Houston, Texas-based Camden Property Trust (CPT) is a real estate company with a market cap of $10.9 billion. It primarily owns, manages, develops, redevelops, acquires, and constructs multifamily apartment communities.

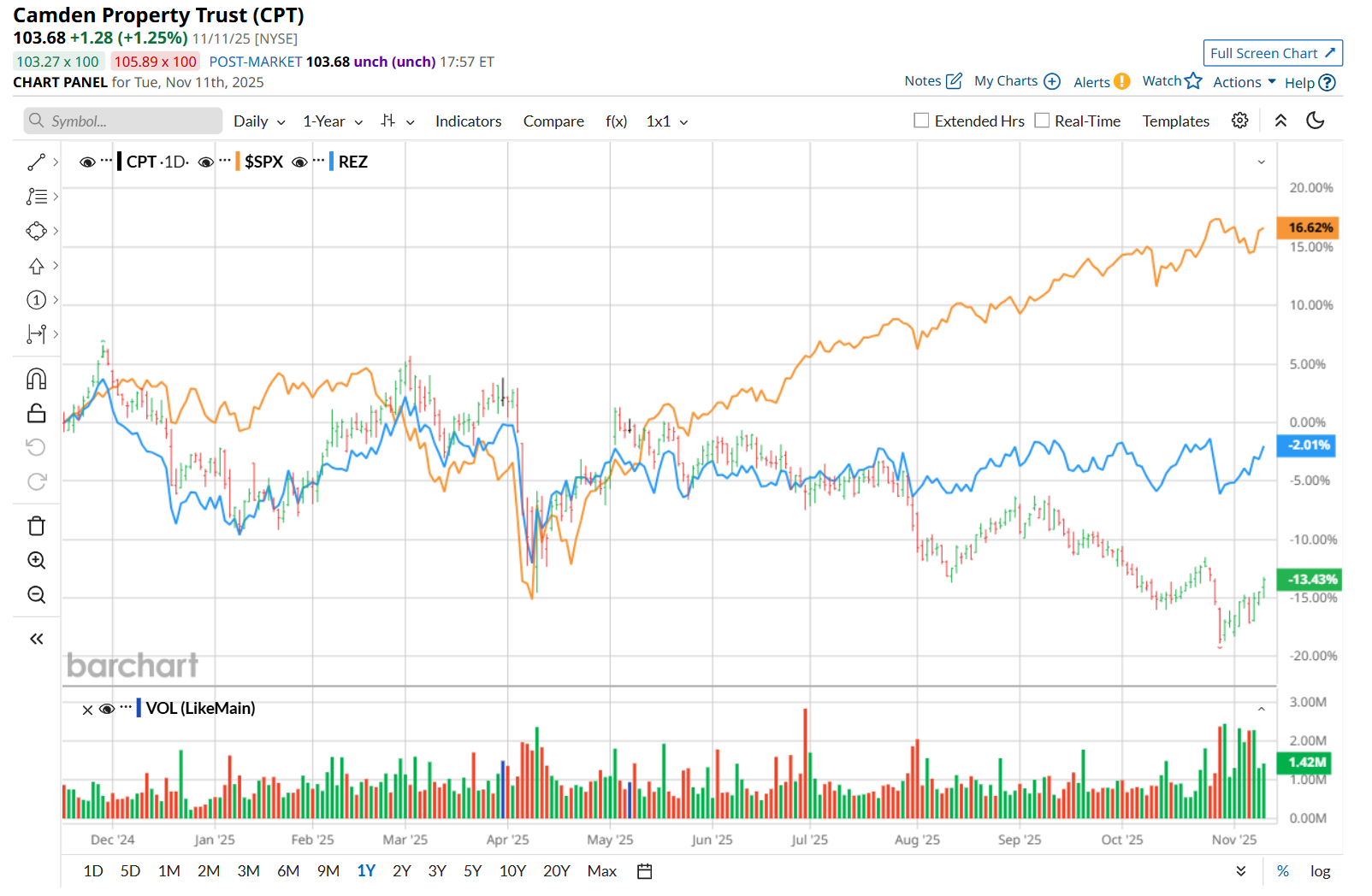

This residential REIT has considerably underperformed the broader market over the past 52 weeks. Shares of CPT have declined 15% over this time frame, while the broader S&P 500 Index ($SPX) has soared 14.1%. Moreover, on a YTD basis, the stock is down 10.7%, compared to SPX’s 16.4% uptick.

Narrowing the focus, CPT has also lagged behind the iShares Residential and Multisector Real Estate ETF’s (REZ) 3.3% drop over the past 52 weeks and 4.7% YTD rise.

On Nov. 6, REG delivered mixed Q3 results, and its shares surged 2.5% in the following trading session. On the downside, the company’s property revenue improved 2.2% from the prior-year quarter to $395.7 million, but missed consensus estimates by a small margin. Nonetheless, on the other hand, its core FFO declined marginally year-over-year to $1.70 and topped analyst expectations by a penny. Additionally, due to positive impacts expected in the fourth quarter from the timing and volume of future acquisition/disposition activity and lower-than-expected borrowing costs, the company raised the midpoint of its fiscal 2025 core FFO guidance to $6.85 per share.

