Alphabet's (GOOGL) decision to embed its cutting-edge Gemini AI directly into Gmail marks a significant inflection point in the company’s broader artificial intelligence (AI) strategy, and it could have meaningful implications for GOOGL stock. This month, Google began rolling out a host of AI-powered features in Gmail, from automatic conversation summaries and natural-language AI Overviews to context-aware drafting tools and an intelligent AI Inbox that highlights priority messages and actionable items.

These enhancements, powered by Gemini 3, aim to transform Gmail from a static email platform into a proactive productivity assistant for more than 3 billion users worldwide — a shift that not only deepens user engagement across Google’s ecosystem but also strengthens the company’s competitive footing in the AI race.

Is GOOGL stock a buy now? Let’s discuss.

About Alphabet Stock

Headquartered in Mountain View, California, Alphabet has transformed the tech landscape through its wide-ranging businesses, including Google Services, Google Cloud, and forward-looking initiatives like Waymo and Verily. Its strategic focus on AI and cloud computing continues to be a major growth engine, reinforcing its strong competitive positioning. With a market capitalization of $3.96 trillion, Alphabet remains a dominant force in global technology and a key member of the Magnificent Seven.

Alphabet’s stock has delivered a powerful rally over the past year, with shares climbing strongly throughout 2025 and into early 2026. On Jan. 12, GOOGL reached a new 52-week high of $334.04 on the back of bullish catalysts like the integration of advanced AI features like Gemini into core products and analyst upgrades.

GOOGL stock has registered a 72% increase over the past year, substantially outperforming the broader market benchmarks and underscoring significant investor confidence and robust performance driven by renewed growth in advertising, accelerating cloud revenue, and enthusiasm around AI initiatives like Gemini.

This rally helped Alphabet recently surpass Apple (AAPL) in market cap for the first time since 2019, reflecting how investor sentiment has shifted in favor of Google’s AI strategy and longer-term growth prospects.

GOOGL currently trades at a premium compared to the sector median and its own historical average at 29.7 times forward earnings.

Alphabet's Robust Q3 Performance

Alphabet’s third-quarter 2025 financial results, released on Oct. 29, showed robust year-over-year (YOY) growth, underscoring continued momentum in advertising, cloud computing and AI-driven demand. For the quarter ended Sept. 30, total revenue came in at about $102.3 billion, representing a roughly 16% increase YOY, and marking the first time in the company’s history that quarterly revenue exceeded $100 billion, a milestone that reinforced investor confidence in Alphabet’s scale and growth trajectory.

Net income jumped about 33% YOY to $34.9 billion, while EPS climbed around 35% to $2.87, both well ahead of analyst expectations.

Breaking down the performance, Google Services — which includes Search, YouTube advertising and subscription businesses — grew 14% compared with the prior year.

Google Cloud continued to be a standout growth driver, with revenue up 34% YOY to about $15.2 billion, driven by strong enterprise demand for cloud infrastructure and AI solutions. Operating income expanded modestly, though margins were impacted by a one-off $3.5 billion fine from the European Commission, with adjusted operating margins remaining healthy after excluding that charge.

Furthermore, Alphabet projected its 2025 capital expenditure guidance to be between $91 billion to $93 billion, as it accelerates investment in data centers, AI infrastructure and cloud capacity to support long-term growth.

Analysts remain optimistic, forecasting EPS of roughly $10.58 for fiscal 2025, a 32% YOY jump, followed by a further 4% rise to $11.04 in 2026.

What Do Analysts Expect for Alphabet Stock?

Recently, Cantor Fitzgerald upgraded Alphabet from “Neutral” to “Overweight” and raised its price target to $370 from $310. The firm noted easing concerns around the U.S. antitrust trial, while Alphabet’s massive user base across search, Chrome, and Android positions it as a key long-term beneficiary in the AI market.

Canaccord Genuity also raised its GOOGL price target to $390 from $330 and reiterated a “Buy” rating. The analyst firm cited a major shift in investor sentiment driven by search stability, accelerating AI innovation, strong cloud growth, and regulatory relief.

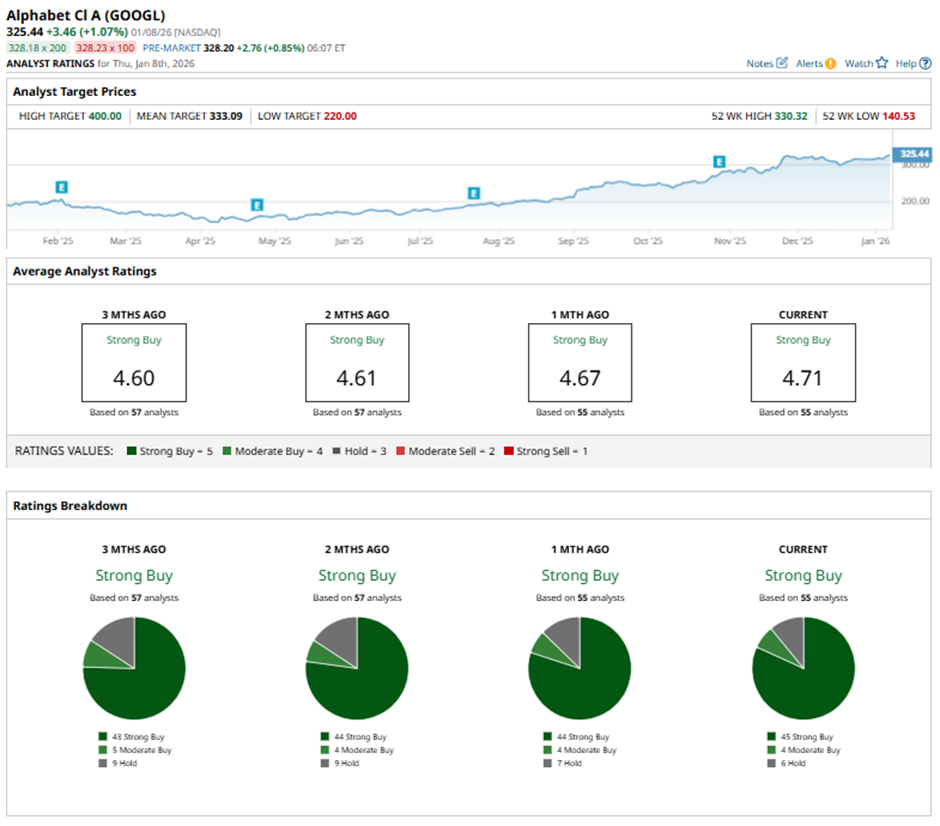

Wall Street is majorly bullish on GOOGL. Overall, GOOGL stock has a consensus “Strong Buy” rating. Of the 55 analysts covering the stock, 45 advise a “Strong Buy,” four suggest a “Moderate Buy,” and the remaining six analysts provide a “Hold” rating.

GOOGL’s average analyst price target of $334.23 points to 1% potential upside from here, while the Street-high target price of $400 suggests that the stock could rally as much as 21%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart