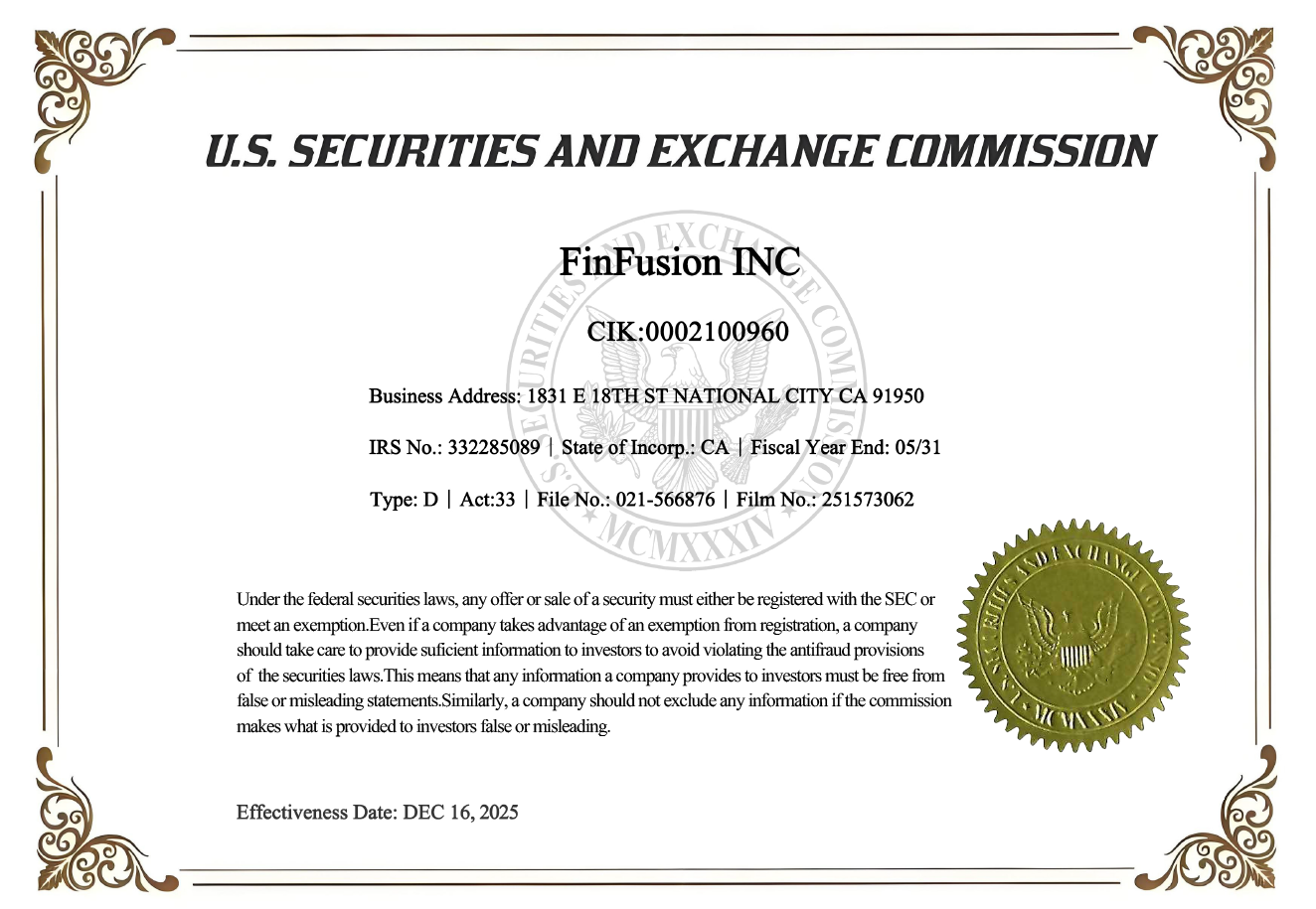

FinFusion Exchange has entered the SEC disclosure framework, aligning its corporate governance with U.S. regulatory transparency standards while establishing a more comprehensive compliance structure for its U.S. operations.

NEW YORK CITY, NEW YORK / ACCESS Newswire / January 9, 2026 / Recent developments surrounding FinFusion Exchange have drawn market attention as publicly available information shows that the company's relevant corporate records are now included within the disclosure framework of the U.S. Securities and Exchange Commission. This development places the platform's corporate governance and information transparency within a clearly defined U.S. regulatory context.

