West Pharmaceutical Services, Inc. (WST) is a leading global healthcare company that designs, manufactures, and sells innovative containment and delivery systems for injectable drugs and healthcare products. Its offerings include elastomeric components (like stoppers and seals), syringe and cartridge parts, advanced drug delivery devices, and comprehensive analytical services. The company is headquartered in Exton, Pennsylvania, and has a market cap of around $19.2 billion.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and West Pharmaceutical fits this criterion perfectly, underscoring its leading position as a manufacturer of packaging components and delivery systems for injectable drugs and healthcare products.

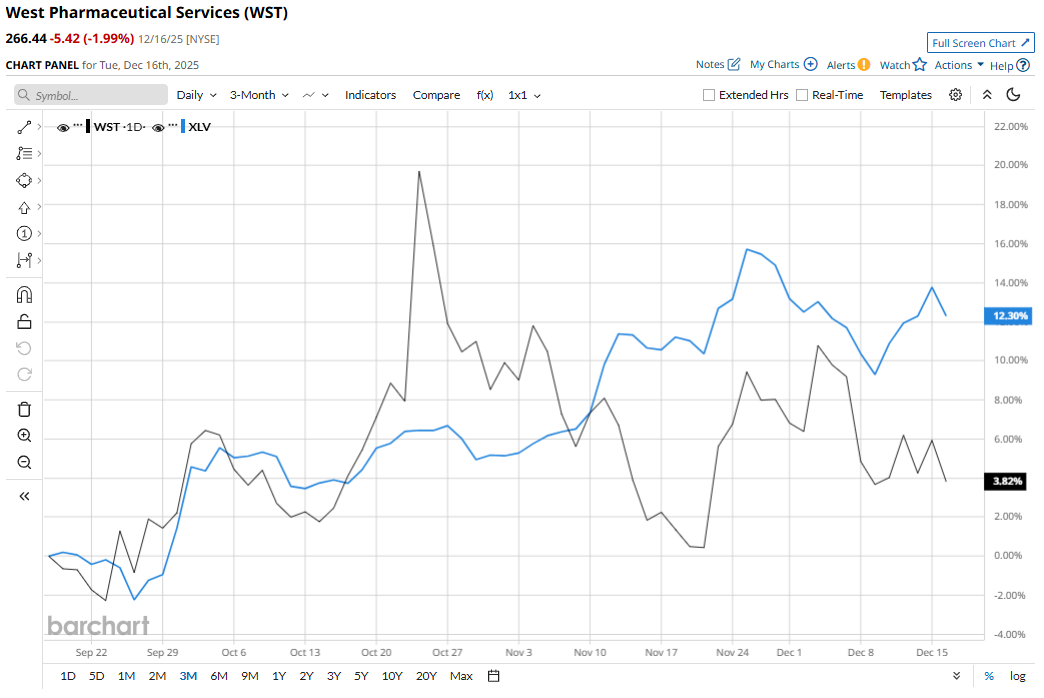

The stock is down 23.6% from its 52-week high of $348.90 reached in January. Over the past three months, shares have gained 3.1%, underperforming the 12.5% gains of the Health Care Select Sector SPDR Fund (XLV) during the same period.

In the longer term, WST has again delivered a weak performance with 18.7% decline on a YTD basis, lagging behind XLV’s 12% gains. Moreover, shares have dipped 19.4% over the past 52 weeks, compared to XLV’s 10.6% gain during the same period.

The stock has traded above the 50-day moving average since early June but with some fluctuations lately. It is trading above the 200-day moving average since mid-September.

The stock has been sliding in 2025 mainly due to investor concerns about its outlook and operational headwinds, even though the company remains a leader in injectable drug delivery systems. Investors sentiments have been hampered amid broader pricing headwinds, tariff-related cost pressures, and inventory destocking by customers have dampened near-term growth prospects.

Its rival, Thermo Fisher Scientific Inc. (TMO), has gained 7.8% over the past 52 weeks and 9.6% on a YTD basis, which outpaced WST’s performance.

Despite the underperformance, WST has a consensus rating of "Strong Buy" from 17 analysts, and the mean price target of $345.36, suggests an upside of 29.6%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.