The cybersecurity market is getting more attention as companies worldwide spend more to protect their data as threats increase. Projections show the sector reaching $211.69 billion in 2026 before rising to $265.17 billion by 2030, which works out to a 5.79% compound annual growth rate (CAGR)through the decade. Cloud security, a key part of that growth, is drawing even more focus as businesses shift more work into hybrid and multi-cloud setups.

Akamai Technologies (AKAM) moved into Wall Street’s spotlight on Jan. 12, when Morgan Stanley delivered a rare double upgrade, lifting AKAM stock from “Underweight” to “Overweight” and raising its price target to $115 from $83. The Cambridge, Massachusetts based company, which runs content delivery, cloud security, and compute platforms, saw shares rise 3.5% on the news to close at $91.27.

With a market capitalization of $12.78 billion and trailing 12-month sales of around $4 billion, Akamai has been steadily shifting from its legacy roots toward a broader cloud infrastructure business, even though AKAM stock had been sitting near multi-year lows before Morgan Stanley’s call.

But can Akamai successfully execute its transformation from a content delivery network pioneer into a broad-based cloud security and compute player? Or is this Morgan Stanley call simply the market chasing yesterday’s thesis with fresh analyst enthusiasm? Let’s find out.

What Akamai’s Numbers Reveal

Akamai Technologies (AKAM) is a behind-the-scenes infrastructure company that helps businesses deliver content and run computing workloads closer to users, using its content delivery, security, and cloud computing platforms. Over the past 52 weeks, AKAM stock is down about 0.3% but up 3.4% year-to-date (YTD), which points to a steady, gradual move rather than a sudden spike.

Akamai’s forward price-to-earnings (P/E) is around 19.5 times, below the sector’s 25.8, so the market is valuing AKAM at a discount even though the company is still growing and generating solid cash.

In the third quarter of 2025, revenue rose 5% year-over-year to about $1.05 billion, with security revenue up 10% YOY and cloud computing revenue up 8% YOY, even as delivery revenue fell 4% YOY. Security was still the biggest and strongest segment during Q3 at $568 million, while cloud computing came in at $180 million, helped by cloud infrastructure services revenue of $81 million, which jumped 39% YOY and shows momentum in newer offerings.

Profitability also improved. GAAP income from operations increased 135%, and GAAP operating margin rose to 16%, while non-GAAP income from operations grew 9% and non-GAAP margin reached 31%, pointing to a better mix and tighter cost control. Net income followed the same trend, with GAAP net income up 142% and non-GAAP net income up 10%, leading to GAAP EPS of $0.97 (up 155%) and non-GAAP EPS of $1.86 (up 17%). That shows earnings are growing faster than revenue as Akamai keeps leaning into security and cloud.

Akamai’s Real Fundamental Story

In its strategic collaboration Visa (V) , Akamai is combining Visa’s Trusted Agent Protocol with Akamai’s edge-based behavioral intelligence, user recognition, and bot and abuse protection. The goal is to give merchants the identity, authentication, and fraud controls they will need as AI agents start showing up in digital storefronts with real intent to buy. This creates a clear link between edge security and revenue opportunity. If agentic commerce grows, businesses will not only care about speed. They will also pay for stronger verification and protection right where traffic and transactions hit the edge.

That same edge-plus-cloud strategy also shows up in Akamai’s computer ecosystem. Redpanda, joining the Akamai Qualified Compute Partner Program as an ISV, is focused on enabling globally distributed, real-time data streaming built for AI-driven applications, especially in regions where buyers prefer Akamai’s platform. The takeaway is simple: Akamai is pulling in workloads that need low-latency, high-performance data access close to users and devices.

Then there’s Vindral, an ISV Catalyst partner focused on ultra-low latency live streaming, including setups as low as 150 milliseconds glass-to-glass, while keeping viewers in sync. By pairing Akamai’s reach and resilience with a “future-ready streaming stack” and supporting emerging standards, Akamai is leaning into a bundled approach where edge delivery, compute, and security work together — and where low latency and reliability are central.

Why Wall Street Is Rewriting the Script on AKAM Stock

Akamai guided for Q4 2025 revenue of $1.08 billion and full-year 2025 revenue of $4.19 billion at the high ends, while keeping non-GAAP operating margin at 28% to 30% for Q4 and 29% to 30% for the full year. The firm also gave non-GAAP EPS guidance of $1.65 to $1.85 for Q4 and $6.93 to $7.13 for 2025. That came along with an 18% to 19% non-GAAP tax rate for Q4 (19% for the full year) and 147 million shares used in non-GAAP per-share calculations, which gives investors a clear set of targets to work with.

This clearer outlook helps explain Morgan Stanley’s double upgrade. KeyBanc also changed its stance earlier, upgrading Akamai from “Underweight” to “Overweight” on Dec. 15, 2025, and raising the price target from $66 to $115. The firm said it was “wrong early,” noting that the stock had returned more than 12% since KeyBanc started coverage in June 2025, compared with a 4.9% software index gain over the same period. KeyBanc’s view also leaned on compute, pointing to Akamai’s Nvidia (NVDA) partnership to secure GPU capacity as a way to tap demand from AI companies looking for available computing resources.

