Keysight Technologies, Inc. (KEYS) is a leading technology company that provides electronic design and test solutions used worldwide across communications, industrial, aerospace, defense, automotive, and semiconductor industries. The firm’s products include oscilloscopes, network analyzers, modular instruments, software for electronic design automation, and advanced test systems that support innovation from research to manufacturing. The company is headquartered in Santa Rosa, California, and has a market cap of $35.2 billion.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Keysight Technologies fits this criterion perfectly. The company is a powerhouse in the electronic test and measurement space, providing the essential tools and expertise that underpin the rapid technological advancements we see across numerous critical industries today.

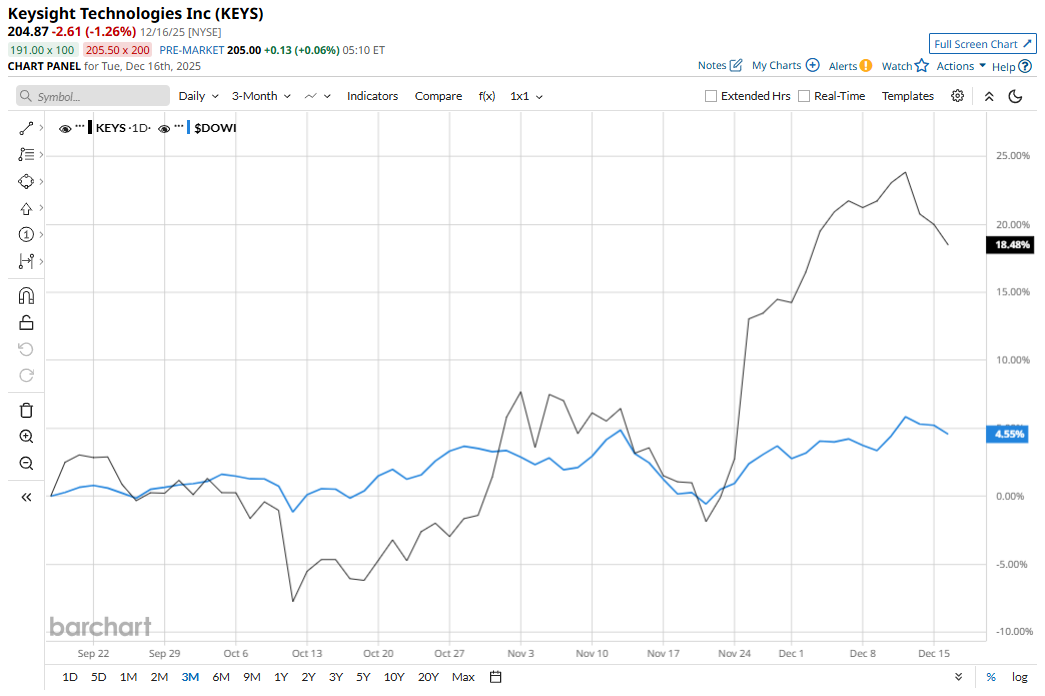

The stock, having reached a 52-week high of $214.58 on Dec. 11, has pulled back 4.5% since then. It has surged 19.1% over the past three months, outperforming the broader Dow Jones Industrials Average’s ($DOWI) 5.2% return.

Over the longer term, KEYS has gained 27.5% on a YTD basis, outperforming DOWI’s 13.1% increase. Additionally, shares have risen 19.9% over the past 52 weeks, compared to DOWI’s 10.1% returns during that period.

The stock has mostly traded above the 200-day moving average since early June. It is also trading above the 50-day moving average since late November, indicating renewed momentum.

The stock has been rising lately due to a combination of strong financial performance and positive investor sentiment. For Q4 2025 (released on Nov. 24), Keysight Technologies reported a 10% year-over-year increase in revenue, to $1.42 billion for the quarter ended Oct. 31. Non-GAAP EPS also rose significantly, coming in at $1.91, up from $1.65 in the year-ago period, contributing to positive investor sentiment. The stock rose 2.9% on Nov. 24 and 10% on Nov. 25.

In comparison, KEYS has outpaced its rival Teledyne Technologies Incorporated (TDY), with TDY’s returns of 9.1% YTD and 6.4% over the past year.

Overall, KEYS has a consensus “Strong Buy” rating from the 13 analysts covering the stock, and the mean price target of $219.75 suggests an upside of 7.3% ahead.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- As Visa Rolls Out Stablecoin Settlement, Should You Buy, Sell, or Hold the Blue-Chip Stock?

- Cathie Wood Keeps Buying the Dip in CoreWeave Stock. Should You?

- JPMorgan Says the Dip in Broadcom Stock Is a Screaming Buy. Are You Loading Up on Shares Now?

- Is SoundHound Stock a Buy for 2026? This Analyst Thinks So.