It’s an unavoidable reality that anytime you place a wager in the options market, Wall Street pros — not the retail players — enjoy the house advantage. However, this advantage is embedded in the structure of risk modeling, which ironically leads to an opening for everyday traders, so long as you know how to exploit the mathematical loophole.

Without getting too deep into the technicalities, market makers price risk based on a monotonic framework. Essentially, for every unit of distance away from the current share price, the magnitude of risk increases. To use a sports analogy, layups are much easier to make than sinking three-pointers, all other things being equal.

Now, I’m not a big basketball fan but generally speaking, making a shot from outside the arc is going to be roughly half the odds of making a layup (not including slam dunks, which can distort the statistics). And that’s basically the intuitive thought process with risk models that use Black-Scholes-based parametric logic: the further your target strike price is from the current market price, the less likely the outcome is to materialize.

However, as you know from watching professional sports matchups, the less probable path isn’t always the least desirable option. For example, you might want to go for a layup and grab an easy two points. But if the route to the basket is blocked by a congested defensive scheme, the most prudent idea could be the open player standing outside the arc.

Of course, all other things being equal, greater distance to the basket increases shot difficulty — no one’s denying that. During a game, though, dynamics shift. Mere proximity to the basket isn’t the fulcrum that defines the success ratio. Rather, it’s the structure of the current environment that could most influence outcomes.

In the options-based ideas below, my argument is simple. By using the analytics provided by Barchart Premier, we can see where risk might be mispriced under a non-monotonic framework — and how we just might be able to exploit the underlying structural arbitrage.

Coupang (CPNG)

