, premium EVs that emphasize connected technology, autonomous capabilities, and a unique customer ecosystem. Notably, the company also develops semi-autonomous driving technologies and has been involved in platforms like Formula E racing, likely to enhance brand and tech credibility.

Valued at a market cap of about $10 billion, the NIO stock is up 13.4% over the past year.

However, before deciding to ride on the NIO bandwagon, is NIO a stock that will operate in cruise control, or will its engines splutter? Let's find out.

Mixed Set of Financials

Nio's numbers do not induce as much excitement as its strategic vision. At least, not now. Except for one metric: sales.

Over the last five years, the company has recorded an exponential revenue CAGR of 42.23%. The most recent quarter was no exception.

While total revenues for Q3 2025 stood at $3.06 billion, up 16.7% from the previous year, vehicle sales surged by 15% in the same period to $2.7 billion. The company attributed this to the rise in delivery volumes (something Tesla is struggling with), which was at 87,071 in the quarter. This marked an annual rise of 40.8%.

Moreover, losses narrowed to $0.16 per share from $0.31 per share in the year-ago period, also coming in softer than the consensus estimate of a loss of $0.23 per share. Notably, this was the sixth quarter where Nio's losses narrowed on an annual basis in the past nine quarters. However, out of these nine quarters, this was only the third instance when the company's losses came in lighter than the consensus estimates. This drives home the fact that the company is not meeting expectations in terms of its bottom line.

Yet, the company remains profitable at the gross level. In fact, the showing here was quite impressive, with gross profits rising by 50.7% from the previous year to about $425 million, with gross margins also improving to 13.9% in the quarter from 10.7% in the year-ago period. This shows that Nio's competitive strength is improving, and the company has control over its direct costs.

In terms of the cash situation, the company closed the quarter with a cash balance of $1.3 billion, almost comparable to its short-term debt levels of $1.22 billion. This is an aspect that Nio should be careful about, as spiraling debt, especially in the short term, can raise liquidity questions about the company.

Finally, for Q4 2025, Nio expects revenues to be in the range of $4.60 billion and $4.78 billion, which would imply another impressive yearly growth rate between 66.3% and 72.8%. Meanwhile, deliveries for the same period are expected to be between 120,000 and 125,000 vehicles, denoting a purported growth rate of 65.1% to 72%.

Road to Two Million

So, now that the milestone of one million vehicles produced is complete, what comes next for Nio? Two million.

But, for that, Nio has to make efforts to increase the adoption and acceptability of its vehicles, as deliveries remain modest when compared to its production. Here, Nio's premium brand and higher pricing relative to mainstream EVs have constrained broader market penetration, making portfolio expansion, price-band flexibility, and enhanced brand visibility essential for scaling volumes. The Onvo sub-brand was launched precisely to target lower price tiers, extending the company's reach beyond its core luxury customer base and accelerating unit growth.

Achieving meaningful scale will also largely depend on the Firefly sub-brand's performance. Firefly directly tackles Nio's longstanding challenge of an upscale-skewed lineup that limits overall demand potential. The brand's introduction has been timed with major industry events like Auto Shanghai 2025, supplemented by limited-edition releases to sustain interest. Competitors such as XPeng (XPEV) and BYD enjoy structural advantages in this segment through established volume presence across wider price segments, with XPeng routinely updating models like the G6 and G9, including hardware and AI refreshes, to remain competitive. In a nutshell, Firefly is strategically sound for market-size expansion, but the compact-EV space is highly price-sensitive, raising the execution threshold considerably.

Meanwhile, the flagship Nio ES8 large luxury SUV has delivered impressive early traction and now serves as a primary driver of delivery momentum. November volumes for the model reached 10,677 units, representing roughly 29% of total deliveries, with sequential growth of 59%. This pace has elevated the ES8 to one of the top-selling vehicles in China's domestic market.

From a technology standpoint, Nio is seeking differentiation through SkyOS, its proprietary full-domain operating system that consolidates intelligent driving, cabin functionality, and chassis management. Greater system cohesion aims to create a distinctly upscale experience encompassing fluid assisted-driving transitions, uniform interface design, and refined dynamics that support premium pricing in a segment where hardware gaps are narrowing. SkyOS provides a unified framework for high-end capabilities, though Nio lags BYD in rollout breadth and XPeng in aggressive AI-platform messaging.

Finally, Nio has additionally progressed its proprietary 5 nm Shenji NX9031 autonomous-driving processor, now incorporated in top-tier models such as the ET9. Fabricated with over 50 billion transistors, the chip offers approximately four times the compute capacity of Nvidia's Orin-X, enabling tighter software-hardware synergy. This translates to more advanced ADAS functionality, improved cabin interactions, and potential long-term cost efficiencies compared with third-party reliance.

Analyst's Opinion of NIO Stock

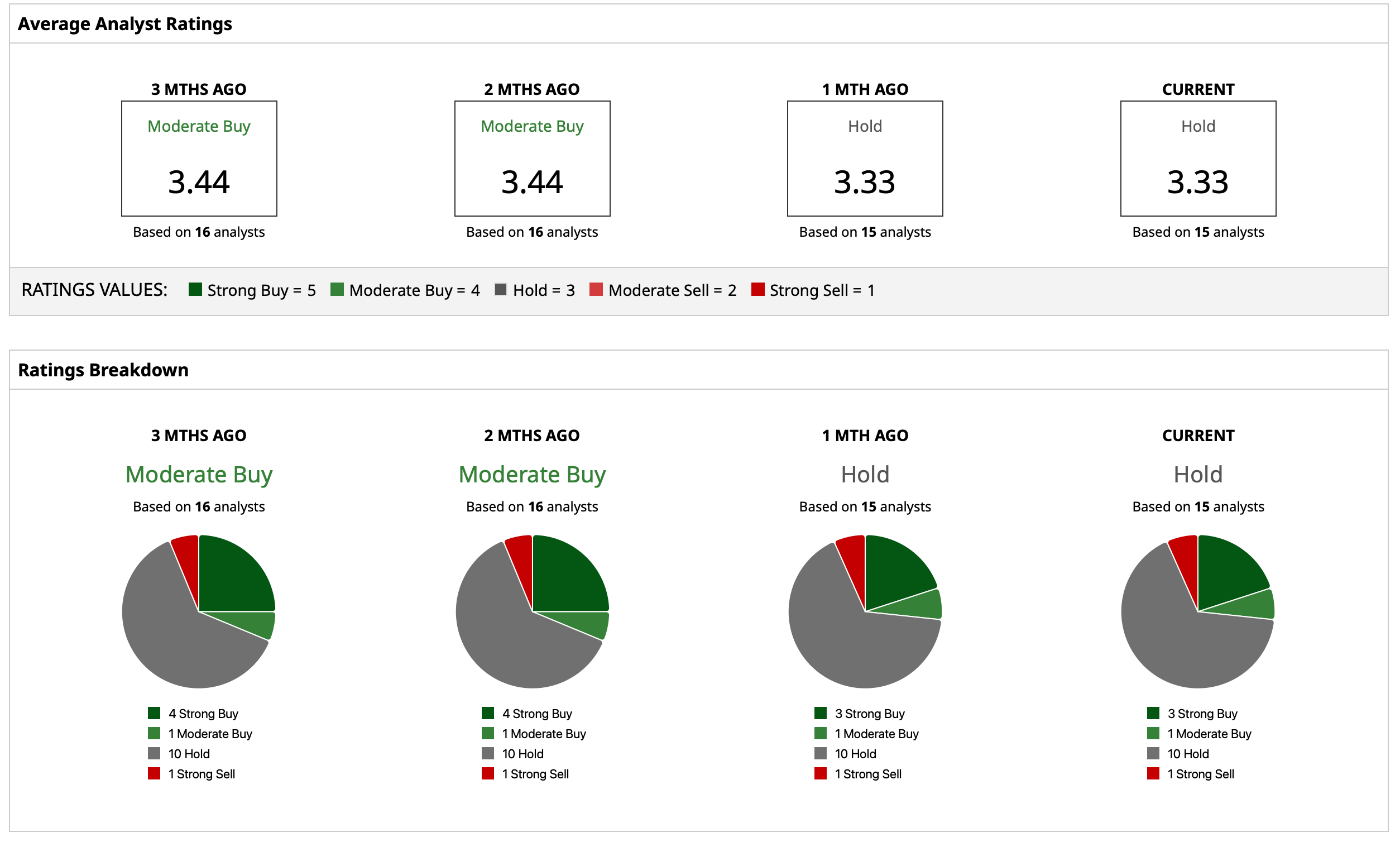

Thus, analysts have deemed the NIO stock to be a consensus “Hold,” with a mean target price of $6.05. This indicates an upside potential of about 28% from current levels. Out of 15 analysts covering the stock, three have a “Strong Buy” rating, one has a “Moderate Buy” rating, 10 have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart