With a market cap of $108.1 billion, Robinhood Markets, Inc. (HOOD) operates a digital investment platform enabling users to trade stocks, ETFs, options, cryptocurrencies, and other assets, along with features such as fractional trading, recurring investments, margin access, and retirement accounts. It also offers education tools, news services, cash and spending accounts, credit cards, and a global digital currency marketplace.

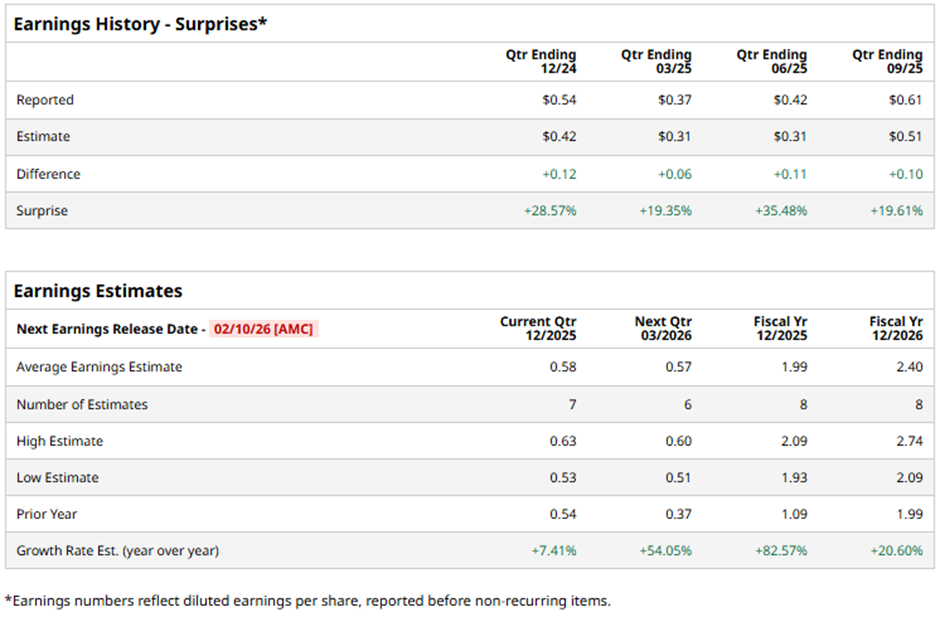

The Menlo Park, California-based company is expected to release its fiscal Q4 2025 results after the market closes on Tuesday, Feb. 10. Ahead of this event, analysts forecast HOOD to report an EPS of $0.58, a 7.4% rise from $0.54 in the prior year's quarter. It has surpassed Wall Street's bottom-line estimates in the past four quarters.

For fiscal 2025, analysts anticipate Robinhood Markets to post an EPS of $1.99, a surge of 82.6% from $1.09 in fiscal 2024.

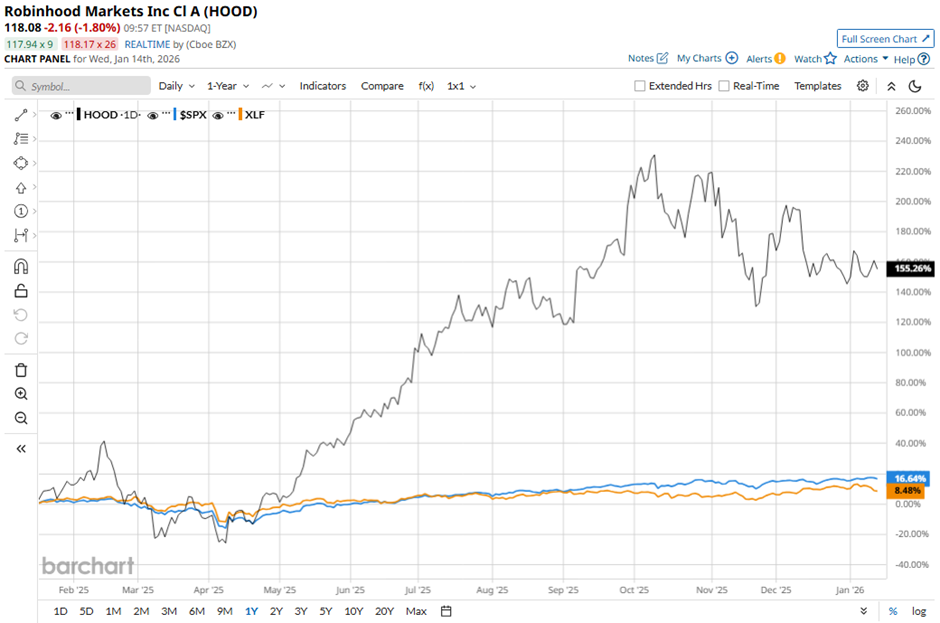

Shares of Robinhood Markets have jumped 183.1% over the past 52 weeks, significantly outpacing both the S&P 500 Index's ($SPX) 18.6% gain and the State Street Financial Select Sector SPDR ETF's (XLF) 12% return over the period.

Shares of Robinhood tumbled 10.8% following its Q3 2025 results on Nov. 5 because the company raised its full-year 2025 guidance for combined adjusted operating expenses and SBC to about $2.28 billion. Investors were also concerned that Q3 operating expenses rose to $639 million, beating expectations, driven by marketing, growth initiatives, and acquisition-related costs.

Although Robinhood posted strong results with Q3 revenue of $1.27 billion (up 100%), EPS of $0.61 (up 259%), and net deposits of $20.4 billion, the higher-than-expected expense outlook pressured the stock.

Analysts' consensus view on HOOD stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 21 analysts covering the stock, 13 recommend "Strong Buy," two suggest "Moderate Buy," five indicate “Hold,” and one has a "Strong Sell." The average analyst price target for Robinhood Markets is $153.22, indicating a potential upside of 29.8% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Behind Berkshire’s Curtain: Is Greg Abel Preparing to Cut Davita Loose?

- Thursday Earnings Preview: Look to These Banking Giants for Key Consumer Insights

- As Wayfair Launches New AI Shopping Features, Should You Buy, Sell, or Hold W Stock?

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?