Valued at a market cap of $36.1 billion, Ventas, Inc. (VTR) is a healthcare real estate investment trust (REIT) that owns and operates a diversified portfolio of senior housing, medical office buildings, life science facilities, and healthcare-related properties. The Chicago, Illinois-based company is expected to announce its fiscal Q4 earnings for 2025 in the near future.

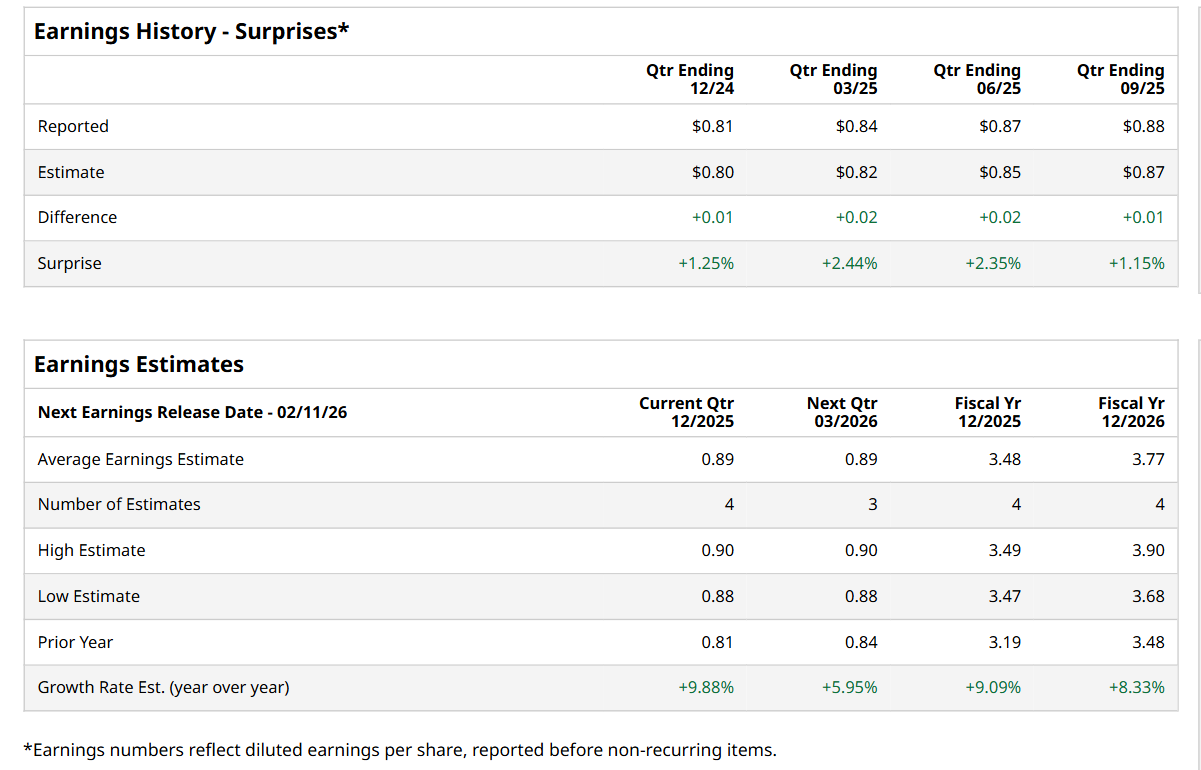

Before this event, analysts expect this healthcare REIT to report a profit of $0.89 per share, up 9.9% from $0.81 per share reported in the same quarter last year. The company has topped Wall Street’s bottom-line estimates in each of the last four quarters. Its FFO of $0.88 per share in the previous quarter exceeded the forecasted figure by 1.2%.

For the current fiscal year, ending in December, analysts expect VTR to report an FFO of $3.48 per share, up 9.1% from $3.19 per share in fiscal 2024. Its FFO is expected to further grow 8.3% year-over-year to $3.77 in fiscal 2026.

