IonQ (IONQ), the largest pure-play quantum computing company in terms of market capitalization and revenue, has deepened its relationship with the Korea Institute of Science and Technology Information (KISTI). As part of this partnership, the company will now deliver its Tempo 100 quantum system to support the institution's hybrid quantum-classical research endeavors.

The Tempo 100 is IonQ's current flagship commercial quantum computer, defined by Algorithmic Qubits (AQ) instead of raw qubit count. AQ is IonQ’s performance metric that reflects how many usable, low-error, fully connected qubits a customer can actually run algorithms on. In contrast, 100 refers to approximately 100 high-quality, error-corrected-ready qubits, accounting for gate fidelity, coherence time, and connectivity.

IonQ Is a Trusted Partner of Many Reputable Institutions

To be combined with the institute's KISTI-6, the Tempo 100 improves on earlier IonQ systems primarily through much higher effective computational power, not just incremental hardware changes. Earlier systems had significantly lower AQ, meaning that although they might have had a comparable or even higher physical qubit count, real algorithms would break down faster due to noise, errors, or limited gate depth. Tempo 100 delivers substantially higher gate fidelity, longer coherence times, and more stable all-to-all qubit connectivity, allowing customers to run deeper, more complex circuits before errors dominate.

Notably, IonQ has been partnering with KISTI in some form since 2022, when the two began collaborating to provide South Korea's research community with cloud access to IonQ's trapped-ion quantum systems and to advance national quantum research capabilities. Additionally, in South Korea, IonQ has partnerships with two other universities, namely the Seoul National University and Sungkyunkwan University.

Beyond South Korea, IonQ has also forged partnerships back home with the University of Chicago, the University of Maryland, and the University of Washington. While the partnership with the University of Chicago was to establish the IonQ Center for Engineering and Science, the company allied with the University of Maryland through a dedicated quantum research center.

These collaborations may not bring substantial revenue to IonQ in the short term. However, they do help in building credibility for IonQ's systems, with these institutions of repute acting as anchor customers, strengthening the firm's competitive moat and acting as a readymade talent pipeline for the company.

But is there more to IonQ than just these partnerships that make it a viable investment option now? Or is IONQ stock still too niche to warrant an investment?

A Huge Leap in Losses Overshadows the Positives

Since IonQ's latest results for the most recent quarter, the stock is down about 18%. A quantum leap in losses was the main culprit, although revenues came in ahead of the consensus estimates. The third quarter of 2025 saw IonQ report revenue of $39.9 million, up a major 222% from the previous year. The company also achieved a world-record 99.99% Two-Qubit Gate performance, making it the first company to secure fidelity required to scale to full-fault-tolerant quantum computing.

Amid this breakthrough, however, losses widened significantly to $3.58 per share from $0.24 per share in the year-ago period. Moreover, that was considerably higher than the consensus estimate of a loss of $0.44 per share.

Net cash used in operating activities for the nine months ended Sept. 30 ballooned to almost a quarter of a billion dollars at $208.7 million compared to just $66.3 million in the year-ago period. Again, a sizeable jump in losses contributed to this outflow. Overall, IonQ closed the quarter with a cash balance of $346 million, much higher than its short-term debt levels, dismissing any liquidity or solvency concerns in the near term.

Notably, IONQ stock, with a market cap of $15.7 billion, is up 7% on a year-to-date (YTD) basis.

Analyst Opinions on IONQ Stock

Investors focused on the long term, who see quantum computing as a sector with massive upside, could treat the latest weakness in IONQ stock as a reasonable place to build a position. The stock has come off its highs, yet IonQ remains one of the rare companies that controls the entire quantum stack, right from designing processors and networking hardware to delivering finished systems.

Further, clients can run workloads either on dedicated machines at their own sites or through cloud links with the three major hyperscalers. At the core of all this is the trapped-ion method IonQ uses, which stands out for its long coherence periods and near-perfect gate accuracy. Such traits make algorithms run more reliably and cut down on coding headaches, giving the company a clear technical gap over many rivals.

