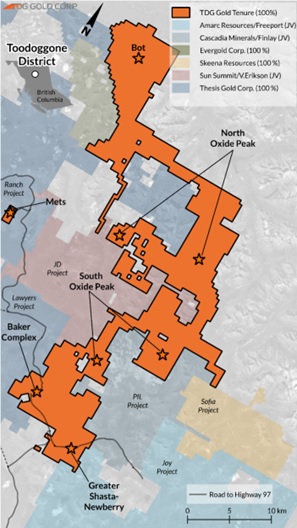

WHITE ROCK, BC / ACCESSWIRE / October 22, 2024 / TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to provide an update on progress at its highly prospective land package in the renowned Toodoggone gold-silver-copper district of north-central B.C. ( Figure 1 ).

Highlights include:

SHASTA

Updated NI 43-101 Mineral Resource Estimate ("Shasta MRE" 1 , news release May 01, 2023) for the flagship former producing Shasta Gold-Silver Mine ( See Table 1 for full Shasta MRE Table ):

Indicated Resources of 401,400 ounces gold and 14.2 million ounces silver grading 1.27 grams per tonne ("g/t") equivalent ("AuEq 2 ") , contained within 12.6 million tonnes

Inferred Resources * of 382,300 ounces gold and 14.2 million ounces silver grading 1.00 g/t AuEq 2 , contained within 15.4 million tonnes

Relogging and assaying ~6,000 metres ("m") of historical core (out of ~30,000 m) including support to potentially include in a future MRE update (news release Feb 12, 2024).

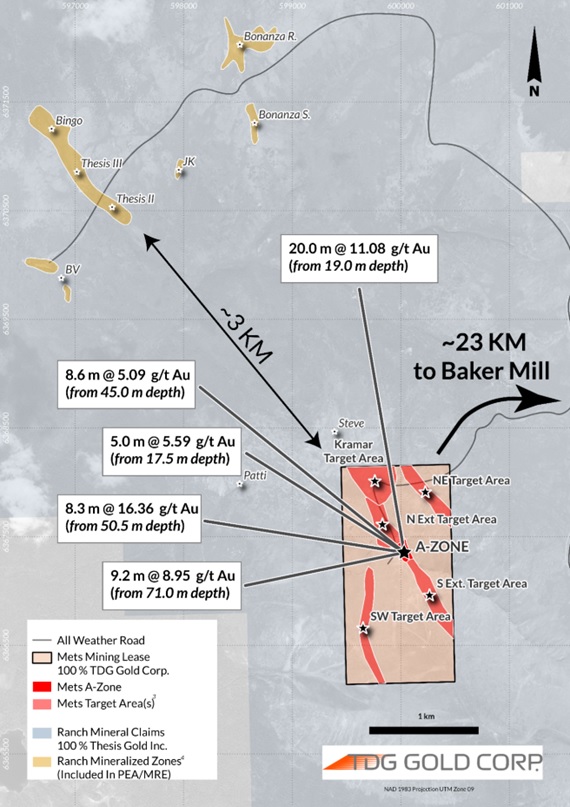

METS

High-grade, shallow, free gold intercepted in the first modern drilling at TDG's Mets mining lease including:

20 m of 11.1 g/t gold from 19 m depth, and

8.3 m of 16.4 g/t gold from 51 m depth (news releases Sep 07, 2023 and Dec 04, 2023).

Multiple drill targets 3 generated for potential north-south extensions and two parallel trends (news releases Jan 08, 2024 , Jan 15, 2024 and Jan 22, 2024).

REGIONAL

Maintained and significantly expanded TDG's 100% owned brownfield and greenfield exploration tenure to over 375 square kilometres ("sq.km") including a Mines Act permit, road use permit and infrastructure including mill and licensed Tailings Storage Facility ("TSF").

Extension of three mining leases for 30-years (to 2051-53) with support of the local communities.

Completion of the first property-wide, comprehensive evaluation of the porphyry potential at the Baker Complex, including the definition of at least two drill-ready porphyry targets 3 (news releases Mar 07, 2024 and Apr 02, 2024).

In 2024, TDG has focused on three initiatives and has made tangible progress for each

Baker Complex: Compiling a comprehensive database focused on porphyry style Cu +/- Au mineralization with a view to seeking a joint venture partner for the 53 sq.km Baker Complex.

