Boeing (BA) has been on a roll; the stock has rallied 43% in the last 52 weeks. This rally has been associated with strong fundamental developments. With the company reporting its Q4 results on Jan. 27, there could be more reasons to remain bullish.

As Susquehanna Financial Group points out, Boeing has made “meaningful progress in stabilizing production on its 737 and 787 programs.” Further, with the completion of its acquisition of Spirit AeroSystems, growth is likely to be supported coupled with improvement in cash flows.

In other positive news, Boeing beat Airbus (EADSF) (EADSY) in jet orders for the first time since 2018. Leeham aerospace analyst Scott Hamilton believes that this is a clear indicator that the “company's turnaround is real.”

About Boeing Stock

Headquartered in Arlington, Virginia, Boeing develops, manufactures, and sells commercial airplanes, defense products and space systems. The company has customer presence in more than 150 countries and clocked a turnover of $66.5 billion for FY24.

For Q3 2025, Boeing reported 30% growth in revenue on a year-on-year basis to $23.3 billion. Further, the total backlog was $636 billion, which provides clear revenue visibility. While Boeing reported operating level losses, it was on the back of a $4.9 billion charge associated with updated 777X certification.

Even with a strong backlog and robust growth, BA stock has trended higher by only 9.7% in the last six months. As the backlog converts to revenue and cash flows improve, it’s likely that the rally will be sharper.

Multiple Growth Catalysts

Boeing is positioned for healthy growth in the coming years, and there are multiple factors supporting this view. The first point to note is that Boeing ended 2025 with a robust order backlog of 6,130 planes.

In the first few weeks of 2026, there has also been a flurry of orders. Delta Air Lines (DAL) placed an order for up to 60 Boeing 787 Dreamliners. Further, Alaska Airlines placed an order for 105 737-10 airplanes and options for 35 more of the largest 737 MAX variants. With an accelerated order intake, the growth outlook is bright.

Another catalyst for Boeing is the defense and space business. Besides revenue growth, the company reported significant improvement in operating margin in the defense, space, and security segment. With an order backlog of $76 billion, the revenue visibility is strong. It’s worth noting that 20% of the backlog is from customers outside the U.S. This expands the company’s total addressable market. Additionally, considering global geopolitical tensions, it’s likely that the order intake in this segment will be robust.

From a financial perspective, Boeing has maintained a strong cash buffer of $23 billion. Further, Boeing has an undrawn credit facility of $10 billion, which adds to the liquidity buffer. While the company’s debt stands at $53.4 billion as of Q3 2025, it’s unlikely to be a concern with visibility for improvement in operating margin. Key credit metrics are therefore likely to remain healthy.

What Analysts Say About BA Stock

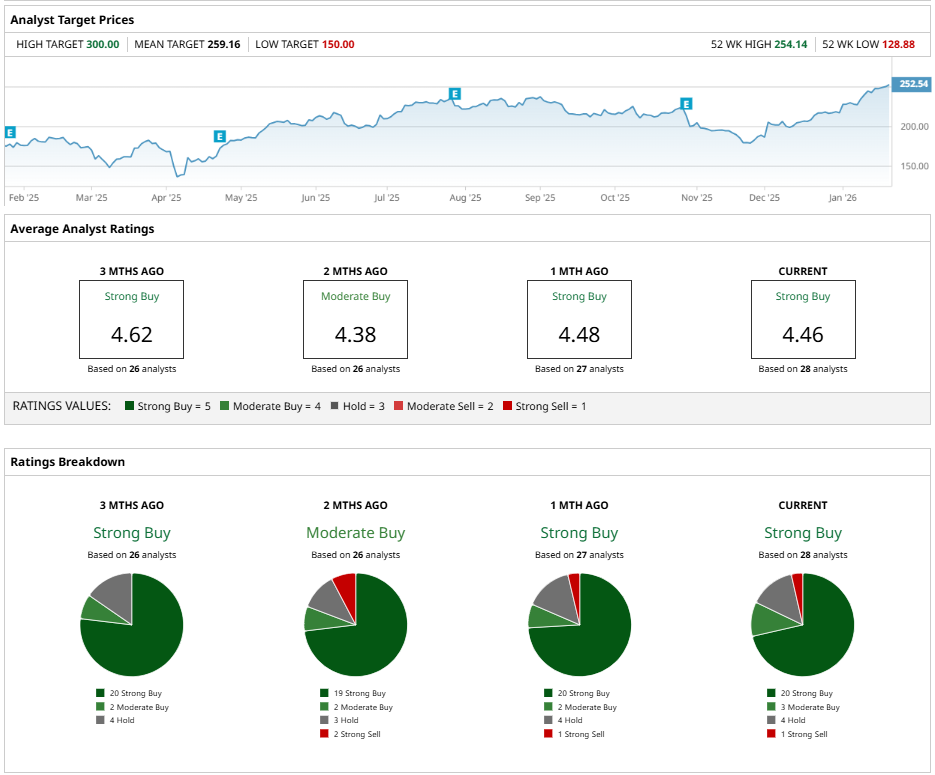

Based on the ratings of 28 analysts, BA stock is a consensus “Strong Buy.” While 20 analysts assign a “Strong Buy” rating to BA, three analysts have assigned a “Moderate Buy,” and four analysts have rated the stock a “Hold." On the bearish side, only one analyst has a “Strong Sell” view.

Based on these ratings, analysts have a mean price target of $259 currently, which would imply upside potential from current levels.

This bullish view on Boeing is also reflected in the earnings growth potential. For FY25 and FY26, analysts expect earnings growth of 53.1% and 111.7%, respectively. The impending growth acceleration is likely to ensure that BA stock remains in an uptrend.

On the date of publication, Faisal Humayun Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- How This Options Expert Screens for High-Probability Spread Trades, Step-by-Step

- Calling Back to Jimmy Carter, Citigroup’s CEO Says Credit Card Rate Caps Would ‘Not Be Good’ for the U.S. Economy

- ‘Yes or No AI’: 93% of DuckDuckGo Users Overwhelmingly Reject AI, So What Does This Mean for the Future of Nvidia, Alphabet, and Other AI Stocks?

- KHC Is Low-Hanging Fruit for Greg Abel: Which Warren Buffett Stock Will He Sell Next?