Novo Nordisk A/S ADR (NVO), a trailblazer in the weight-loss revolution, has endured a bruising 2025. The Danish pharma giant has been hit by trimmed growth forecasts, pricing pressure, rising competition from Eli Lilly (LLY), mass layoffs, dramatic leadership changes, and even a high-profile public bidding war with U.S. rival Pfizer (PFE). Although Novo’s blockbuster Ozempic enjoyed a four-year head start over Lilly’s Mounjaro, Lilly has now pulled ahead in U.S. prescriptions.

Novo’s struggles to keep up with demand also allowed compounding pharmacies to step in, chipping away at its market share and making 2025 one of its toughest years yet. But just as investor confidence was wearing thin, Novo delivered what felt like an early Christmas gift. On Dec.22, the Wegovy manufacturer became the first drugmaker to win FDA approval for a GLP-1 pill for weight loss, a milestone some analysts called a “redemption for investors” following the stock’s worst year on record.

The breakthrough instantly repositioned Novo at the forefront of the next phase of obesity treatment, shifting the narrative from setbacks to a strategic comeback. Importantly, the FDA’s green light also gives Novo a critical head start over Eli Lilly, which has also filed for approval of its own oral weight-loss drug, orforglipron. Novo plans to launch oral Wegovy, called “Wegovy-in-a-pill”, in the U.S., its biggest market, in early January 2026. With this major catalyst now in place, should you buy, sell, or hold NVO shares?

About Novo Nordisk Stock

Best known for its blockbuster weight-loss drugs Ozempic and Wegovy, Novo Nordisk is one of the world’s most influential healthcare companies, with a deep-rooted focus on chronic disease. Founded in 1923 and headquartered in Denmark, the company built its global reputation in diabetes care before expanding aggressively into obesity and other severe conditions.

Today, Novo commands a market capitalization of roughly $230.4 billion, underscoring its scale and influence in the global pharma landscape. Even so, the stock hasn’t had a smooth ride in 2025. Multiple factors, including soft demand for its blockbuster drugs and intensifying competition in the weight-loss space, have eroded investor confidence.

That mood shifted sharply Dec. 22 when the FDA approved “Wegovy-in-a-pill,” sending NVO shares jumping nearly 7.3% on Dec. 23. And the story doesn’t stop in the U.S. Novo has also submitted the oral drug for approval to the European Medicines Agency (EMA) and other regulators, paving the way for a much broader global rollout.

The science behind the pill looks impressive, too. In trials, it helped patients lose an average of 16.6% of their body weight over about a year, beating Eli Lilly’s pill, which delivered 12.4% weight loss in a late-stage study. Still, despite this powerful catalyst, the bigger picture remains tough. Novo’s stock is down about 39% in 2025, badly lagging the broader S&P 500 Index ($SPX), which has surged 17.86% over the same stretch.

Novo Nordisk’s Q3 Earnings Snapshot

Novo Nordisk’s fiscal 2025 third-quarter earnings report, released on Nov. 5, delivered a mix of resilience and rising pressure as the company continued to ride the GLP-1 wave, but with growing headwinds. Total revenue reached DKK 74.98 billion, up 5% year-over-year (YOY), reflecting steady global demand for its diabetes and obesity treatments. While the top line held up well, profitability told a more complicated story as costs and competition began to weigh on results.

The diabetes and obesity care segment remained the backbone of growth, generating DKK 70.25 billion in sales, up 5.3% annually. Novo’s blockbuster GLP-1 drugs continued to lead the charge, though momentum is clearly moderating. Wegovy sales surged 18% YOY to DKK 20.35 billion, underscoring that demand for weight-loss and diabetes drugs remains strong, even as pricing pressure and supply constraints intensify.

However, the cost structure moved sharply higher. Research and development spending jumped 62% YOY to DKK 15.39 billion, as Novo ramps up investment in next-generation obesity drugs and oral GLP-1 formulations. At the same time, profitability took a hit, with net profit sliding 27% to roughly DKK 20 billion, partly due to restructuring charges tied to workforce reductions and operational streamlining.

Despite the Q3 slowdown, the company’s longer-term performance remains solid. Operating profit for the first nine months of 2025 climbed 10% Wegovy sales surged 18% YOY to DKK 20.35 billion at constant exchange rates to DKK 95.92 billion, and management noted that growth would have been 21% without about DKK 9 billion in restructuring costs, highlighting the underlying strength of Novo’s core business.

Looking ahead, Novo narrowed its full-year guidance for the fourth time this year, signaling a more cautious outlook. The company now expects sales growth of 8% to 11% at constant exchange rates, down from 8% to 11%, and operating profit growth of 4% to 7%, trimmed from the prior 4% to 10% range. The revised forecast reflects slower-than-expected growth in GLP-1 prescriptions and intensifying competition.

What Do Analysts Think About Novo Nordisk Stock?

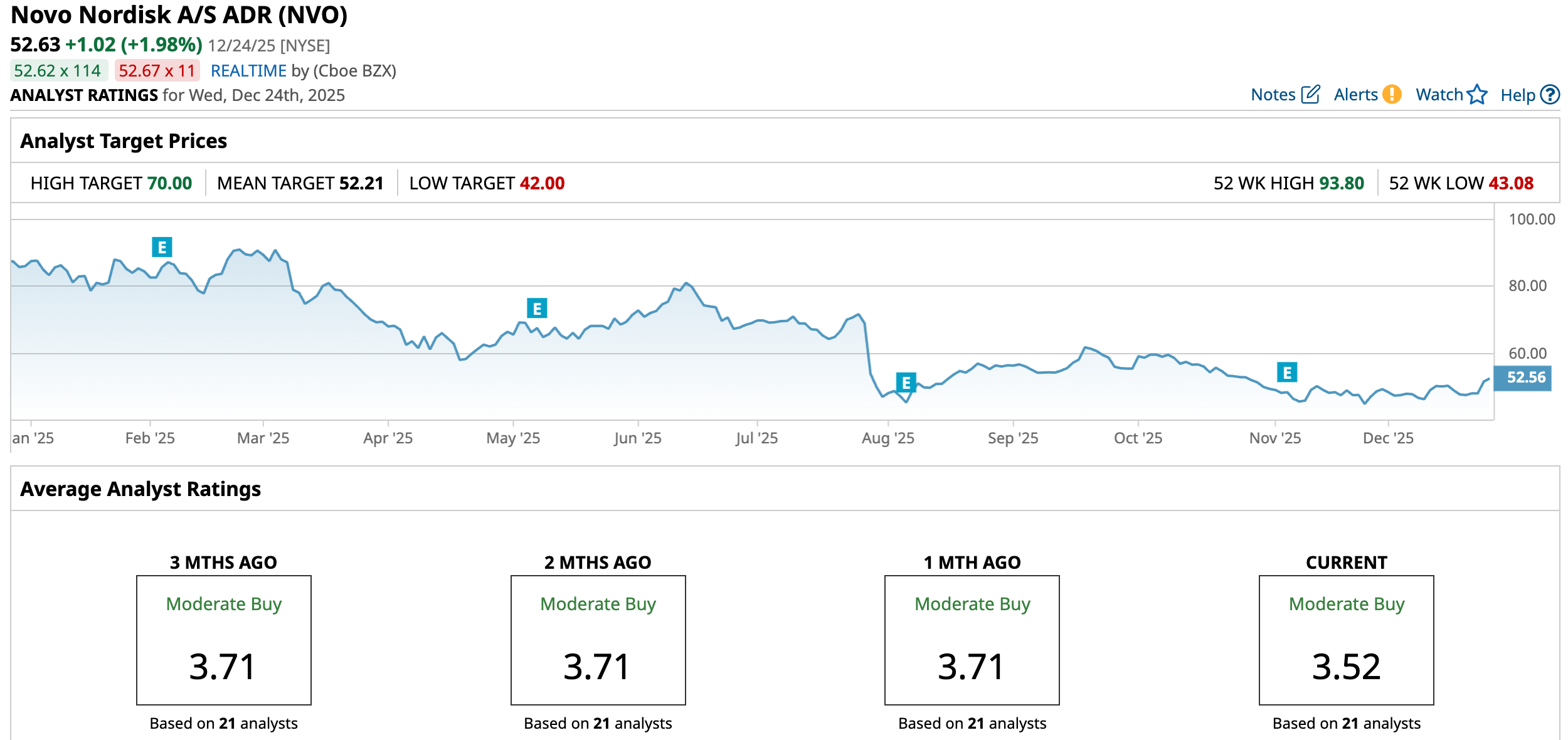

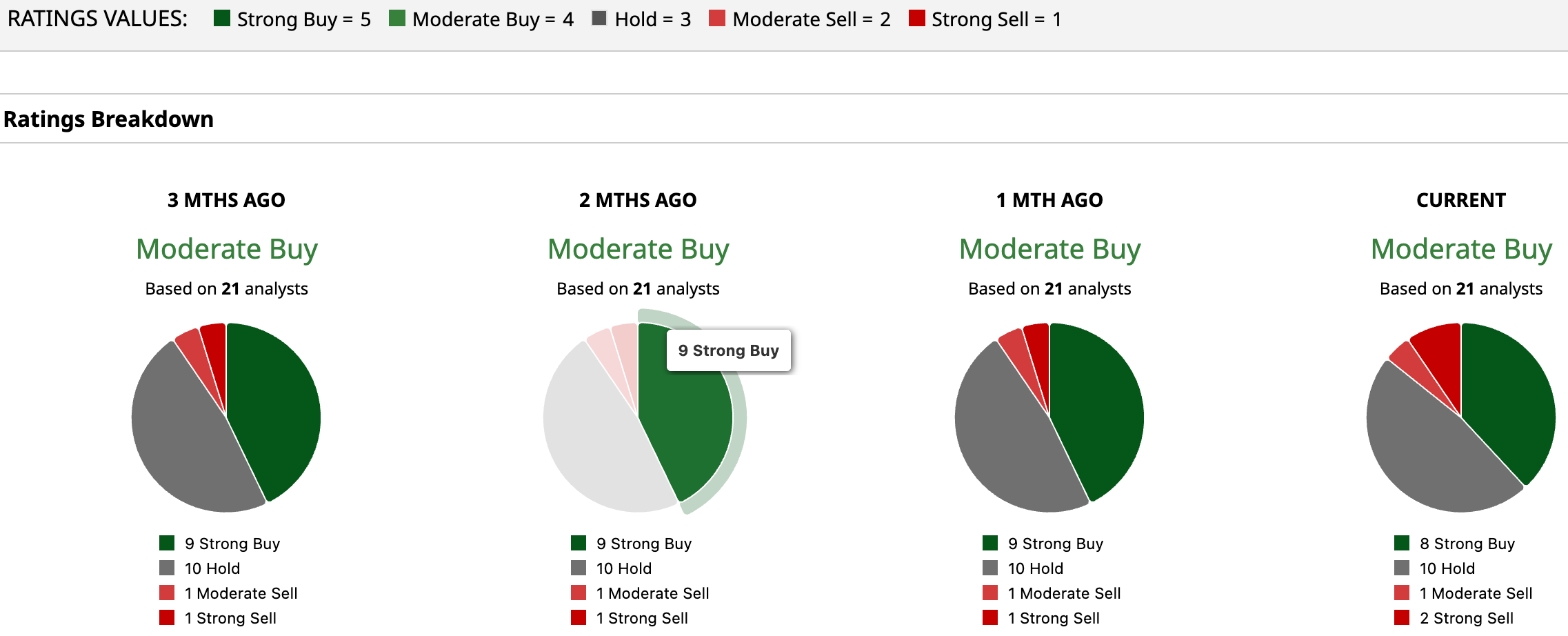

Nevertheless, Wall Street remains cautiously upbeat on Novo Nordisk, even after a turbulent year for the stock. NVO currently holds a “Moderate Buy” consensus rating, showing that most analysts still see more upside than downside. Of the 21 analysts covering the company, eight are confident enough to call it a “Strong Buy,” while 10 prefer to wait on the sidelines with a “Hold.” A smaller group is more skeptical, with one analyst rating it a “Moderate Sell” and two issuing “Strong Sell” calls.

The average target of $52.21 points to only limited upside from here, but the most optimistic forecasts paint a much brighter future. The Street-high target of $70 suggests Novo shares could climb as much as 33%, showing that some analysts believe the company’s Wegovy pill breakthrough could still fuel a powerful comeback.

On the date of publication, Anushka Mukherji did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Sydney Sweeney Made American Eagle Stock a Star in 2025. Should You Keep Buying AEO in 2026?

- CEO Satya Nadella Is Doubling Down on AI at Microsoft. Does That Make MSFT Stock a Buy Here?

- Wall Street Thinks This 1 Psychedelic Stock Can Gain 335% in 2026

- As the FDA Approves a Wegovy Pill, Should You Buy, Sell, or Hold Novo Nordisk Stock?