Big moves make big headlines, and when the government steps in the favor, even cautious investors sit up and take notice. That’s exactly what happened with Trilogy Metals Inc. (TMQ). It secured a major win when the U.S. federal government approved the key infrastructure link for its ambitious Ambler Mining District project in Alaska and grabbed roughly a 10% stake in the company.

Trilogy Metals jumped 15.9% on Oct. 24 after announcing that Alaska had executed key right-of-way permits for its Ambler access project, restoring crucial federal authorizations from the U.S. Army Corps of Engineers, the National Park Service, and the Bureau of Land Management. The move reinstates a 50-year right-of-way across federal lands, allowing the Alaska Industrial Development and Export Authority to restart road planning and engineering work for the Ambler mining district.

With the approved 211-mile industrial “access road” into the remote district, Trilogy’s long-stalled development path now has a real shot. So, is this the right time to scoop up Trilogy Metals shares?

About Trilogy Metals Stock

Trilogy Metals is a Vancouver-based Canadian mining exploration company that focuses on advancing its high-grade copper (HGZ25), zinc, lead, gold (GCZ25), silver (SIZ25), and cobalt properties in the Upper Kobuk Mineral Projects in Alaska’s Ambler Mining District. Its market cap is around $984.3 million.

Trilogy Metals’ share price has experienced dramatic appreciation this year. From trading a little over $1 in early 2025, the stock surged past $10 recently, following major government-backed developments.

Recent momentum is driven by the U.S. government’s announcement of a roughly $35.6 million investment and approval of the critical access-road permitting for the Ambler project. The news propelled shares to a 52-week high of about $11.29 on Oct. 14 before some subsequent pull-back. The stock has gained 251% on a year-to-date (YTD) basis and 542% over the past year.

While the stock remains volatile and speculative, given that Trilogy has yet to generate significant revenue, its recent rally reflects the market’s reevaluation of its prospects in critical minerals and infrastructure access.

The stock looks overvalued compared to industry peers with a price-book ratio of 6.1x.

Trilogy Metals Is Yet to Generate Revenue

Trilogy Metals released its Q3 2025 results on Sept. 30, covering the quarter ended Aug. 31, 2025. The company reported a net loss of $1.7 million, up from a loss of $1.6 million in the same quarter a year earlier. On a nine-month basis, losses widened to about $7.5 million, compared with $7 million for the same period in 2024.

The increase in losses was driven primarily by higher costs associated with its 50/50 joint-venture Ambler Metals LLC (with South32 Limited), particularly environmental‐baseline work and the start of a core re-boxing program, as well as elevated regulatory and legal fees for its base shelf prospectus and ATM (at-the-market) equity program.

On the liquidity front, Trilogy ended the quarter with close to $23.4 million in cash and equivalents as of Aug. 31, which management says is sufficient to meet its working-capital needs for the next 12 months.

At the same time, the company emphasized that additional funding may be required beyond the near term and has established a base shelf prospectus authorizing up to $50 million in securities, along with an ATM program for up to $25 million, providing flexibility for future equity raises.

Analysts predict loss per share to be around $0.04 for fiscal 2025, an improvement of 20% year-over-year (YoY), before improving by another 50% annually to $0.02 in fiscal 2026.

What Do Analysts Expect for Trilogy Metals Stock?

Earlier this month, BMO Capital downgraded Trilogy Metals from “Outperform” to “Market Perform” while raising its price target to $5.50 from $3.00. The downgrade comes after Trilogy’s shares surged substantially, driven by the U.S. government’s investment and renewed authorizations for the Ambler Road Project. While BMO acknowledged these as “materially positive” developments, it warned that the stock is now valued above typical levels for development-stage miners.

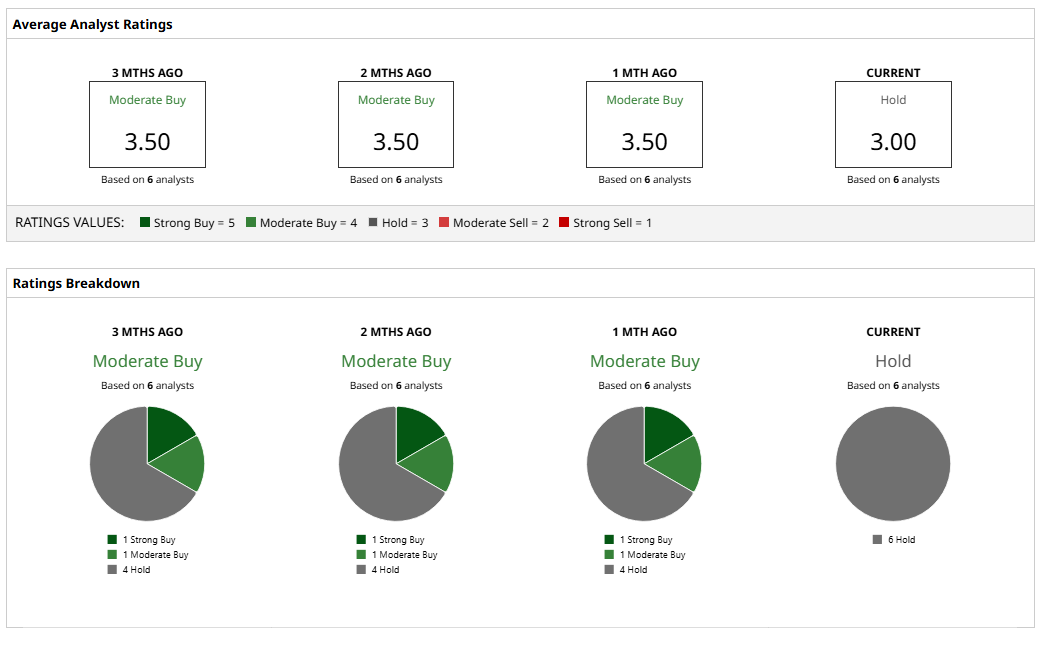

Wall Street remains cautious about TMQ. Overall, TMQ has a consensus “Hold” rating, with each of the six analysts covering the stock advising said stance.

The average analyst price target for TMQ is $5.08, indicating 23% upside. The Street-high target price of $6.21 suggests that the stock could rally 50%.

On the date of publication, Subhasree Kar did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart