Among the world's largest semiconductor makers, Nvidia (NVDA) remains the go-to choice for investors. And rightfully so—looking at this stock's long-term chart, investors who have stuck with this name have outperformed the market by an incredible margin in recent decades.

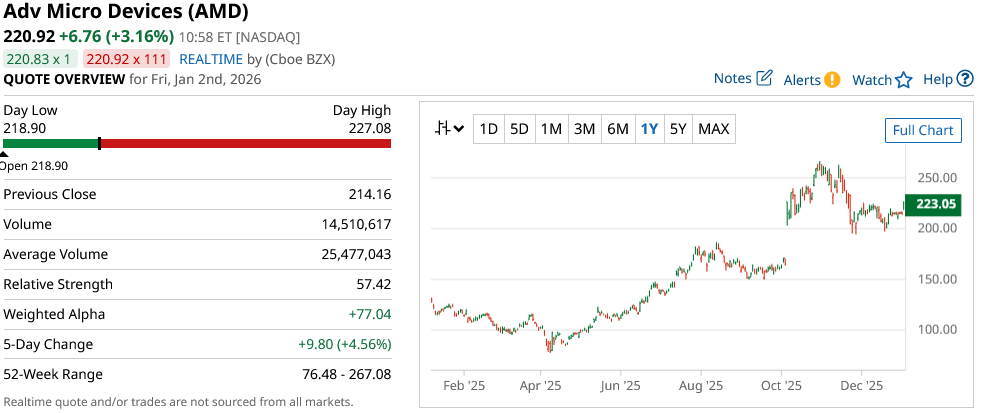

Of course, it's not just a one-horse race, regardless of what the media tries to tell you. Rival Advanced Micro Devices (AMD) is another top name worth considering, and one that's actually outperformed Nvidia on a year-to-date basis (YTD). Surging 77% to end 2025, AMD roughly doubled Nvidia's performance this year (the world's largest chipmaker still surged 39% higher in 2025, so not bad). Thus, there are plenty of eyeballs already on AMD as 2026 kicks off.

As it turns out, there's another major catalyst on the horizon investors are watching when it comes to both companies. Analysts at Wedbush have pointed out that AMD's CEO, Lisa Su, is expected to make the keynote address at the upcoming Consumer Electronics Show (CES) in Las Vegas on this date, with the potential for a big announcement to come.

Why Is This Catalyst So Important for AMD?

I think the key announcements for AMD for this coming year are indeed likely to come at this event. CES is the biggest show in the world when it comes to anything tied to consumer electronics and is honestly one of the key shows I've always wanted to attend, for this reason. Many CEOs are expected to make big product announcements, from technological upgrades to next-generation technology expected to be released over the course of the year.

I'd expect to see a strong narrative from Lisa Su around the company's roadmap moving forward, and Wedbush analysts tend to agree. They think that some “significant” technological improvements to AMD's core Ryzen chips could be announced at this conference. Doing so may propel a range of mega-cap tech companies who are looking for reasons to buy AMD chips (at a lower price point) to do so. Especially if the output differential between these Ryzen chips and Nvidia's new Blackwell and Rubin chips isn't as wide as it appears now.

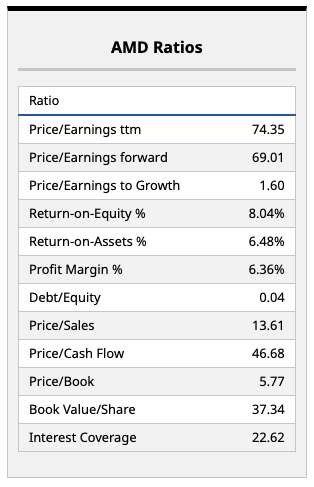

We'll have to see, of course, what is ultimately announced. But any sort of meaningful improvements in AMD's core CPU chip technology could spur greater investor interest in 2026 and take this stock's recent momentum to new levels. It does appear that AMD has retained strong pricing power, reflected in the company's margins above. If these margins expand further in the coming quarters, and AMD can show a cash flow growth profile that's above Wall Street estimates, I certainly think this is a stock that could be off to the races.

So, What Does Wall Street Think?

As it turns out, Wedbush is just one of 44 analysts currently covering AMD stock. With a consensus price target of $285.05 per share on AMD stock, analysts believe that this chipmaker could have roughly 33% upside from current levels.

That's a healthy potential gain for investors looking to add some momentum to their portfolios in 2026. Indeed, momentum-driven growth stocks have provided most of the gains in the markets over the course of the past decade and a half. Thus, for those who think this trend is likely to continue and risk-on sentiment will remain in the coming year, AMD's fundamentals do point in a very positive direction right now.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Is UnitedHealth Stock a Buy, Sell, or Hold for January 2026?

- Looking for the Next Berkshire Hathaway? Experts Are Circling In on This 1 Little-Known Stock

- Looking for the Big AI Winners of 2026? This Analyst Says Reddit Stock Should Top Your List.

- 1 Lesser-Known Stock Set to Steal the Spotlight in 2026