As regulatory scrutiny across the digital asset sector continues to intensify, a platform's disclosure status within established financial regulatory systems is increasingly viewed as an important reference point for assessing operational structure and governance maturity.

SEC Disclosures Provide a Governance-Level Transparency Foundation

At the corporate governance level, FinFusion Exchange's relevant company information is available through the SEC's public disclosure systems. These disclosures reflect the platform's legal entity status, organizational structure, and foundational corporate information, providing regulators and market participants with a standardized and verifiable reference.

Through this disclosure framework, the company's governance structure and compliance background can be reviewed through public channels, contributing to greater transparency and institutional clarity.

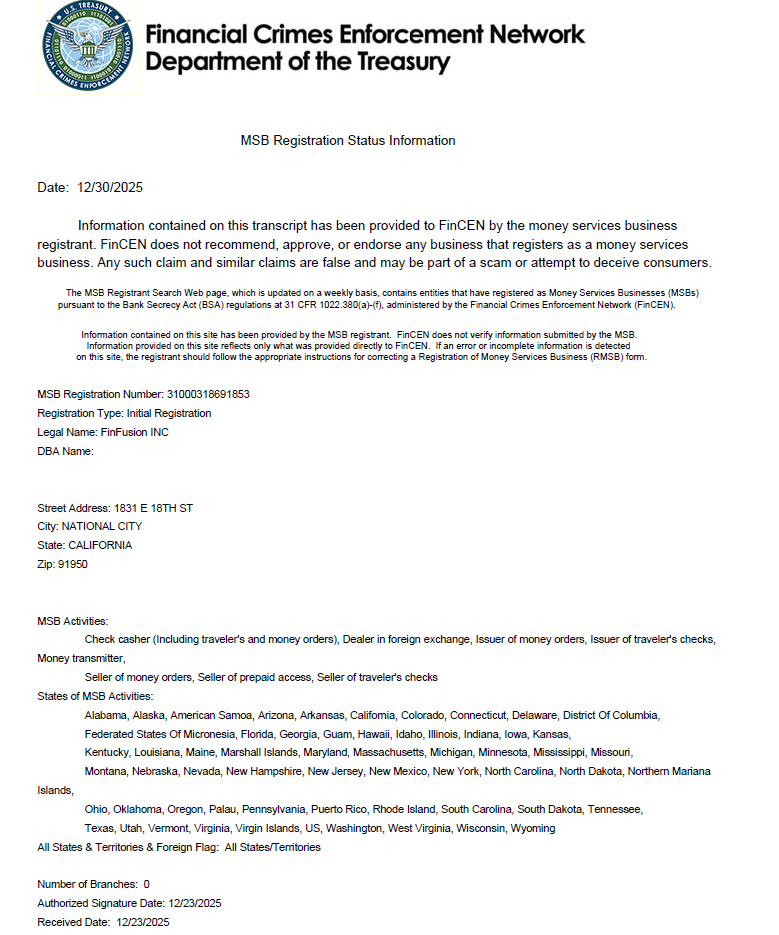

Operational Compliance Structure Further Clarified

In parallel with corporate disclosure arrangements, FinFusion Exchange's U.S. operating entity has completed registration as a Money Services Business (MSB) under the framework of the Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury.

The MSB regulatory framework applies to entities involved in funds transmission, payment processing, and certain digital asset-related services. Associated requirements typically cover anti-money laundering (AML), customer identification (KYC), transaction recordkeeping, and suspicious activity monitoring. This framework is focused on financial process compliance and risk controls and does not relate to securities issuance or investment product approval.

Combined Compliance Structure and Regulatory Context

From a structural perspective, SEC disclosure and MSB registration address two distinct regulatory dimensions: corporate transparency and financial process compliance. When applied within the same operational framework, these mechanisms contribute to a more clearly delineated compliance structure, particularly in areas related to governance transparency, anti-money laundering controls, and regulatory consistency.

As the digital asset industry continues to move toward greater institutionalization and regulatory definition, such compliance configurations are increasingly regarded as a standard feature for platforms operating within mature financial regulatory environments.

About FinFusion Exchange

FinFusion Exchange is a global digital asset trading platform whose operational framework emphasizes regulatory disclosure, risk management, and infrastructure development. The platform's business operations and governance arrangements are aligned with existing financial regulatory frameworks, supporting ongoing operations across multiple market environments.

Media Contact

Company Name: FinFusion Exchange

Contact Person: Aaron Blythe

Email: service@finfusions.com

Website: https://finfusions.com/

SOURCE: FinFusion INC

View the original press release on ACCESS Newswire