Semiconductor equipment manufacturer Applied Materials (AMAT) has gained about 77% over the past year on strong demand, but Mizuho analysts think the upside potential is far from over. Analyst Vijay Rakesh raised AMAT stock’s rating from “Neutral” to “Outperform” and hiked the price target from $275 to $370, implying potential upside of about 15% from current prices.

This upgrade was based on the analyst’s view of “significant acceleration” in wafer fabrication equipment (WFE) spending through 2027. Mizuho projects WFE expenses to rise 13% year-over-year (YOY) this year and climb by 12% in 2027.

Applied Materials generates a significant portion of its topline from foundry and logic customers. This business segment is expected to benefit from increased spending by major players such as Taiwan Semiconductor (TSM) and Intel (INTC) .

About Applied Materials Stock

Headquartered in Santa Clara, California, Applied Materials is a leading provider of materials engineering solutions that enable the production of semiconductor chips. The company designs, manufactures, and services advanced equipment for chip fabrication processes, including deposition, etching, and inspection, thereby supporting the production of electronics for smartphones, computers, and renewable energy technologies.

Its global operations include manufacturing facilities, research collaborations with partners and universities, and customer support, all of which drive innovation in nanotechnology and next-generation devices. Through these efforts, Applied Materials plays a vital role in advancing the performance and efficiency of modern technology. The company has a market capitalization of about $270 billion.

Major capital spending increases from Taiwan Semiconductor and Intel, along with new DRAM fabs by chipmakers, are boosting demand for the company's deposition and etching tools, which is in turn driving optimism. Over the past 52 weeks, AMAT stock has gained 77%, while shares have risen 70% over the past six months. Following the Mizuho upgrade, AMAT stock reached a 52-week high of $344.60 on Jan. 29, although shares are down almost 7% from that level.

AMAT stock is trading at a higher valuation than its peers, with its price-to-earnings (P/E) ratio of about 35 times exceeding the industry average.

Robust AI-Driven Demand Fueled Applied Materials’ Q4 Earnings Beat

On Nov. 13, 2025, Applied Materials reported fourth-quarter fiscal 2025 earnings (for the quarter ended Oct. 26) that exceeded analyst expectations. Revenue decreased 3% YOY to $6.8 billion, exceeding the $6.7 billion Wall Street analysts had aniticipated. Non-GAAP diluted EPS also dropped 6% YOY to $2.17, surpassing the expected $2.11 figure.

On the other hand, the firm's annual results were buoyed by increased investment in advanced semiconductors and WFE, driven by rising adoption of artificial intelligence (AI). Fiscal 2025 net revenue climbed 4% YOY to $28.37 billion, while non-GAAP EPS climbed 9% to $9.42. Fiscal 2025 marked the company’s sixth consecutive year of growth.

However, the company also stated that its growth was tempered due to trade restrictions and an unfavorable market mix. The trade rule changes have shrunk the firm's accessible market size in China.

For Q1 fiscal 2026 (to be reported on Feb. 12), the company expects its topline to be approximately $6.85 billion, plus or minus $500 million. Meanwhile, non-GAAP EPS is projected to be about $2.18, plus or minus $0.20.

Wall Street analysts have a mixed view of the firm's bottom-line trajectory. For Q1, Applied Materials' EPS is expected to drop by 8% YOY to $2.19. On the other hand, for fiscal 2026, EPS is projected to increase 1.3% annually to $9.54.

What Do Analysts Think About Applied Materials Stock?

In addition to Mizuho analysts, other Wall Street analysts maintain a bullish stance on AMAT stock. This month, analysts at Deutsche Bank raised their rating from “Hold” to “Buy,” while raising the price target from $275 to $390. The upgrade reflects Deutsche Bank’s growing optimism surrounding WFE businesses heading into this year and next.

In the same month, Needham analyst Charles Shi raised the price target on AMAT stock from $260 to $390, while maintaining a “Buy” rating. The significant increase in the price target indicates improving analyst sentiment.

KeyBanc analysts also hiked their price target from $285 to $380, while maintaining an “Overweight” rating. Analysts cited the firm's “diversified supplier position” and also noted that the company stands to benefit from rising demand for deposition and etching tools, which stems from advanced chips increasingly adopting vertical architectures.

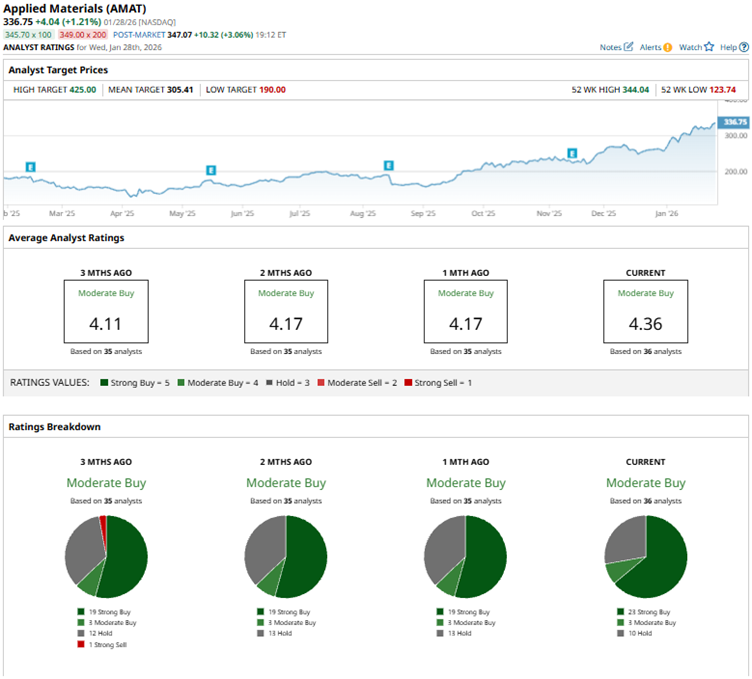

Wall Street analysts are soundly bullish on Applied Materials, awarding AMAT a consensus “Strong Buy” rating overall. Of the 36 analysts rating the stock, a majority of 24 analysts rate it a “Strong Buy,” three analysts suggest a “Moderate Buy,” and nine analysts have a “Hold” rating. The consensus price target of $312.75 represents 3% potential downside from current levels. However, the Street-high price target of $425 points to 32% potential upside from here.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Up 77% in the Past Year, This Analyst Says More Upside Is Still in Store for Applied Materials Stock

- This Trump Stock Just Announced a $100 Million Catalyst. Should You Buy Its Shares Now?

- Apple Is Reportedly Looking to Partner with Intel Foundry. Does That Make INTC Stock a Buy Here?

- Dear Disney Stock Fans, Mark Your Calendars for February 2