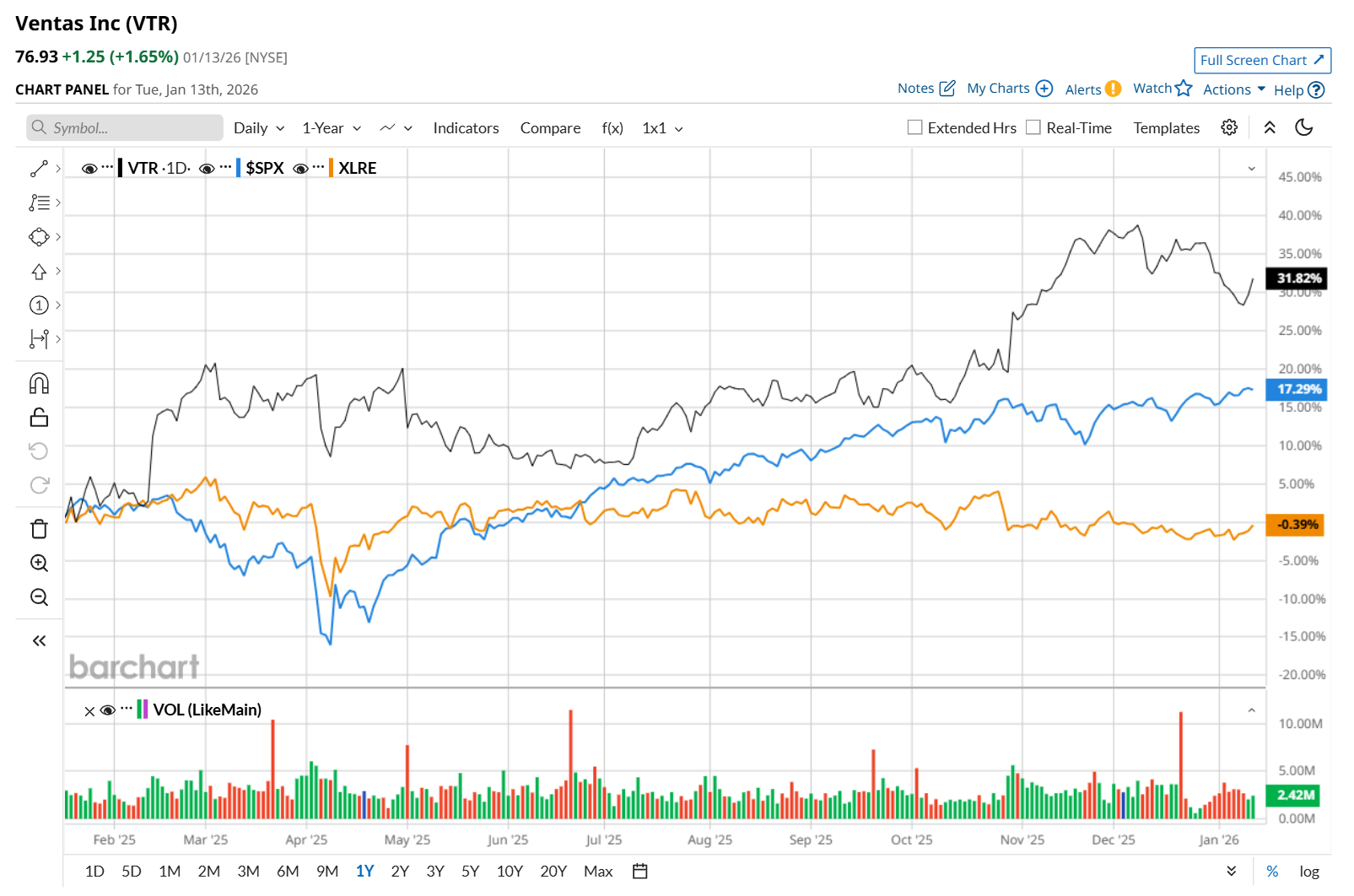

Ventas has soared 32.6% over the past 52 weeks, outperforming both the S&P 500 Index's ($SPX) 19.3% return and the State Street Real Estate Select Sector SPDR ETF’s (XLRE) 2.3% uptick over the same time period.

Ventas delivered better-than-expected Q3 earnings results on Oct. 29, and its shares surged 6.6% in the following trading session. The company’s total revenue increased 20.4% year-over-year to $1.5 billion, exceeding consensus estimates by 4.2%. Moreover, its normalized FFO of $0.88 improved 10% from the year-ago quarter, topping analyst expectations by a penny. VTR’s upbeat performance was driven by its senior housing operating portfolio (SHOP), which experienced broad-based demand and grew organically year-over-year by double digits.

Wall Street analysts are highly optimistic about VTR’s stock, with a "Strong Buy" rating overall. Among 21 analysts covering the stock, 16 recommend "Strong Buy," one indicates a "Moderate Buy," and four suggest "Hold.” The mean price target for VTR is $86.40, indicating a 12.3% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- MicroStrategy Just Exponentially Increased Its Bitcoin Purchases. What Does That Mean for MSTR Stock?

- President Donald Trump Says, “The United States Government Is Proud to Be a Shareholder of Intel.” Should You?

- Whole Foods Founder Calls Jeff Bezos a ‘Genius’ Who Killed the ‘Whole Paycheck’ Stigma

- Supermicro Stock Slips 46% in 3 Months: Should You Buy, Sell, or Hold SMCI?