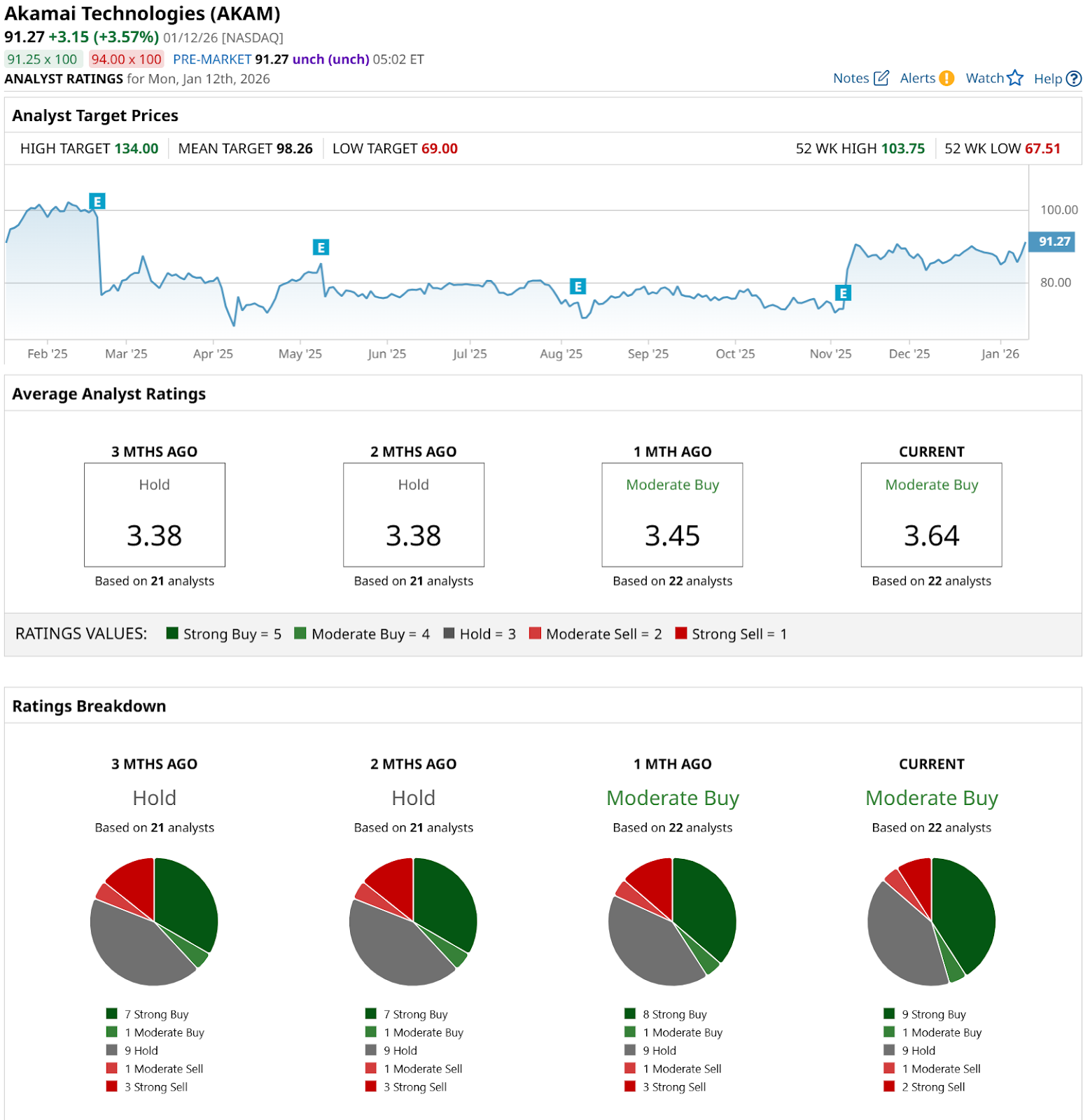

Put those upgrades next to the wider Street view, and the tone is clearly improving. AKAM stock has a consensus “Moderate Buy” rating, and the mean price target is $98.26. That points to about 8% potential upside from AKAM's current price.

The Bottom Line

When you pull everything together, Akamai looks like a quietly solid “yes, but know what you’re buying” rather than a speculative flyer. AKAM stock still trades at a discount multiple to its sector despite accelerating security and compute fundamentals, improving margins, and a clear roadmap that’s now being validated by high-profile upgrades from Morgan Stanley and KeyBanc. That setup argues that the risk‑reward skews modestly to the upside from here, with shares more likely to grind higher than round-trip the recent move, assuming that execution in security and compute holds and the broader AI and cloud spending cycle doesn’t crack.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Google vs. Apple: Which Magnificent 7 Stock is a Better Buy Right Now?

- Should You Buy or Sell Nvidia Stock Amid China’s H200 Whiplash?

- Morgan Stanley Just Upgraded This 1 Lesser-Known Tech Stock. Should You Buy Shares Now?

- China Just Banned Broadcom’s Cybersecurity Solutions. What Does That Mean for AVGO Stock?