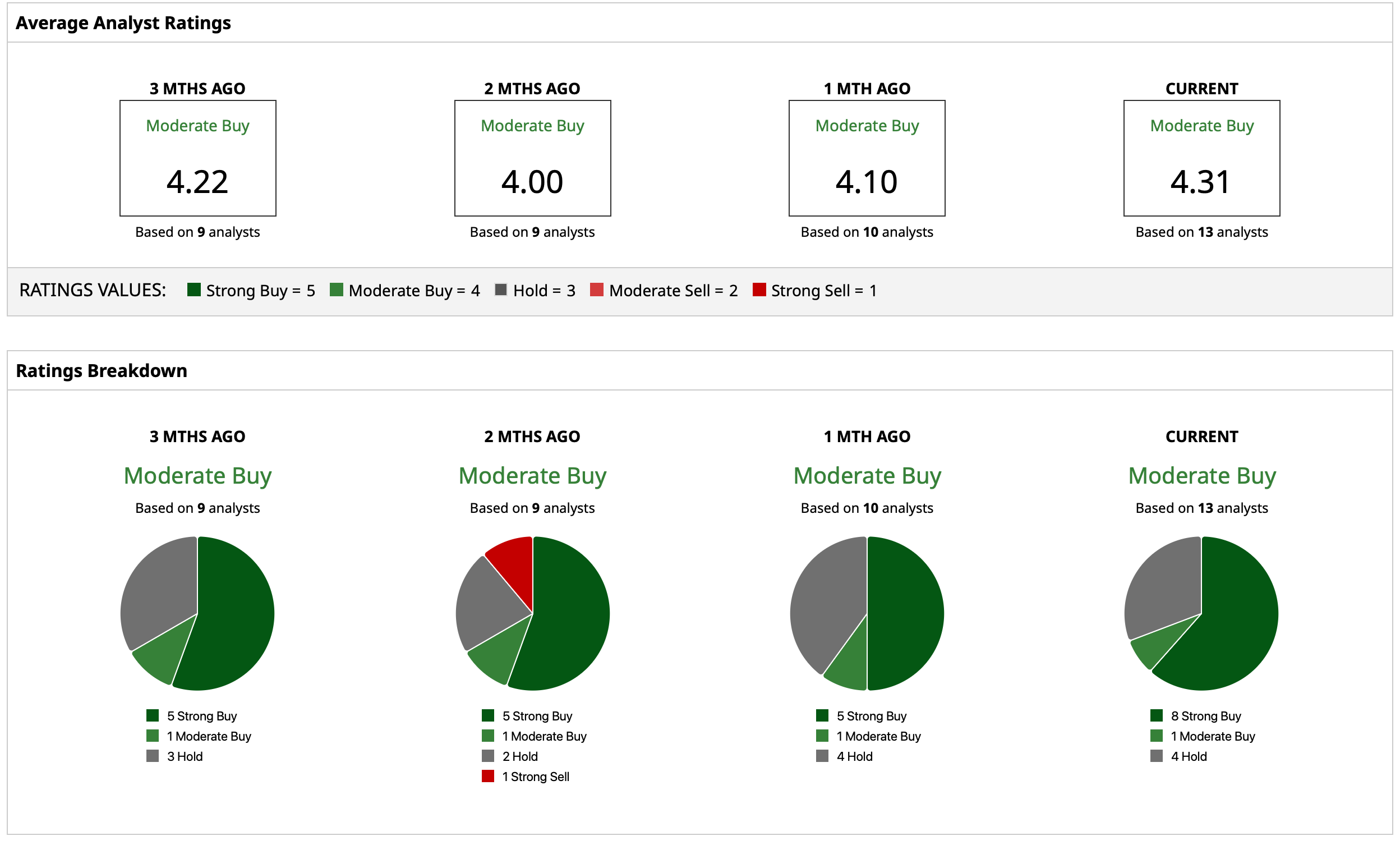

Analysts attribute a consensus rating of “Moderate Buy” for IONQ stock, with a mean target price of $75.50. This denotes upside potential of about 68% from current levels. Out of 13 analysts covering the stock, eight have a “Strong Buy” rating, one has a “Moderate Buy”, and four have a “Hold” rating on IONQ stock.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- IonQ Is Bringing a 100-Qubit System to South Korea. Should You Buy IONQ Stock for 2026?

- AST SpaceMobile Just Made Satellite History. Should You Buy ASTS Stock for 2026?

- Buy This 1 Top AI ‘Picks-and-Shovels’ Stock Now for 2026

- Trump Is Promising That the U.S. Will Return to the Moon. Does That Really Make Little-Known SIDU Stock a Buy?