The beauty segment, within the consumer discretionary part of the market, is one area I think is worth watching closely. Indeed, the amount that consumers spend on beauty products can often be taken as a bull/bear market indicator. That's because in good times, spending above one's budget on such items can drive higher profit margins and earnings for companies like Ulta (ULTA). However, if we see consumer spending deteriorate for such a company — particularly given Ulta's status as one of the lower-cost providers of beauty products in this sector — that can be bad news for investors over specific time frames.

As it happens, Ulta has seen some interesting dynamics play out over the course of 2025. For 2026, the company is eyeing some significant gains from its so-called “Ulta Beauty Unleashed” initiative, which aims to improve in-store shopping experiences for its core clientele, diversifying its operations to have a more global footprint with operations in other higher-growth markets.

Let's dive into this specific strategy, and what to make of Ulta's current fundamentals and positioning in its key sector right now.

What Is Ulta's Plan?

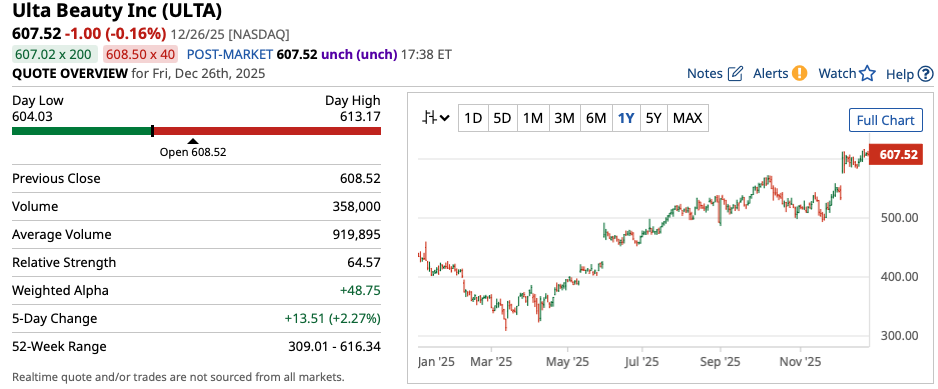

Ulta's management team clearly has an eye on improving the firm's underlying operations, and expanding into new markets, which is something investors are clearly cheering. With ULTA stock trading near its all-time high, the company's fundamentals and market positioning are clearly being viewed in a very positive light right now.

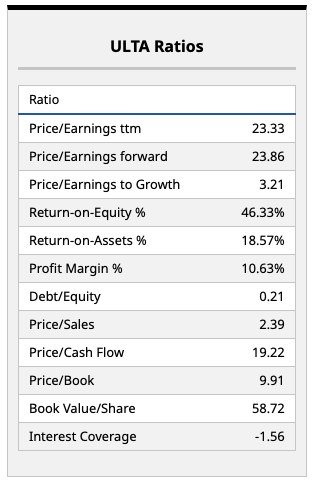

Ulta's fundamentals indicate that ULTA stock isn't incredibly overpriced, even after its recent rally. Trading at just 23 times forward earnings, with a solid profit margin driven by a value proposition in the beauty sector, Ulta could be a winner heading into 2026.

Of course, if the company is able to execute efficiently on its growth strategy, this multiple could look cheap in hindsight. With a roughly 5% free cash flow yield and a solid balance sheet that looks not only able to support the company's capital expansion plans (but could be an excellent use of capital long-term), I think this is a name investors will want to watch closely moving forward.

What Do Analysts Think?

Analysts from Morgan Stanley have adjusted their models to factor in higher margins in the coming years, thanks to this strategic reset. Other analysts appear to be following suit, with the consensus $634.28 price target on ULTA stock implying upside of roughly 4% from here.

I think this price target will likely increase over time, as analysts rush to catch up to ULTA stock on its way higher. Some material things have changed in recent quarters, with Ulta absolutely blowing away expectations.

If that dynamic continues into the first quarter, the company's price target could increase toward the $700 level, as this value becomes baked into Ulta's market capitalization. We'll have to see. For now, investors will want to keep ULTA stock on their watch list as the company moves boldly forward in uncertain times.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Jefferies Is Betting Big on Mining Stocks for 2026. Here Is Barchart’s Top-Rated Name.

- A $100 Million Reason to Buy This Critical Minerals Stock in 2026

- Unusual Activity in Occidental Petroleum Call Options - A Signal Investors Expect a Dividend Hike

- Ulta Stock ‘Unleashed’ Gains in 2025. Should You Keep Buying Shares in 2026?