Early 2026 brought a lift to semiconductor stocks from strong AI and data center spending, even as interest-rate volatility and supply-chain noise kept the sector choppy. Investors are rotating into names they see as undervalued, but short-term headlines can distract from longer-term fundamentals.

Qualcomm (QCOM) fits that pattern. Talk about Apple’s (AAPL) move to in-house modem chips has pressured the stock, yet Qualcomm’s core businesses—Android handsets, automotive, IoT, and data center initiatives—remain intact and performing.

Bernstein urges investors to look past the Apple noise and focus on what comes next, noting Qualcomm stands to benefit from steady AI spending and improving sector dynamics. If Apple-related concerns fade, Qualcomm could reassert itself as a solid semiconductor pick for 2026.

About QCOM Stock

Qualcomm is a leading wireless tech and semiconductor company. It dominates handset processors, the Snapdragon chip, and generates royalty income by licensing key 3G/4G/5G wireless technology to phone makers.

Qualcomm has been active in new partnerships lately and product launches beyond smartphones. Notably, it unveiled an AI solution center in Riyadh in partnership with Saudi firm Humain. This Qualcomm-Humain collaboration will roll out up to 200 megawatts of Qualcomm-powered AI data center racks starting in 2026. Moreover, the chip company is also expanding its IP business, which plans to acquire UK-based Alphawave high-speed connectivity chips in a $2.5 billion deal expected to close in Q1 2026.

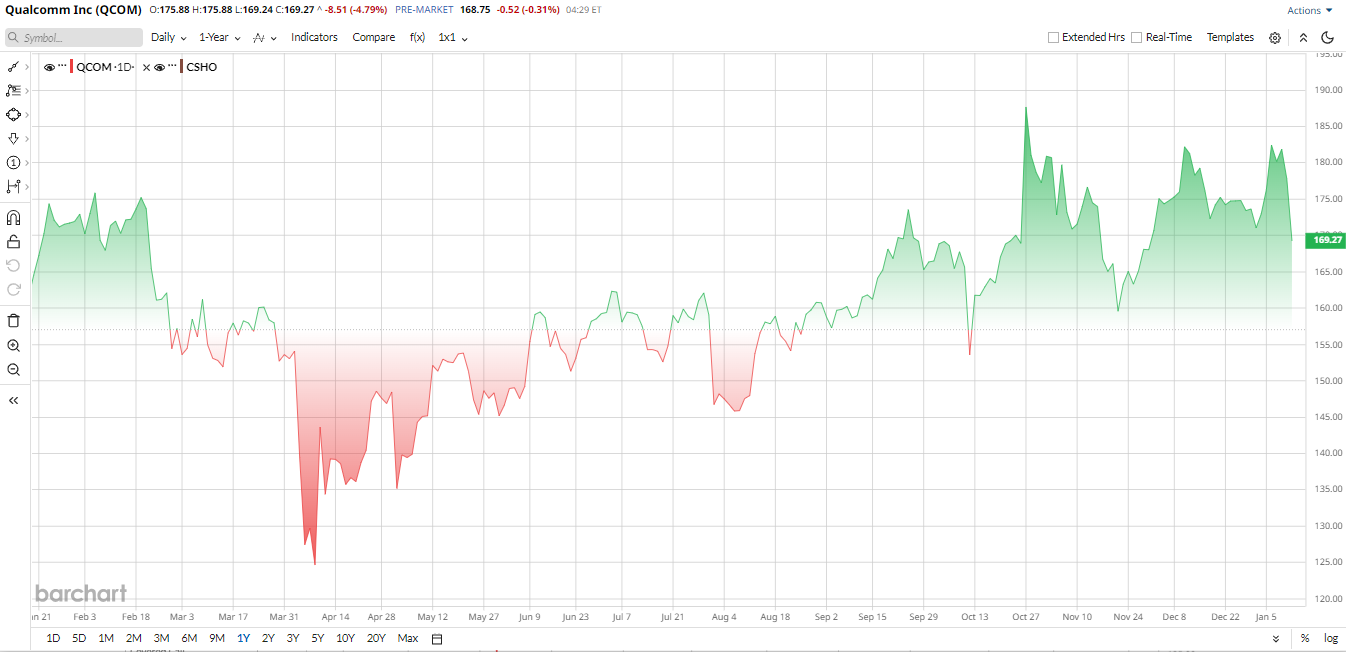

Valued at around $180 billion by market cap, shares of QCOM have gone up modestly by about 6% over the past 52 weeks, significantly below the broader market index, which climbed almost 20% in the same period.

Following the modest rally, Qualcomm’s valuation looks relatively cheap. Its forward price-to-earnings (P/E) multiple is only in the mid-teens, about 14×, well below the mid-20s median for semiconductor peers. In fact, Bernstein notes QCOM trades at roughly a 40% to 50% discount to the broader market and semiconductor index. So it's clear that QCOM appears undervalued given its strong growth outlook; a potential rerating could be forthcoming if sales and margins continue to improve.

QCOM Apple Overhang

Recently, the main worry has been Apple’s move to in-house modem chips. Press reports suggest Apple will gradually reduce Qualcomm content in new iPhones. However, analysts say much of that bad news is already baked into the stock. Bernstein points out that Qualcomm’s valuation “sticker shock” has settled as Apple-related revenue slides and encourages investors to “stick with QCOM as AAPL prepares to drop out of the model.”

In reality, Apple continues to use Qualcomm parts in its latest handsets; for example, analysts note that Qualcomm’s chips are still in the upcoming iPhone 17 models, even if older or lower-end models switch to Apple's silicon. Qualcomm management itself acknowledges some mix shift but emphasizes that the primary growth driver is surging premium Android sales.

So, once the Apple modem news recedes, Qualcomm’s strong Android handset, automotive, IoT, and data center franchises remain intact, supporting the bull case.

QCOM Beats Q4 Estimates

Qualcomm closed fiscal Q4 on a strong note, and management looks confident as it heads into fiscal 2026. Revenue for the quarter came in at $11.3 billion, roughly 10% above a year earlier and above the high end of guidance. EPS hit $3.56, up about 12% year-over-year (YoY), a clear beat that reflects broad strength across the business.

Margins and cash flow tell the rest of the story. QCT posted about a 29% operating margin in the quarter and finished the year near a 30% run rate. Free cash flow for fiscal 2025 reached a record $12.8 billion, and Qualcomm returned nearly all of that to shareholders through buybacks and dividends.

Management frames the momentum around a premium shift in devices. CEO Cristiano Amon says the move to higher-end, 5G-enabled phones is lifting content-per-phone and ASPs, while CFO Akash Palkhiwala points to Android strength as the primary driver this quarter.

Looking ahead, Qualcomm guided fiscal Q1 revenue of $11.8 to $12.6 billion and EPS of $3.30 to $3.50. Qualcomm also expects to keep roughly 75% modem share in Samsung’s Galaxy S26, helping smooth concerns about customer concentration. Hit these marks, and Qualcomm could be on a path to roughly $44 to $45 billion in revenue and about $12.8 to $13.0 in EPS for fiscal 2026, comfortably above current street estimates.

What Do Analysts Think About QCOM Stock

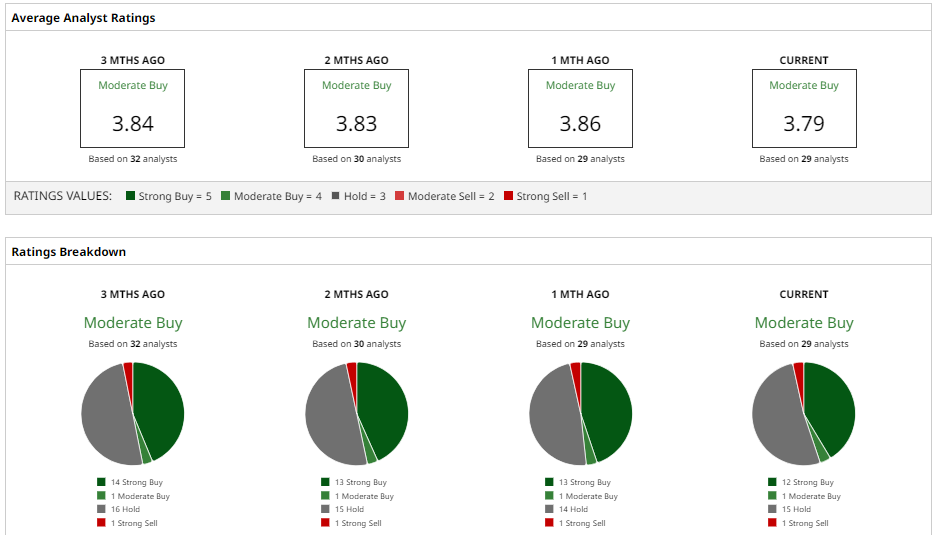

Qualcomm is still divided on Wall Street, but the mood is generally favorable. UBS increased the price objective to approximately $185 and maintained an additional “Neutral” rating that demonstrates better confidence in the long-term earnings sustainability regardless of the short-term risks.

J.P. Morgan, however, took a rosy outlook, revising its price objective as high as $210 and reiterating an “Overweight” rating after the beat-and-raise quarter at the company.

More bullishly, Susquehanna and Cantor also raised their targets to over $200 following the strong performance in Q4 and positive expectations.

But not everyone believes that. Wells Fargo is wary and has given an “Underweight” rating and a target of $165, stating that it is not sure about the demand for handsets and the deceleration of Apple-related content. Such indecisiveness is a deterrent to certain analysts, despite good performance at Qualcomm.

Analysts argue that Qualcomm is getting more diversified beyond the smartphones, especially in automotive, IoT, and new data centers, which analysts point to as evidence that the business mix is becoming stronger.

Taken together, the analyst community currently rates QCOM a consensus “Moderate Buy,” with the average price target sitting near $193, which means the stock still has room to grow about 14% upside from current levels.

On the date of publication, Nauman Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Revenue Keeps Growing at Taiwan Semi. Should You Load Up on TSM Stock for 2026?

- As Goldman Sachs Issues a Warning on Super Micro Computer Stock, Should You Risk Buying the Dip?

- This Analyst Still Thinks Apple Stock Is a Top Pick for 2026

- Nvidia Stock Could Be Just a Few Weeks Away from a Major Downside Catalyst. How to Play NVDA Here.