Infrastructure: Drilling and engineering studies for the existing small-scale mill and tailings at Baker; while also evaluating potential dry-stack tailings storage facility locations and storage capacity in proximity to the known deposits.

Shasta-Mets: Geologic and resource model updating to support engineering studies as potential precursors to economic analysis. An updated mineral resource model is anticipated before year end 2024.

TDG's CEO, Fletcher Morgan, commented: "TDG considered its programs and initiatives for 2024 in the context of our existing strengths and achievements, and the weak capital markets that prevailed during most of the year. In order to properly evaluate alternatives, earlier this year, our Board mandated a Strategic Planning Committee to consider all opportunities and guide management in decision-making and implementation. Our focus has been corporate sustainability and positioning TDG to benefit from record metal prices. We believe that the TDG asset base, with its gold-silver resources, drill-ready expansion potential, brownfields infrastructure, and large land package with porphyry-style Cu+/-Ag potential will attract increasing investment interest in 2025."

Figure 1 - TDG's Mineral Tenure in the Toodoggone, B.C.*Not all tenure holders are identified and presented on this image. There may be additional tenure not displayed on this map.

Shasta MRE

Indicated Mineral Resource 1 ( Table 1 ) of 514,800 ounces ("oz") gold equivalent ("AuEq" 2 ) grading 1.27 grams per tonne ("g/t") AuEq 2, contained within 12.6 million metric tonnes ("Mt").

Inferred Mineral Resource 1 ( Table 1 ) of 496,300 oz AuEq 2 grading 1.00 g/t AuEq 2, contained within 15.4 Mt.

Table 1 - Shasta MRE 1 including Sensitivity (base case highlighted)*

Class |

AuEq 2 Cutoff |

In Situ Tonnage and Grade |

AuEq 2 Metal |

Au Metal |

Ag Metal |

||||

|

AuEq 2 |

Au |

Ag |

NSR |

|||||

(g/t) |

Mt |

(g/t) |

(g/t) |

(g/t) |

($CDN) |

(koz) |

(koz) |

(koz) |

|

Indicated |

0.30 |

15.830 |

1.08 |

0.84 |

29.8 |

77.58 |

550.9 |

429.6 |

15,167 |

0.35 |

14.026 |

1.18 |

0.92 |

32.5 |

84.57 |

532.2 |

414.9 |

14,660 |

|

0.40 |

12.578 |

1.27 |

0.99 |

35.0 |

91.22 |

514.8 |

401.4 |

14,166 |

|

0.45 |

11.300 |

1.37 |

1.07 |

37.6 |

98.11 |

497.4 |

388.0 |

13,667 |

|

0.50 |

10.198 |

1.47 |

1.1 |

40.2 |

105.04 |

480.6 |

375.1 |

13,187 |

|

1.00 |

4.579 |

2.41 |

1.89 |

65.1 |

172.39 |

354.1 |

277.5 |

9,584 |

|

Inferred |

0.30 |

19.881 |

0.85 |

0.66 |

24.6 |

61.18 |

545.7 |

419.9 |

15,718 |

0.35 |

17.391 |

0.93 |

0.72 |

26.8 |

66.62 |

519.8 |

400.1 |

14,974 |

|

0.40 |

15.432 |

1.00 |

0.77 |

28.7 |

71.69 |

496.3 |

382.3 |

14,249 |

|

0.45 |

13.762 |

1.07 |

0.83 |

30.6 |

76.70 |

473.6 |

365.2 |

13,548 |

|

0.50 |

12.276 |

1.14 |

0.88 |

32.5 |

81.88 |

451.0 |

348.4 |

12,823 |

|

1.00 |

4.610 |

1.89 |

1.50 |

49.1 |

135.47 |

280.2 |

221.9 |

7,282 |

|

*Notes to the MRE table:

The Mineral Resource estimate has been prepared by Sue Bird, P.Eng., an independent Qualified Person. The effective date of the mineral resource estimate is February 11, 2023.

Mineral Resources are reported using the 2014 CIM Definition Standards and were estimated in accordance with the CIM 2019 Best Practices Guidelines, as required by NI43-101.

Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. There is no certainty that all Mineral Resources will be converted into Mineral Reserves.

These Mineral Resource estimates include Inferred Mineral Resources that are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued exploration.

