Targa Resources Corp. (TRGP) is a leading U.S. midstream energy infrastructure company, primarily operating gathering, compressing, treating, processing and transporting natural gas and natural gas liquids (NGLs) across major U.S. hydrocarbon basins. The company is headquartered in Houston, Texas. Targa carries a market cap of $36.6 billion.

Shares of this energy company have lagged behind the broader market. Over the past 52 weeks, TRGP stock has declined 12.2%, while the broader S&P 500 Index ($SPX) has gained 14.5%. Moreover, on a YTD basis, the stock is down 4.4%, compared to SPX’s 16.5% rise.

Narrowing the focus, TRGP has underperformed the Energy Select Sector SPDR Fund’s (XLE) 3.8% drop over the past 52 weeks and 5.4% gains YTD.

TRGP’s dip can be attributed to weaker-than-expected quarter performance, while the midstream space is facing concerns around rising infrastructure capacity (especially for NGLs), slower growth in upstream production and the market being cautious on oil prices, all of which weigh on the stock price performance.

For the fiscal year, which ends in December 2025, analysts expect Targa’s EPS to grow 47% year over year to $8.44. The company’s earnings surprise history is mixed. It surpassed the Wall Street estimates in one of the last four quarters while missing on three other occasions.

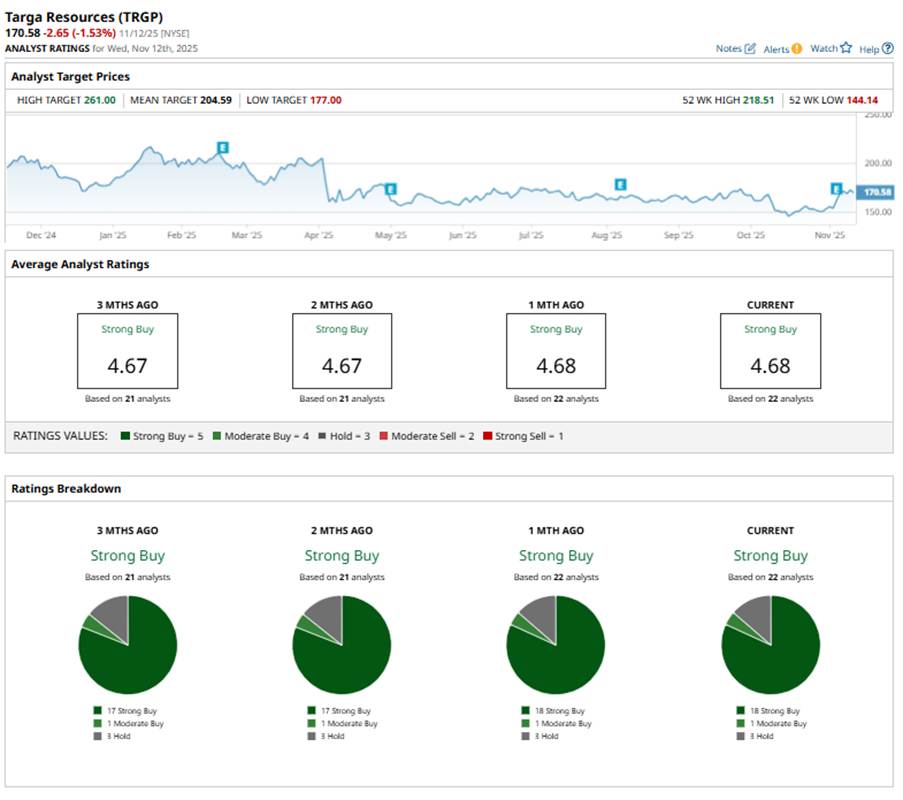

Among the 22 analysts covering the stock, the consensus rating is a “Strong Buy.” This is based on 18 analysts recommending a “Strong Buy,” one advising a “Moderate Buy,” and three analysts staying cautious with a “Hold” rating.

This configuration is slightly more bullish than two months ago, when there were 17 “Strong Buy” ratings.

Last month, J.P. Morgan analyst Jeremy Tonet reaffirmed an “Overweight” rating on TRGP and slightly increased the price target to $215 from $214.

The mean price target of $204.59 represents 19.9% potential upside from TRGP’s current price levels, while the Street-high price target of $261 suggests the stock could rise as much as 53%.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart