Rare earth stocks are back in the spotlight.

In fact, thanks to the latest U.S.-China trade war blows, China lobbed threats to restrict rare earth exports, which are critical for smartphones, computers, televisions, wind turbines, electric vehicle batteries, computer chips, defense equipment, semiconductors, and digital cameras, to name just a few products.

They’re also critical for advanced weapons, including fighter jets, submarines, and missiles. Also, without rare earths, the world can’t even produce the millions of electric vehicles government leaders want on the roads. So, when China, which dominates the rare earth market, threatened to choke supply, related stocks exploded.

U.S. Rare Earth Stocks, Like MP Materials, Soared 52% on the Threat

Look at MP Materials (MP), for example.

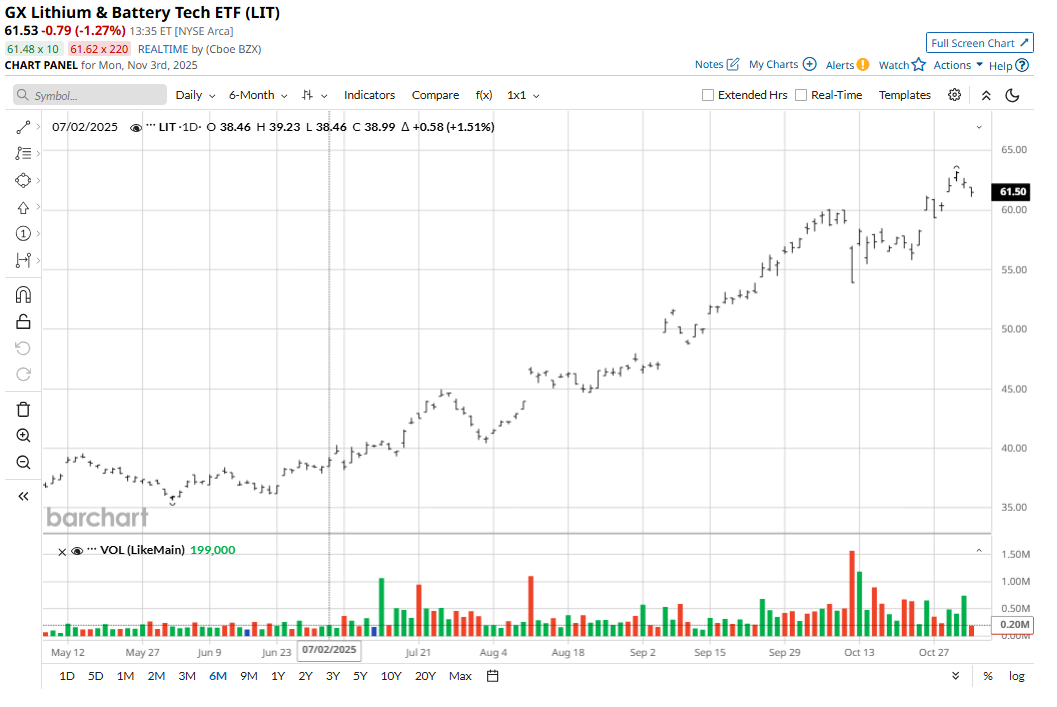

Since China’s threat, MP rallied from about $66 a share to $100.25. Even USA Rare Earth (USAR) rallied from about $17.30 to a high of about $44 a share. It would also help explain why the Global X Lithium ETF (LIT) ran from about $54 to to a 52-week high above $62.

Remember, MP Materials operates a rare earth mine in Mountain Pass, California. USA Rare Earth is focused on manufacturing rare earths in Stillwater, Oklahoma, and its Round Top deposit in West Texas.

Granted, related rare earth stocks cooled off ahead of President Donald Trump and Chinese President Xi Jinping’s meeting on Thursday, Oct. 30. As expected, China agreed to delay rare earth export restrictions. In addition, Trump inked an agreement with Japan to help secure raw and processed critical minerals. There are also rare earth deals in place with Australia, Malaysia, and Thailand, which were done to help diminish China’s rare earth dominance.

Rare Earth Mine Production Is Still Limited Outside of China

Eventually, those deals may be a challenge to China. But it could take 15 to 20 years.

According to Goldman Sachs, rare earth mine development could take a decade to develop, as noted by CNBC. That’s a real problem when China controls 69% of the rare earth mining market share, 92% of refining market share, and 98% of magnet manufacturing. Until China is knocked off its rare earth pedestal, the world will continue to depend on China.

And sure, we have companies like MP Materials attempting to break its dominance. But with its plans to produce about 10,000 metric tons of magnets a year, it won’t be enough to meet the U.S. total demand of 50,000, as noted by Barron’s. Other companies, like USA Rare Earth, haven’t even started production yet. So, we’re already behind the eight ball.

To trade the rare earth story, investors can always invest in MP Materials and USA Rare Earth.

For Broader Exposure to Rare Earths, Invest in ETFs

However, if you want broader exposure to rare earth at a lower cost, you may want to consider ETFs such as the Global X Lithium ETF.

At $61.50 a share with an expense ratio of 0.75%, or $75 on an initial $10,000 investment, the LIT ETF offers exposure to companies that make up the lithium supply channel, including Albemarle (ALB), Ganfeng Lithium (GNENY), Sociedad Quimica y Mineral de China (SQM), and Lithium Americas (LAC).

Since bottoming out in April at around $33 a share, the LIT ETF rallied to a high of $62.38 on Oct. 30. From here, we’d like to see it initially test $70 a share.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart