The rapid adoption of artificial intelligence (AI) in general is increasing the demand for voice and conversational AI. SoundHound AI (SOUN) is gaining attention because its sophisticated platform can take orders at drive-through restaurants, train employees by providing interactive access to training modules, help consumers understand the features of their vehicle, and more.

Cantor Fitzgerald analyst Thomas Blakey recently upgraded the firm’s rating on SoundHound from “Overweight” to “Neutral” and raised the price target from $13 to $15. “SoundHound AI has executed very well, in our view, cross-selling and upselling voice and conversational AI services to its installed base, as well as expanding fully automated voice volumes related to its acquisition of (enterprise AI company) Amelia in late summer 2024,” he said in his note.

Is SoundHound AI a buy right now? Let’s take a look.

About SoundHound AI Stock

California-based SoundHound operates an independent voice AI platform that helps connect brands to people through customized conversations and voice-enabled products, services, and apps. The fast-growing company has a market capitalization of $4.6 billion.

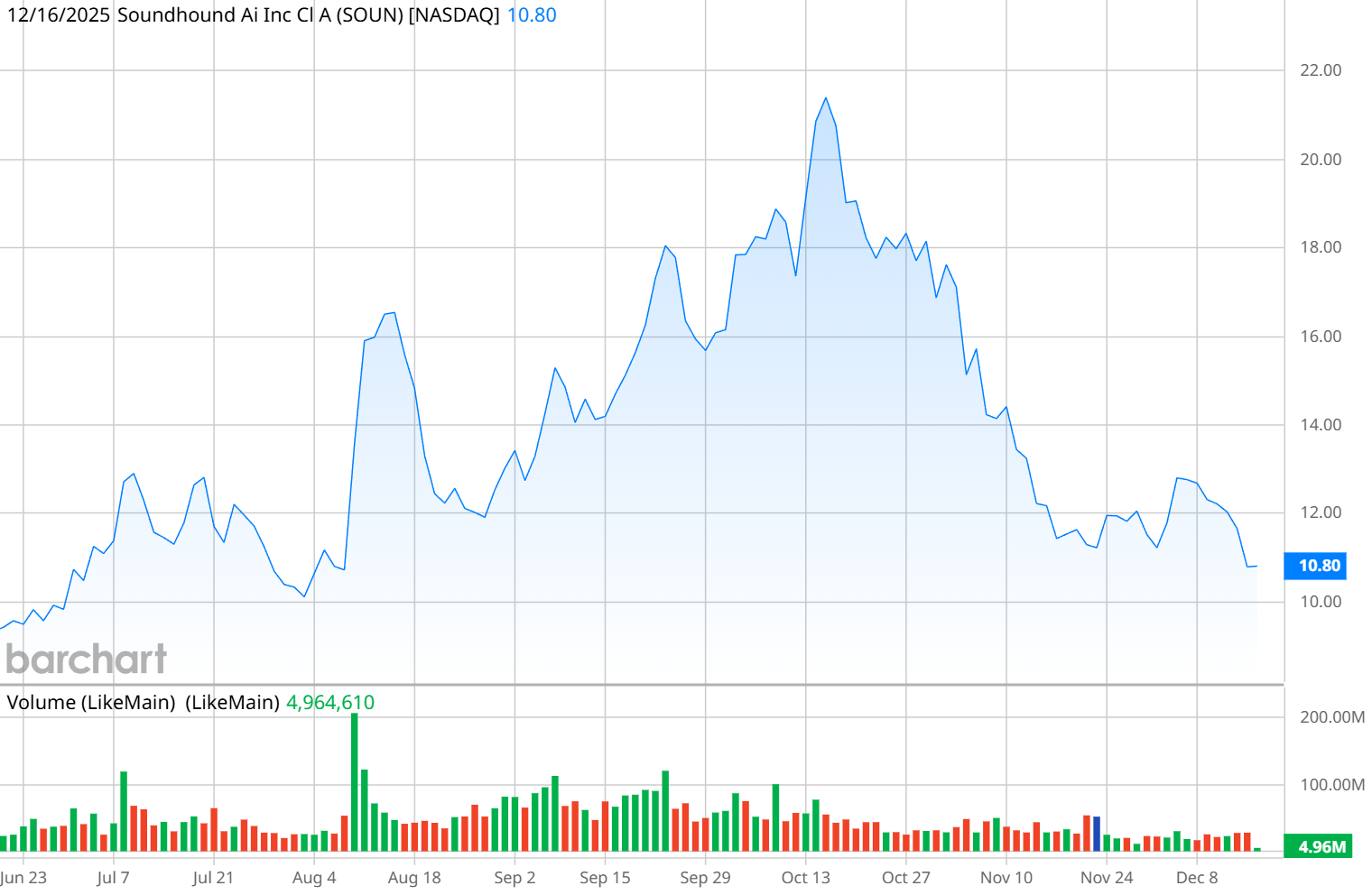

SoundHound stock exploded higher along with the market’s interest in AI, rising 800% over the last three years. But 2025 has been a different story, as SOUN stock retrenched. Shares are down 43% year-to-date.