-

The Mineral Resource has been confined by a "reasonable prospects of eventual economic extraction" pit using the following assumptions, which were estimated from comparable projects:

Au price of US$1,800/oz, Ag price of US$20/oz at an exchange rate of 0.75 US$ per CDN$;

99.8 % payable Au; 95.0 % payable Ag; US$4.25/oz Au and US$1.53/oz Ag offsite costs (refining, transport and insurance);

a 1.5 % NSR royalty; and uses a 94.8 % metallurgical recovery for Au and 77.2 % recovery for Ag;

Mining costs of CDN$2.56/tonne mineralized material, CDN$2.40/tonne waste, CDN$1.8/tonne overburden;

Processing Costs of CDN$12/tonne and G&A of CDN$5.00/tonne processed;

Pit slopes of 45 degrees.

The resulting NSR equation is: NSR (CDN$) = 75.67*Au Grade*0.948 + 0.74*Ag Grade*0.772

The resulting AuEq equation is: AuEq = Au + Ag*0.008

The bulk density of the deposit is based on 2021 & 2022 measurements and is 2.61 throughout the deposit and 2.00 for overburden.

The QP is not aware of political, environmental, or other risks that could materially affect the potential development of the Mineral Resources.

Numbers may not sum due to rounding.

2024 Initiatives & Progress

TDG has actively developing interest in potential joint ventures for its bulk tonnage targets 3 at Baker and surrounding areas, with a primary focus on porphyry-style Cu +/- Au. The objective is to unlock the porphyry-style mineralization potential 3 within the Baker Complex while also allowing TDG to pursue epithermal gold-silver mineralization in its known deposits or that may be related to porphyries 3 . Baker has never been drilled to depth and none of the target areas 3 identified by TDG have been systematically explored for potential porphyries using modern techniques. TDG continues to work towards an acceptable deal structure.

Drilling on the small-scale, existing historical Baker TSF was completed in August with the objective of characterizing the tailings for potential future processing. Assay results are pending. Looking to the future, engineering studies by Tetra Tech Inc. have identified a number of possible locations within the vicinity of the Shasta deposit for larger-scale dry-stack tailings storage facilities in excess of the capacity needed to handle the existing MRE 2 at Shasta, were it to be processed.

Shasta and Mets remain the most advanced assets within the TDG portfolio. Initial studies completed by external consultants suggest compatibility for both mining and processing, with the economics thereof yet to be evaluated. TDG continues to evaluate the results of the assays of TDG selected new samples from historical drillholes (particularly the 2007 and 2010 series), often from previously unsampled core. Once this analysis is completed, TDG plans to update the 2023 Shasta MRE. TDG remains optimistic about the resource expansion potential at Shasta, as well as the potential at TDG exploration targets 3 identified nearby - particularly Newberry and Shasta East (towards the boundary with the Amarc-Freeport Joint Venture on the adjacent property).

The acquisition of the Oxide Peak mineral tenures (news release Feb 14, 2024) and the Bot-Oxide Peak mineral tenures (news release Aug 02, 2024) joined TDG's land package into one contiguous tenure block with >55 km of continuous exploration potential 3 . Having 100% ownership of these additional mineral tenures has reduced ownership and future complexity and this has fed directly into TDG's ongoing joint venture discussions. It also creates opportunities for efficiencies in terms of fieldwork and reporting which TDG took advantage of in 2024 and anticipates will lead to overall net cost savings realized (versus the considerations paid) within the next 2 years. Additionally, TDG rented out a portion of the Baker Camp and related infrastructure to a third party during the 2024 field season, reducing TDG's holding costs. And TDG has followed the path of other companies by streamlining its management, operational teams and structures to deliver further cost savings.

One of the most exciting opportunities within TDG's portfolio remains its 100% owned Mets mining lease which is road accessible, covers 200 hectares, and is surrounded by Thesis Gold Inc.'s PEA-stage mineral claims 4 . Mets is still under-explored, with multiple targets 3 similar to the high grade, near surface A-Zone defined through geological, geophysical and geochemical work. TDG hopes that the recent rise in precious metal prices will lead to renewed interest for earlier stage exploration and support the systematic exploration to unlock Mets' potential in 2025.

Figure 2 - TDG's 100 % Owned Mets Mining Lease. *Not all tenure holders are identified and presented on this image. There may be additional tenure not displayed on this map.

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., Vice President, Exploration for TDG Gold Corp., a qualified person as defined by National Instrument 43-101.