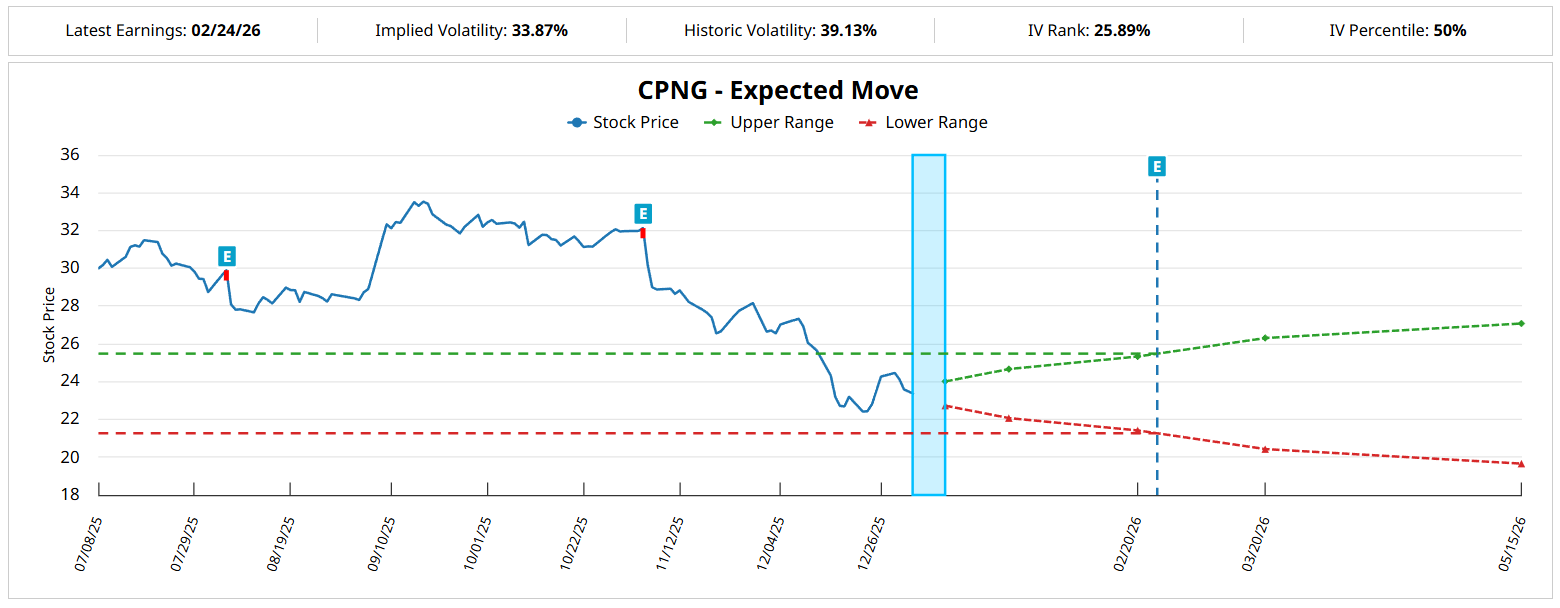

A South Korea-founded technology and online retail company, Coupang (CPNG) presents an intriguing international investment narrative, particularly because of how ingrained the business is in its home market. However, the recent performance of CPNG stock hasn’t been encouraging, down more than 22%. Still, the heavy dose of red ink may present a contrarian upside opportunity.

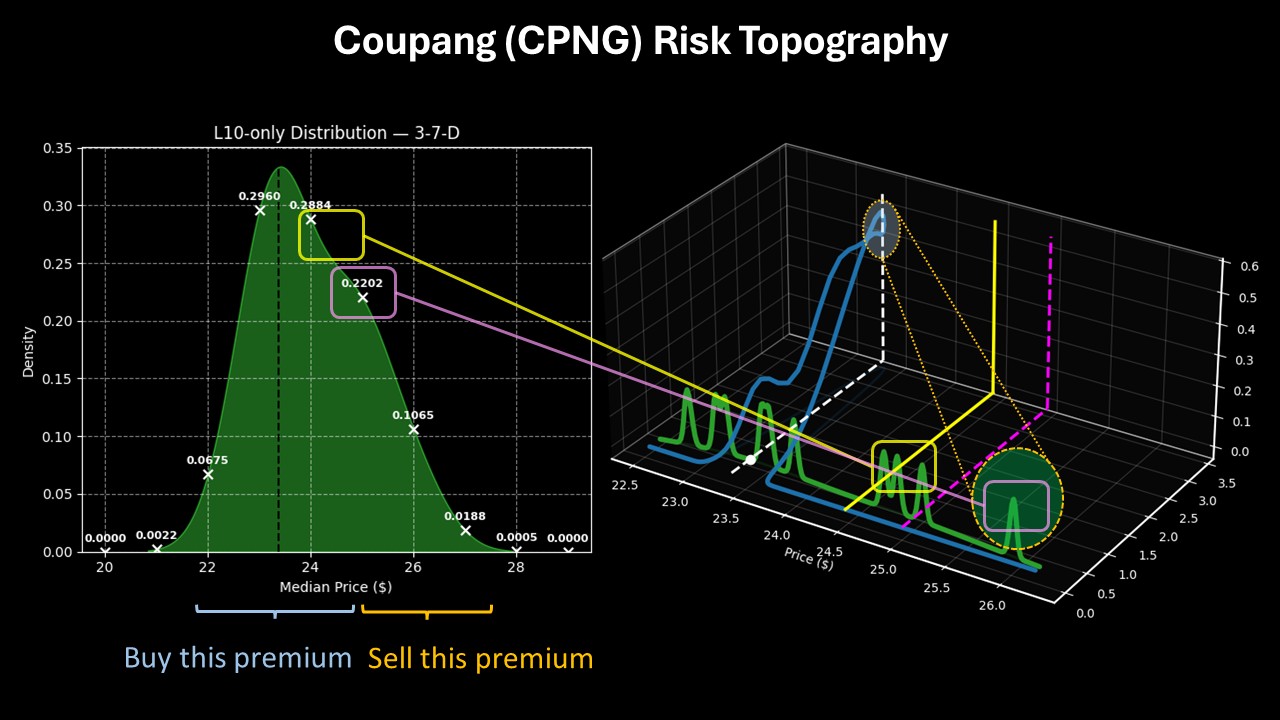

On any given 10-week period, investors would be looking at CPNG stock ranging between $23 and $23.80 (assuming an anchor price of $23.37, Friday’s close). Further, probability density would likely peak at around $23.45.

