IonQ (IONQ) shares printed a high of about $82 this year, sharply above their year-to-date low of roughly $18, reflecting the broader volatility that continues to plague the quantum computing industry.

In the near term, two key levels will likely set the trajectory for IonQ stock: $44.22 that coincides with its 200-day moving average and $53.89 that aligns with its 100-day MA.

A drop below the former would accelerate downward momentum in early 2026, while a rally past the latter would unlock further upside, potentially back to record levels.

At the time of writing, IONQ is up a whopping 150% versus its March low but less than 10% only year-to-date.

How to Play IonQ Stock Heading into 2026

Fundamentally, IonQ maintains a significant competitive advantage through its trapped ion qubit technology, which has achieved a world-record 99.99% two-qubit gate fidelity rate.

This breakthrough translates to about one error in every 10,000 operations, sharply outperforming rivals who have yet to breach the 99.9% threshold of one error per 1,000 operations.

Moreover, the NYSE-listed firm’s recent delivery of its 100-qubit Tempo system to South Korea’s KISTI represents a meaningful scaling milestone.

However, IONQ shares’ valuation (about 400x sales) remains a major overhang heading into 2026.

IONQ Shares to Benefit From Narrowing Losses

IonQ stock remains attractive also because the company is narrowing its loss rather quickly.

In the current quarter, the quantum computing specialist is expected to lose $0.48 on a per-share basis, about a 48% improvement on a year-over-year basis.

More importantly, in fiscal 2026 as a whole, IONQ is estimated to actually earn $1.74 a share, achieving a key profitability milestone that may help justify its premium valuation.

Key inflection points for the coming year include IonQ’s advancement to “stage B” of the DARPA quantum computing initiative, strengthening its competitive advantage over rivals.

What’s the Consensus Rating on IonQ?

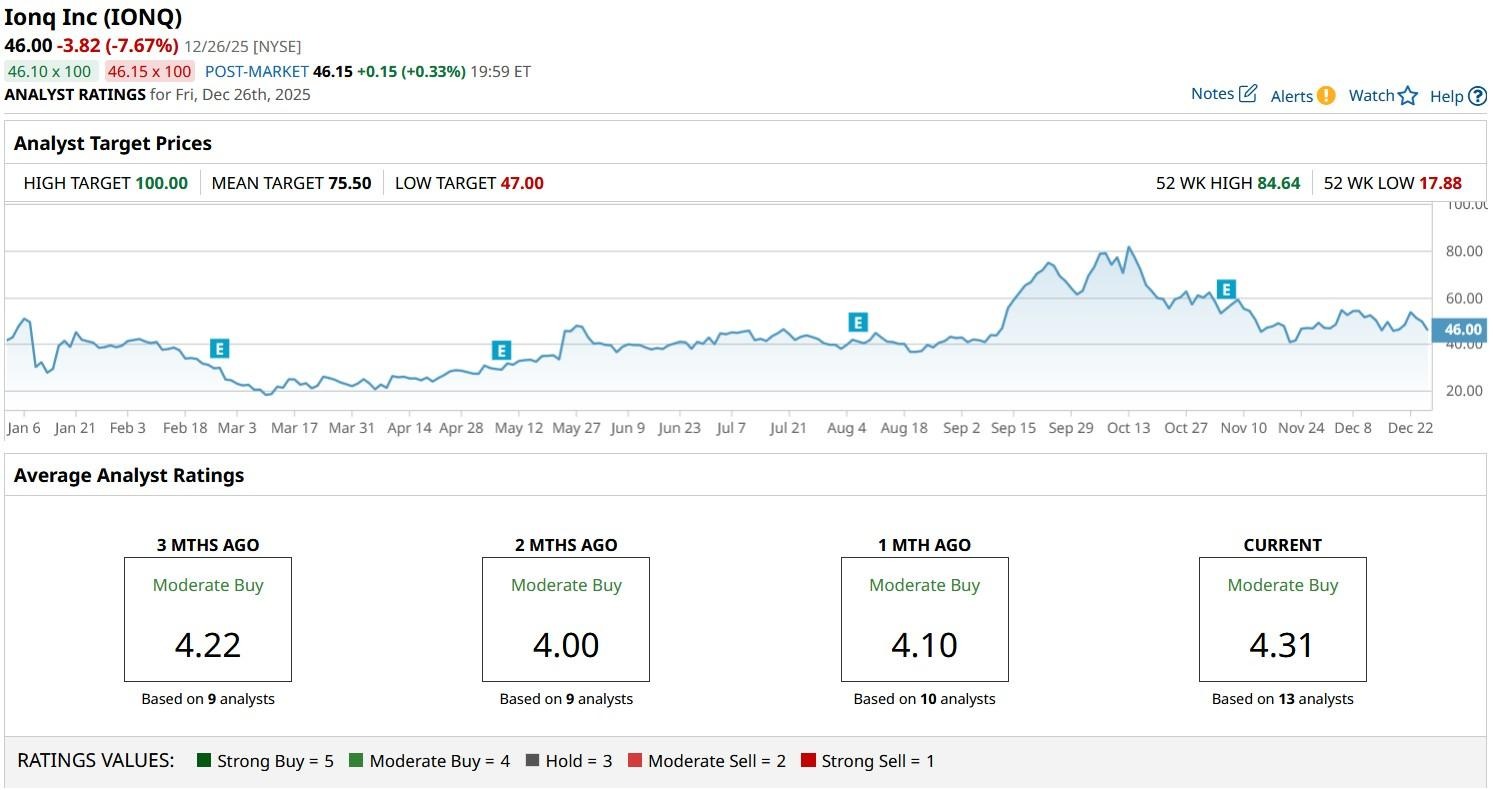

What’s also worth mentioning is that Wall Street remains constructive on IONQ shares heading into 2026.

The consensus rating on the quantum computing stock sits at “Moderate Buy” currently with the mean target of about $75 indicating potential upside of nearly 70% from here.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?

- Activist Investor Toms Capital Is Buying Up Target Stock. Should You?