For the current fiscal year, ending in December, analysts expect REG’s FFO to remain flat year over year at $6.85. The company’s FFO surprise history is promising. It topped the consensus estimates in each of the last four quarters.

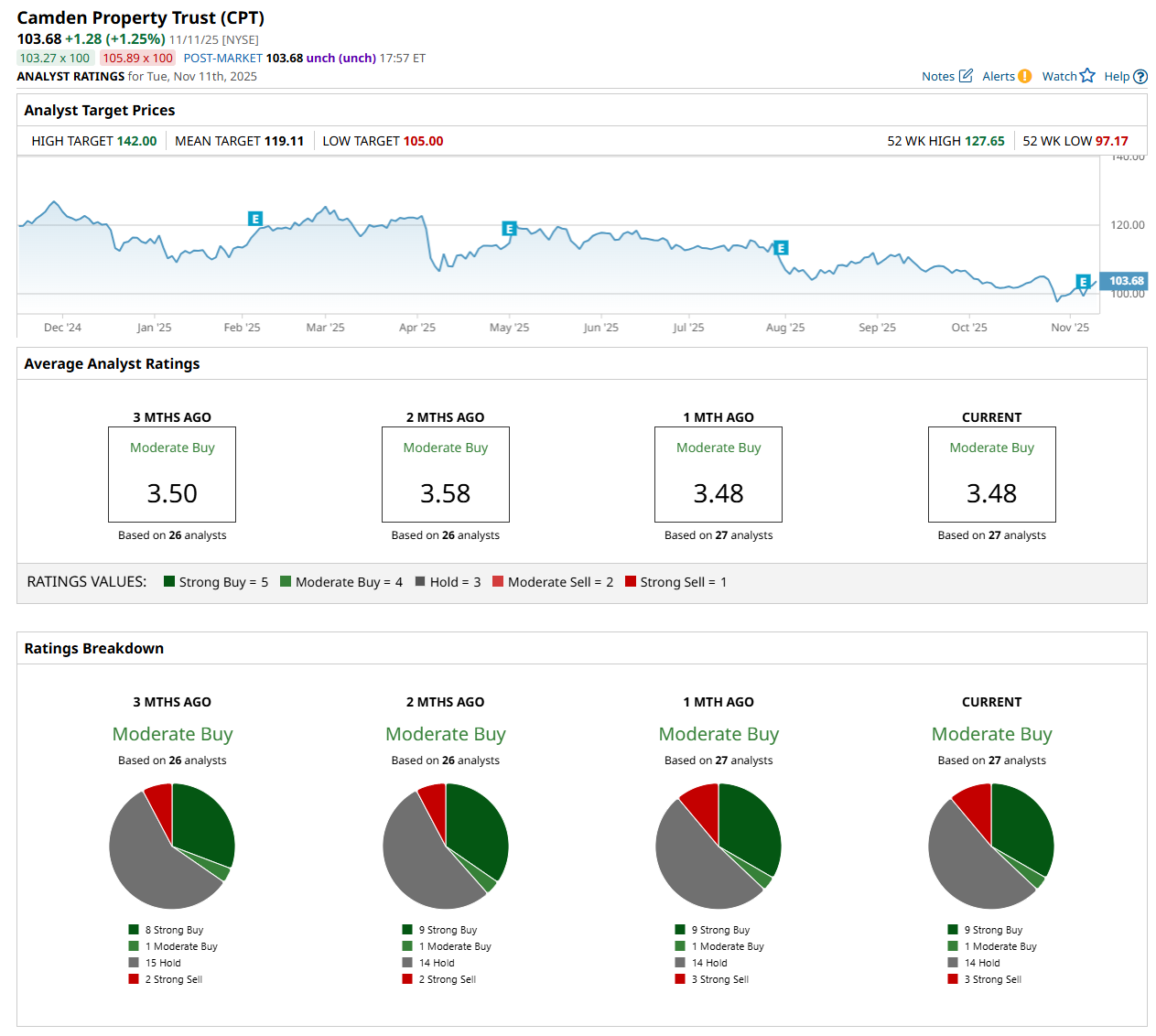

Among the 27 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on nine “Strong Buy,” one "Moderate Buy,” 14 “Hold,” and three “Strong Sell” ratings.

This configuration is more bullish than three months ago, with eight analysts suggesting a “Strong Buy” rating and two recommending “Strong Sell.”

On Nov. 10, UBS maintained a "Neutral" rating on CPT, but lowered its price target to $105, indicating a 1.3% potential upside from the current levels.

The mean price target of $119.11 represents a 14.9% premium from CPT’s current price levels, while the Street-high price target of $142 suggests an upside potential of 37%.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?

- Tesla Just Lost Its Cybertruck Leader. Should You Buy, Sell, or Hold TSLA Stock?

- Palantir Achieved ‘Eye-Popping Growth’ and Is a Buy Through Year-End, According to Wedbush

- Down 40% in the Past 6 Months, Should You Buy, Sell, or Hold MicroStrategy Stock in November 2025?