Of course, we’re not interested in trading CPNG stock as an aggregate performance but we’re instead focused on trading shares under the current quantitative structure. In the last 10 weeks, CPNG printed only three up weeks, leading to an overall downward slope. On surface level, this structure seems risky for the bulls, much like a three-point attempt relative to a layup.

To extend the basketball analogy, my argument is that the layup route is contested. Instead, the three-pointer is relatively open. Under 3-7-D conditions, the forward 10-week returns would be expected to shift positively overall, landing between $21 and $28.

I’d take a long look at the 24/25 bull call spread expiring Feb. 20, 2026, which offers a maximum payout of nearly 113%.

Dropbox (DBX)

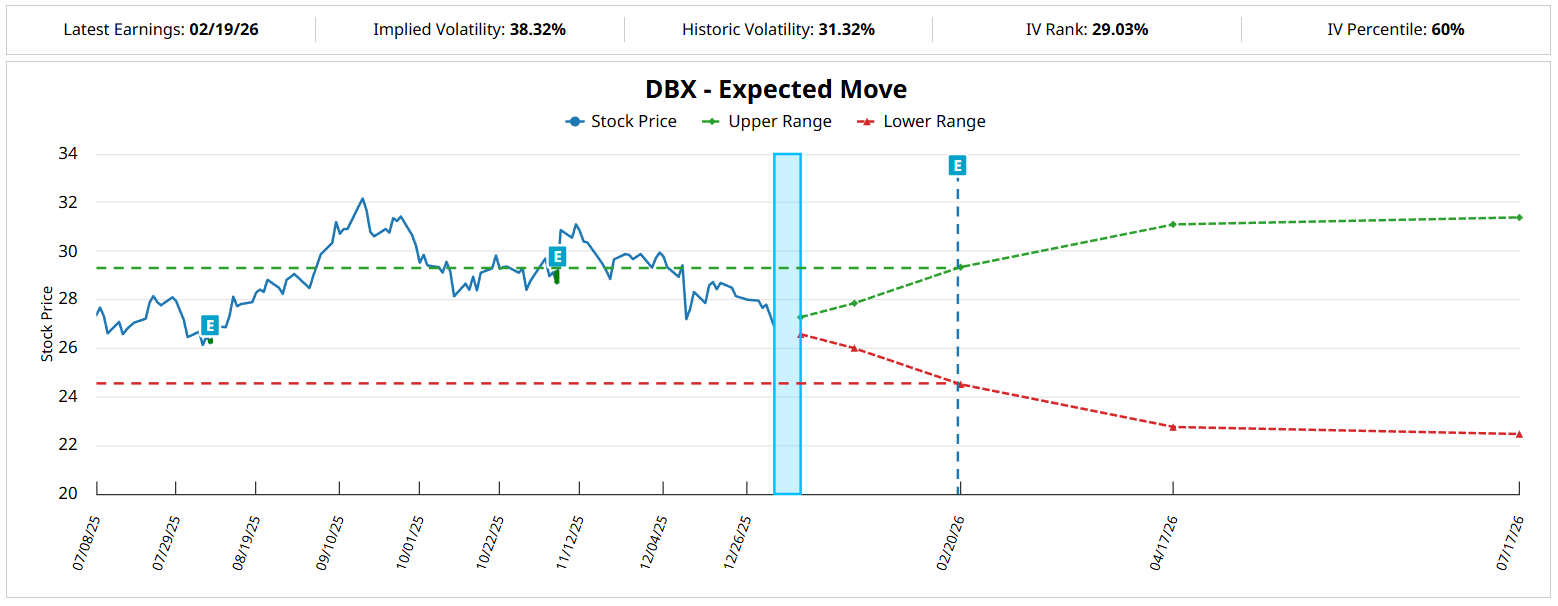