The company is not yet profitable, so the best way to consider its valuation is the price-to-sales ratio, which is currently 53.5x, a hefty price even for a technology stock.

SoundHound AI Misses on Earnings

Part of the stock's performance so far this year can be attributed to its earnings performance. SoundHound missed on earnings for each of the last two quarters.

Revenue in the third quarter was up 68% from a year ago to $42 million, a quarterly record for the company. But the net loss of $109.3 million was a steep decline from the year-ago loss of $21.7 million. And the earnings per share (EPS) loss of $0.27 was much worse than analysts’ expectations for a loss of $0.07 per share.

However, it should be noted that a major reason for the loss was a $66 million non-cash, non-operating accounting charge related to previous acquisitions. The company’s adjusted net loss was only $13 million, and SoundHound ended the quarter with $269 million in cash and no debt.

SoundHound announced expansions to its network of users, including restaurant reservations and parking payments. It is also working with an unnamed automaker to create a custom voice assistant personality, a Chinese company for intelligence-based interactions for hardware and software products, a healthcare company for an agentic AI product, a restaurant chain to deploy AI ordering, and much more.

The company raised its full-year revenue guidance, from a range of $160 million to $178 million to a range of $165 million to $180 million.

What Do Analysts Expect for SOUN Stock?

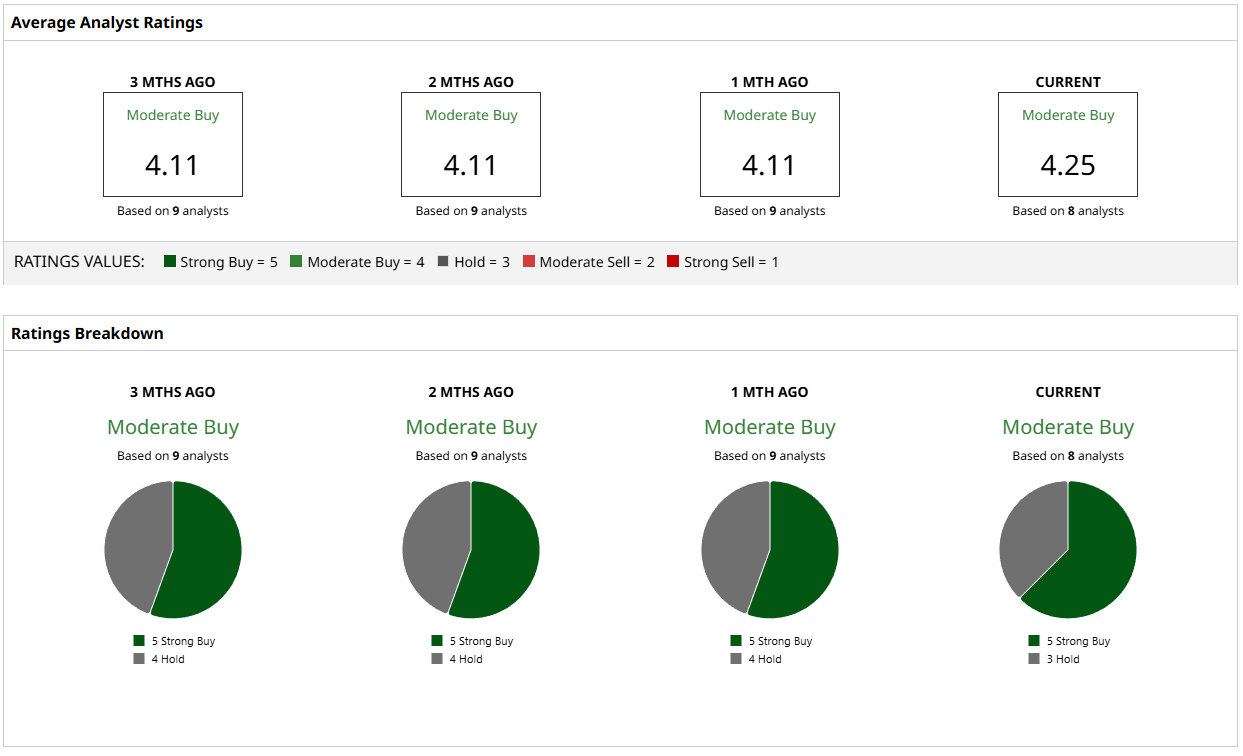

Analysts are generally bullish about SoundHound AI. Of eight analysts covering the stock, none suggest selling. Five analysts have “Strong Buy” ratings, while the others have “Hold” ratings.

And the price targets are similarly aggressive. Cantor Fitzgerald’s $15 target is the lowest suggested target, and even that reflects a 37% gain in the next several months. Analysts’ mean target of $17.42 represents a 60% gain, and the most optimistic target of $26 would be a whopping 139% increase.

So, despite the paper loss in SoundHound’s most recent earnings report, the rapid expansion of AI and voice solutions make SoundHound appealing at this point. The stock is a strong buy.

On the date of publication, Patrick Sanders did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.