1 Mineral Resource Estimate (MRE): All scientific and technical information relating to the TDG's Shasta Project pertaining to the Mineral Resource Estimate ("Shasta MRE") contained in this news release is derived from the Technical Report dated June 14, 2023 (with an effective date of February 11, 2023) titled "The Toodoggone Portfolio and the 2023 Resource Estimate for the Shasta Deposit" (the "2023 Technical Report") prepared by Sue Bird, MSc., P.Eng. of Moose Mountain Technical Services. The information contained herein in respect of the Shasta MRE is subject to all of the assumptions, qualifications and procedures set out in the 2023 Technical Report and reference should be made to the full text of the 2023 Technical Report, a copy of which has been filed with the securities regulators in each of the provinces of Canada (except Québec) and is available on https://www.sedarplus.ca/

2 GoldEquivalent ( AuEq ): Gold Equivalent (AuEq) is used for illustrative purposes, to express the combined value of Au and Ag as a percentage of Au on an in-situ basis. Calculations are uncut and recovery is assumed to be 94.8% for Au and 77.2% for Ag, with an Au price of US$1,800/oz and an Ag price of US$20/oz (based on price of gold trends over the past approximately three years), giving a resulting AuEq equation: AuEq = Au + Ag*0.008. Actual prices and recoveries (following metallurgical test work) may differ from these assumptions, which would change the ratio.

3 Mineral Exploration/Exploration Target Area(s): TDG is a mineral exploration focused company and the Company's Projects are in the mineral exploration stage only. The degree of risk increases substantially where an issuer's properties are in the mineral exploration stage as opposed to the development or operational stage. Exploration Targets and/or Exploration zones are speculative and there is no certainty that any future work or evaluation will lead to the definition of a mineral resource.

4 Adjacent Properties: The Company notes that while results from adjacent or nearby properties may indicate mineralization on these properties, the Company's property does not necessarily share the same geological characteristics or mineralization. The Company has no interest in, or rights to, any of the adjacent properties mentioned, and mineral deposits on adjacent properties are not necessarily indicative of mineralization on the Company's properties. Any references to resources, grades, or historical results are provided for information only and do not imply any certainty of achieving similar results on the Company's properties.

About TDG Gold Corp.

TDG is a major mineral tenure holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 32,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or under acquisition agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta and Baker mines, which produced intermittently between 1981-2012, and the historical high-grade gold Mets developed prospect, all of which are road accessible, and combined have over 65,000 m of historical drilling. The projects have been advanced through compilation of historical data, new geological mapping, geochemical and geophysical surveys and, at Shasta, 13,250 m of modern HQ drill testing of the known mineralization occurrences and their potential extensions. In May 2023, TDG published an updated Mineral Resource Estimate for Shasta (news release May 01, 2023) which remains open at depth and along strike. In January 2023, TDG defined a larger exploration target area adjacent to Shasta (‘Greater Shasta-Newberry'; news release Jan 25, 2023). In Fall 2023, TDG published the first modern drill results from the Mets mining lease (news releases Sep 07, 2023 , Sep 11, 2023 and Nov 28, 2023 ). In early 2024, TDG identified new copper-gold target areas over an expanded footprint covering ~53 sq.km known as the ‘Baker Complex' (news release Feb 28, 2024 ).

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as, "potential", "renowned", "prospective", "comprehensive", "definition", "generate", "framework", "anticipate", "tangible," "precursor", "unlock", "indicate", "advance", "suggest", "evaluate", "convince", "expand" and variations of these words as well as other similar words or statements that certain events or conditions "could", "may", "should", "would" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: whether the geophysical, geological and geochemical results are indicative of a porphyry intrusive with or without associated copper and/or gold mineralization; whether future exploration programs will successfully define potentially economic mineralization; the timing and availability of funding to support such exploration; accidents, labour disputes and other risks common to the mining industry; the availability of sufficient funding on terms acceptable to the Company to complete the planned work programs; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated, or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events, or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

* Inferred Mineral Resources are considered too speculative geologically to have economic considerations applied to them that would enable them to be categorized as Mineral Reserves. It is reasonably expected that the majority of Inferred Mineral Resources could be upgraded to Measured or Indicated Mineral Resource with continued exploration.

SOURCE: TDG Gold Corp.

View the original press release on accesswire.com