Although more exciting tech plays have outshined Dropbox (DBX), the cloud storage leader still offers tremendous relevance. Featuring an intuitive, user-friendly platform, Dropbox offers seamless file syncing across devices, robust sharing capabilities embedded with advanced safety protocols and essential integrations with other apps. Unfortunately, these factors haven’t spared DBX stock from volatility, with shares down over 10% in the past year.

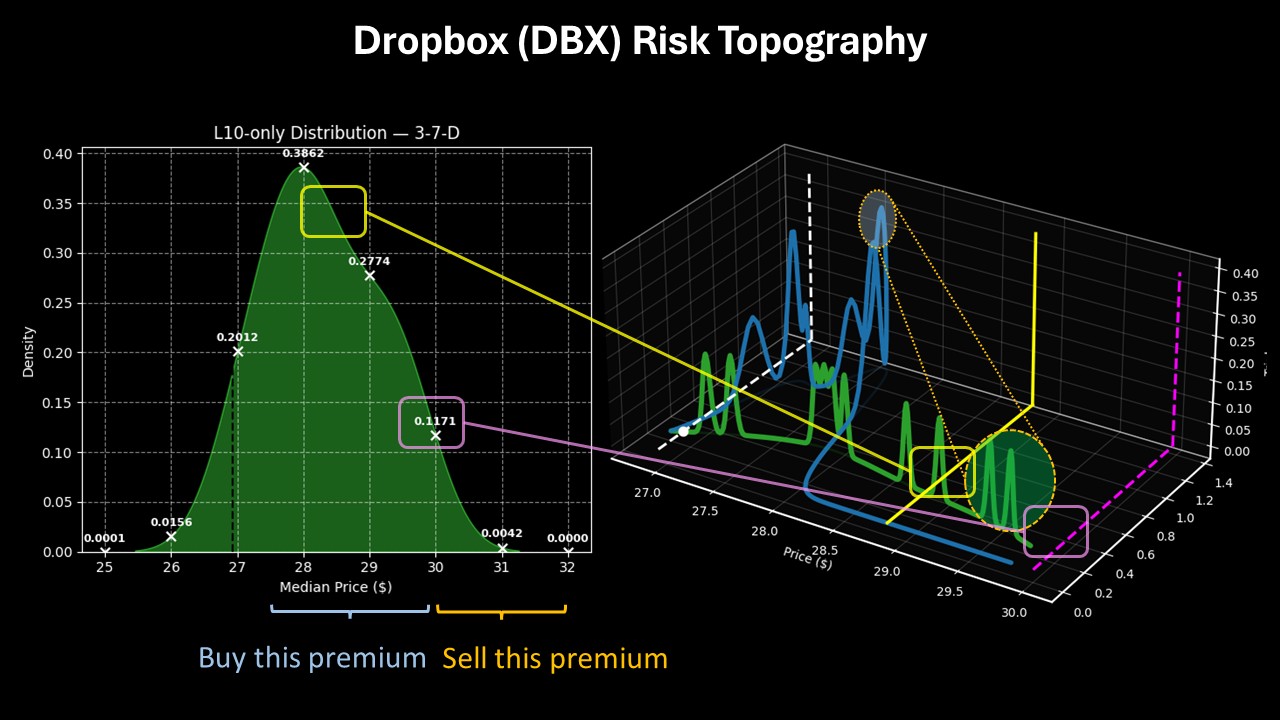

Under normal circumstances, DBX stock has demonstrated an upward bias when viewed from fixed-time intervals. Since January 2019, the average outcome over a 10-week period should range between $26.50 and $28.25 (assuming an anchor price of $26.93). Probability density would likely peak at around $27.70.

