Dell Technologies Inc. (DELL) is a multinational technology company with its headquarters in Round Rock, Texas. Primarily operating through Client Solutions Group (PCs, workstations, peripherals) and Infrastructure Solutions Group (servers, storage, networking, services) segments, Dell provides comprehensive hardware, software and services solutions to consumers, businesses, public sector and enterprise customers globally. The company’s market capitalization stands at $108.9 billion.

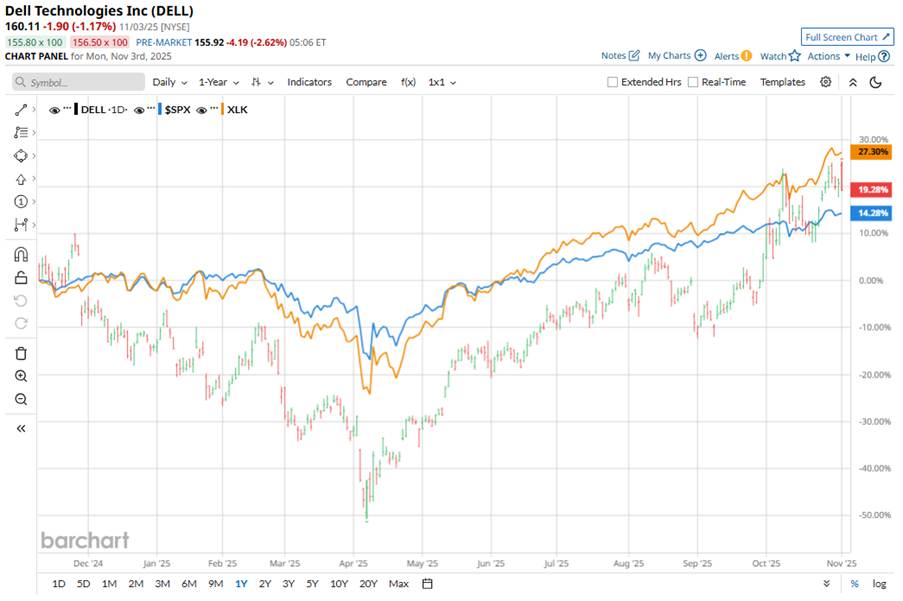

Shares of the tech giant have returned 22.3% over the past 52 weeks, outpacing the broader S&P 500 Index’s ($SPX) 19.6% rally. Moreover, in 2025, DELL has gained over 38.9%, compared to SPX’s 16.5% rise on a year-to-date (YTD) basis.

Looking closer, the stock has lagged behind the Technology Select Sector SPDR Fund’s (XLK) increase of 34.8% over the past 52 weeks, but again outpaced XLK’s 29.8% gains YTD.

Dell is benefiting from a major shift in its business away from just PCs and into the much higher-growth domain of artificial intelligence (AI) and enterprise infrastructure. The company has raised its long-term growth guidance, now targeting annual revenue growth between 7% to 9% (up from 3% to 4%) and annual non-GAAP EPS growth of 15% or more. Much of this optimism stems from surging demand for AI-optimized servers, storage and networking hardware. The company is seeing strong tailwinds as companies build out generative AI and data-center capacity.

For the fiscal year ending in January 2026, analysts expect DELL’s EPS to grow 15.8% year over year (YoY) to $8.66. The company’s earnings surprise history is mixed. It beat the consensus estimates in three of the last four quarters while missing on one other occasion.

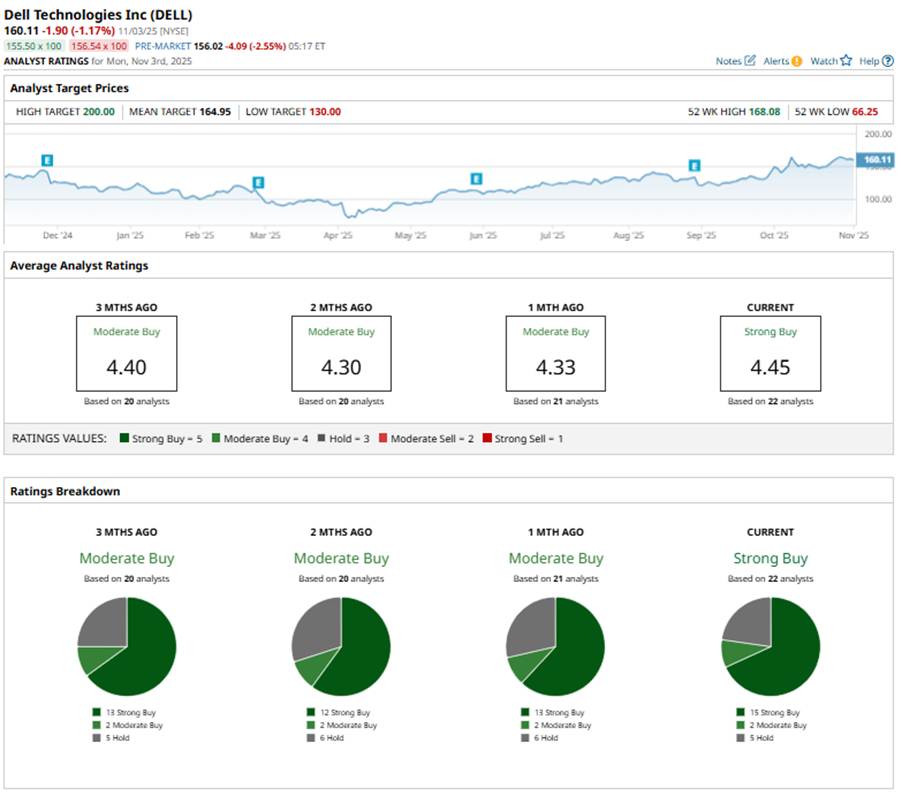

Meanwhile, among the 22 analysts covering the stock, the consensus rating is a “Strong Buy,” an upgrade from the “Moderate Buy” rating a month back. The current rating is based on 15 “Strong Buys,” two “Moderate Buy” ratings, and five “Holds.”

This configuration is significantly more bullish than it was one month ago, when there were only 13 “Strong Buy” ratings for the stock.

Recently, Evercore ISI raised its price target on DELL to $180 from $160, maintaining an “Outperform” rating, following its $5.8 billion GPU supply deal.

DELL’s mean price target of $164.95 indicates that the tech stock could rise about 3% from the current price levels. Meanwhile, the Street-high price target of $200 implies a potential upside of 24.9% from the current price levels.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart