With a market cap of around $18 billion, The Trade Desk, Inc. (TTD) is a global technology company that provides a self-service, cloud-based platform for planning, managing, optimizing, and measuring data-driven digital advertising campaigns across multiple formats and channels. IT serves advertising agencies, advertisers, and other marketing service providers worldwide.

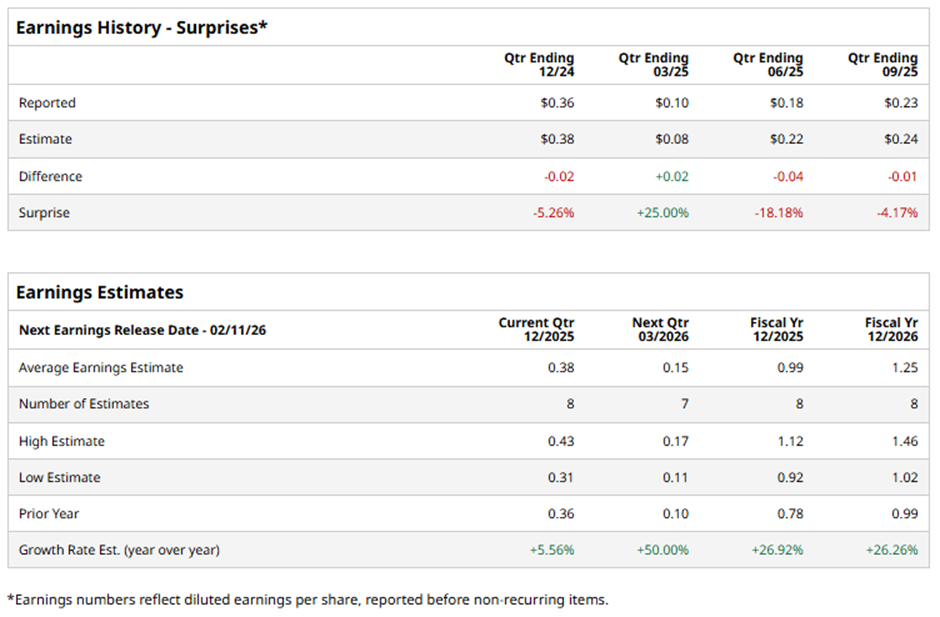

The Ventura, California-based company is expected to announce its fiscal Q4 2025 results soon. Ahead of this event, analysts predict TTD to report an EPS of $0.38, up 5.6% from the previous year's $0.36. It has surpassed Wall Street's bottom-line estimates in one of the past four quarters while missing on three other occasions.

For fiscal 2025, analysts forecast the digital-advertising platform operator to post an EPS of $0.99, an increase of 26.9% from $0.78 in fiscal 2024.

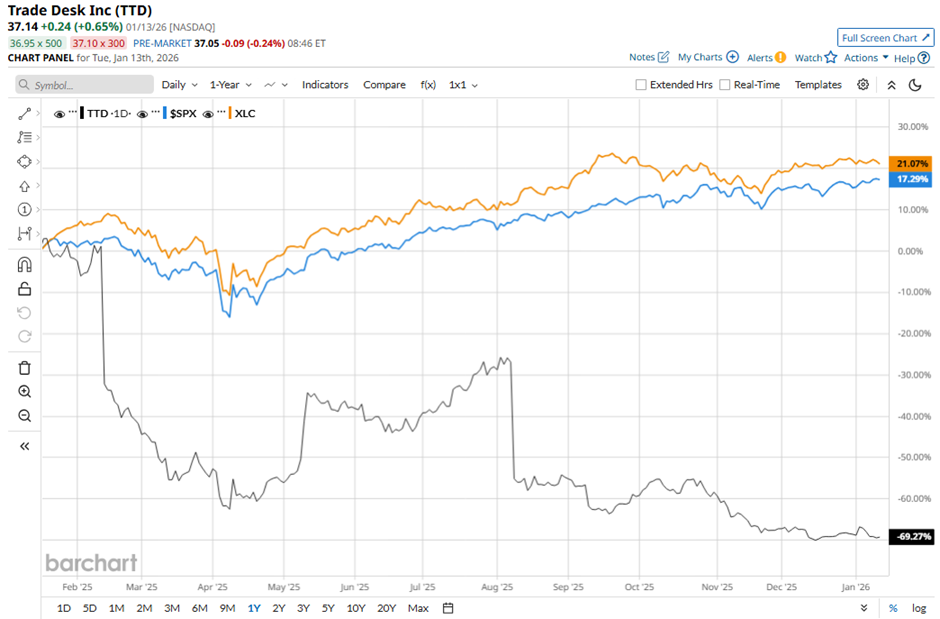

TTD stock has dropped 68.2% over the past 52 weeks, lagging behind the S&P 500 Index's ($SPX) 19.3% gain and the State Street Communication Services Select Sector SPDR ETF's (XLC) nearly 22% return over the same period.

Despite beating expectations with Q3 2025 adjusted EPS of $0.45 and revenue of $739.4 million on Nov. 6, shares of The Trade Desk tumbled 6.3% the next day. Revenue growth decelerated to 18% this quarter, and management cited ongoing macroeconomic uncertainty affecting sectors like CPG and retail due to tariffs and inflation.

Analysts' consensus view on TTD stock is cautiously optimistic, with a "Moderate Buy" rating. Out of 38 analysts covering the stock, 18 give a "Strong Buy," three "Moderate Buys," 14 have a "Hold," one suggests a "Moderate Sell," and two give a "Strong Sell" rating.

The average analyst price target for Trade Desk is $61.52, indicating a potential upside of 65.6% from the current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?

- President Donald Trump Says, “The United States Government Is Proud to Be a Shareholder of Intel.” Should You?

- Whole Foods Founder Calls Jeff Bezos a ‘Genius’ Who Killed the ‘Whole Paycheck’ Stigma

- Supermicro Stock Slips 46% in 3 Months: Should You Buy, Sell, or Hold SMCI?