However, under the current 3-7-D (three up, seven down, downward slope) quant signal, DBX’s forward 10-week outcomes should land between $25.50 and $31.20. Moreover, probability density would likely peak at $28.

Effectively, Dropbox represents another three-point attempt. Given the extensive downside pressure, it’s risky for the bulls to bet on this name. However, the contextual backdrop suggests that, more often than not, a reflexive contrarian shift may swing DBX stock higher, not lower.

As such, I’m looking closely at the 28/30 bull call spread expiring Feb. 20, which offers a max payout of over 135%.

Best Buy (BBY)

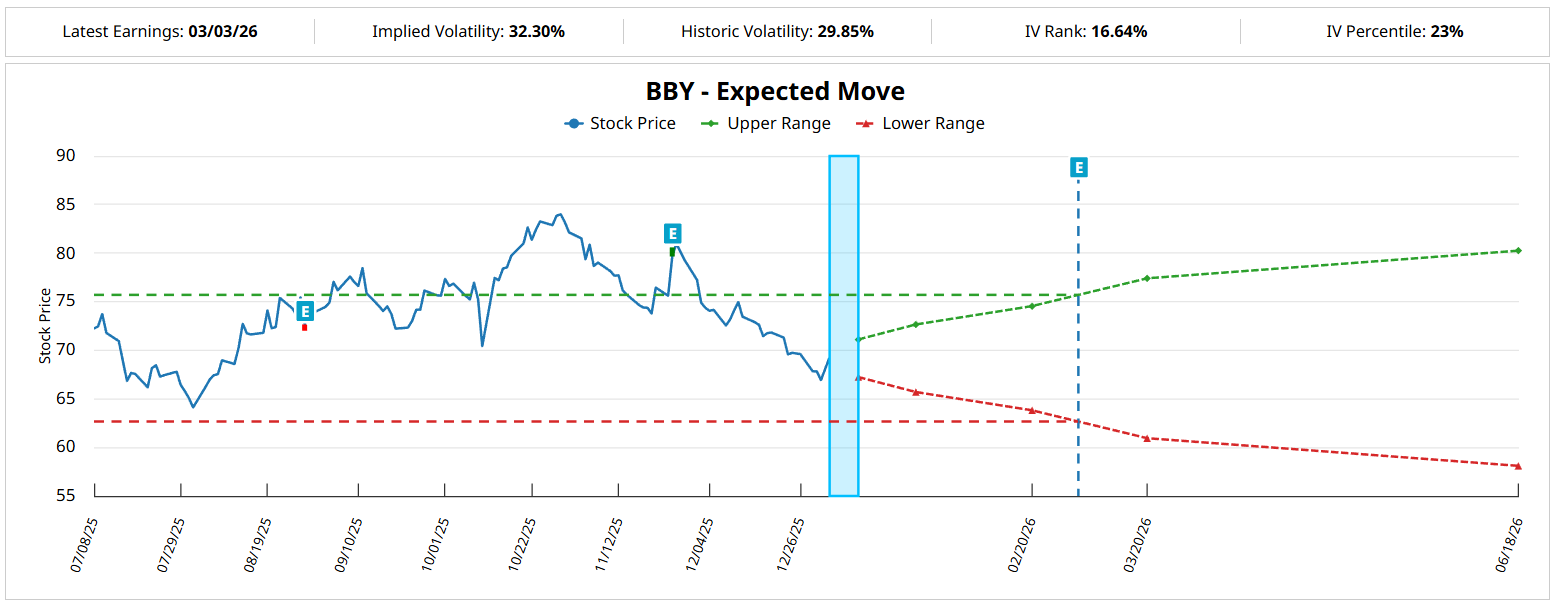

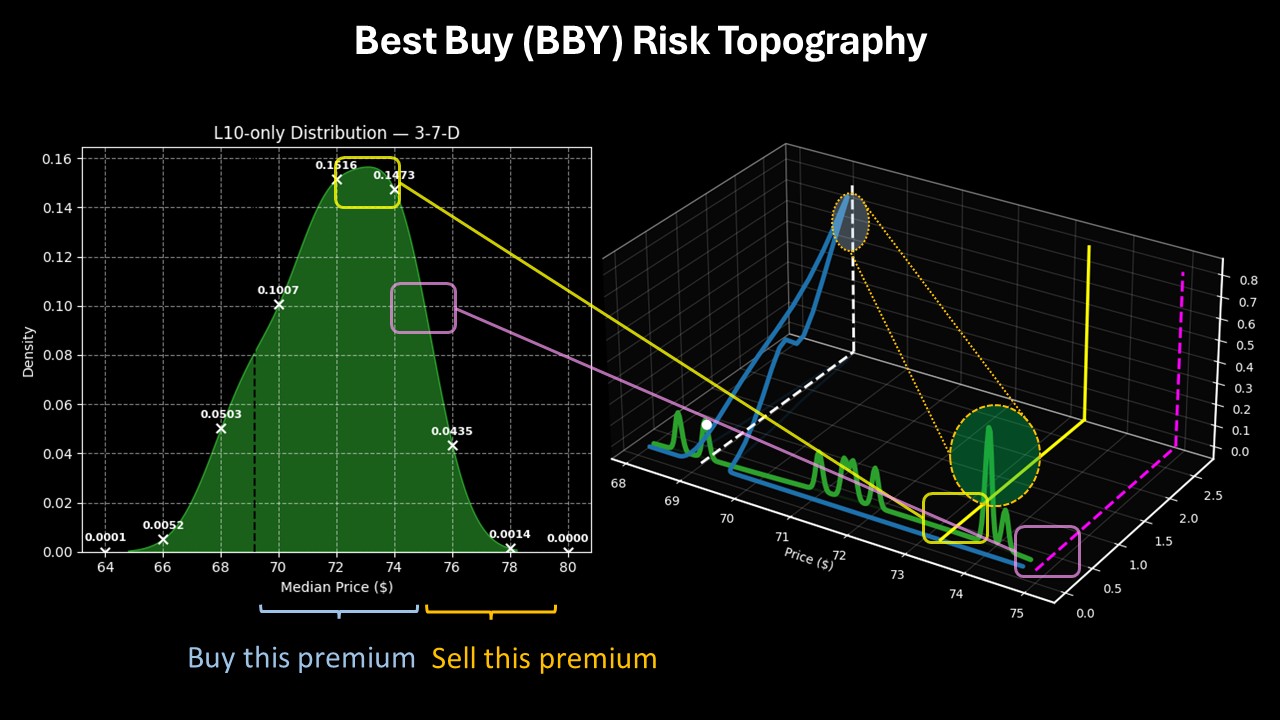

As a big-box retailer, Best Buy (BBY) might not seem like the most relevant idea, especially amid the broader e-commerce transition. Still, Best Buy has managed to reinvent itself over the last several years, making BBY stock an intriguing idea for short-term speculators. Of course, the investment narrative is a bit more on the questionable side, especially with its poor technical sentiment indicator. Nevertheless, this name may offer a contrarian opportunity.

Looking at aggregate data since January 2019, the average outcome over a 10-week period would likely see BBY stock land between $68.80 and $69.80 (assuming an anchor price of $69.18). Further, probability density may be most predominant at around $69.25, indicating a slight upward bias when viewed within a fixed-time interval.

However, under 3-7-D conditions — which is the current quant signal — BBY’s forward 10-week returns would be expected to range between $65 and $78, with peak probability density landing between $72 and $74. Again, this is another one of those three-pointer situations, where a risky trade on paper might be surprisingly viable.

For the bold speculator, I would take a look at the 72.50/75 bull spread expiring Feb. 20, which offers a max payout of nearly 175%.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart