In today’s business environment, organizations and small businesses alike need to be as efficient as possible to succeed. E-billing easily direct them toward that goal by replacing the cumbersome, error-prone process of manually sending customer invoices and processing inbound payments with one system that does it all, often automatically. Among e-billing’s many benefits, companies can trim their expenses and improve cash flow.

What Is E-Billing (Electronic Billing)?

E-billing is a paperless approach to sending invoices and processing customer payments via the internet. E-billing is made possible by an electronic billing system or accounting software with embedded capabilities in their core systems that generates and sends bills to customers, accepts payments and tracks related data. Among its benefits: E-billing can increase invoice accuracy, accelerate the billing process and improve cash flow.

What’s an e-bill (electronic bill)?

E-bills are electronically generated and delivered invoices requesting payment for products or services rendered. They replace paper invoices created manually and sent via the U.S. Postal Service. E-bills typically contain the amount due, payment terms, a purchase order number and a link to a secure payment portal, where customers can pay their bills online using a credit or debit card, PayPal, ACH transfer or other payment method.

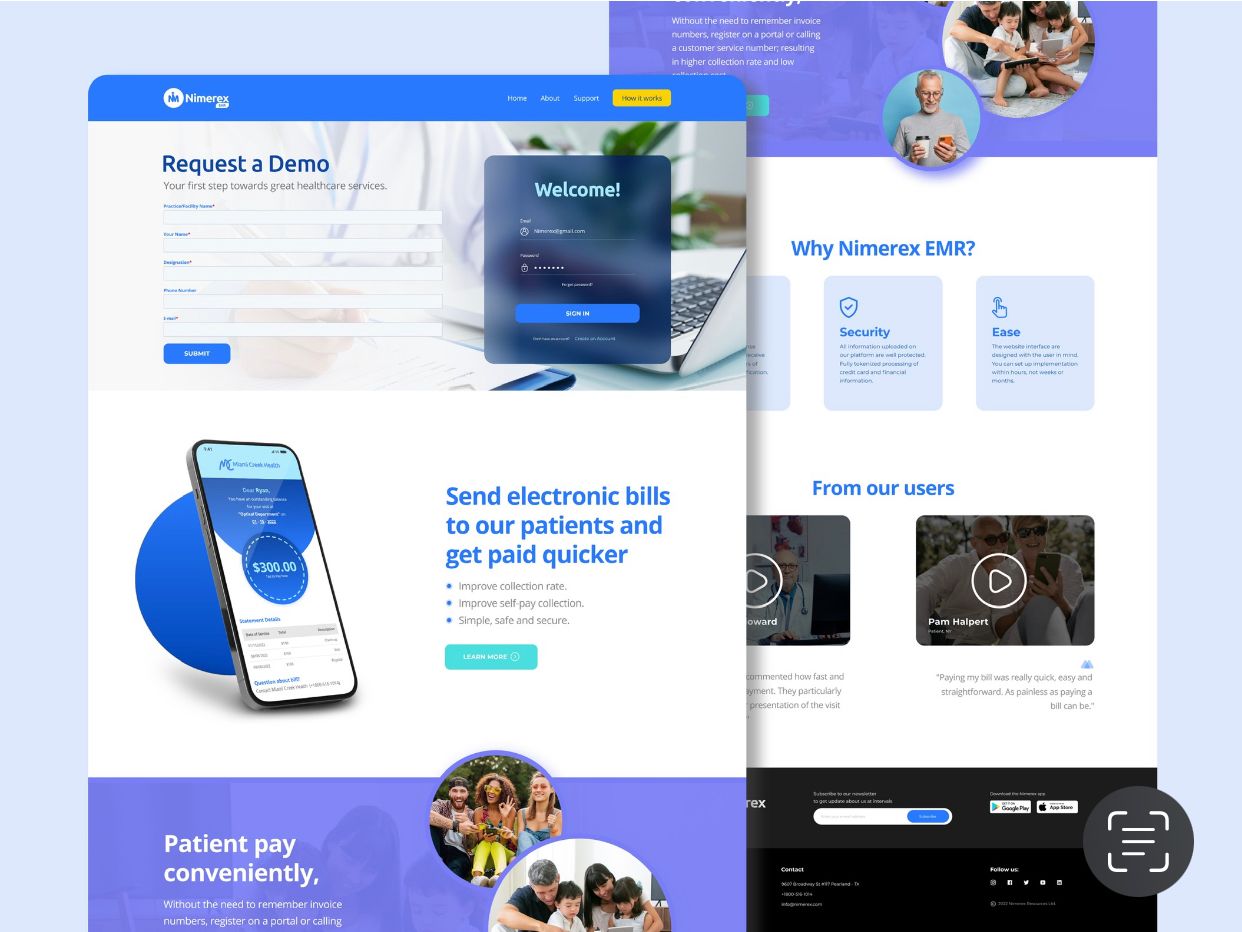

What is Nimerex e-billing system about?

The Nimerex electronic billing system integrates with several types of software that are involved in the billing and payments process. However, our system does not necessarily require an electronic billing system; Users can easily upload an Excel (CSV) files of all account receivables or send a single bill using the Nimerex Pay interface. Each bill is sent via SMS and email, with a payment link, which allows the customer make payment immediately. Customers are also able to schedule multiple payments or apply for external credit which immediately provides payment to the business.

E-billing and e-invoicing are often used interchangeably, but e-invoicing is actually just one piece of e-billing. e-invoicing refers to the electronic delivery of an invoice or bill to a customer for products sold or services rendered.

Key Takeaways

- E-billing enables a business to invoice clients and receive payments electronically.

- Among the benefits of e-billing are improved invoice accuracy, an accelerated billing process and better cash flow.

- It’s often more convenient for customers and may engender greater loyalty.

- E-billing can include automatic subscription renewals or automatic payment reminders.

E-Billing Explained

E-billing is a process used by accounts receivable staff to invoice customers and receive payments electronically. Customers can access their e-bills on the company’s website, or the e-bill can be delivered via SMS or an email attached with an electronic document, such as a PDF, XML file or in our case a link to a payment page will all details in it. In either scenario, customers have the ability to examine their bills online before making a payment.

But e-billing does more than streamline invoicing and payment. For example, e-billing can help a company better. E-billing reporting also provides stakeholders with the financial insight necessary for forecasting and deciding whether to engage in invoice financing or invoice factoring should cash flow look to be in jeopardy.

Most companies use one of two types of e-billing payment systems: biller direct or bank aggregator. In biller-direct e-billing, a customer logs onto a company’s website to view and pay its bills by entering their bank or credit card information. In bank-aggregator e-billing, a customer logs onto their bank’s website for their e-bills and pays using the bank’s payment interface. With Nimerex pay, a customer does not have to log into any system to make payment; they simply have to click on the link and payment in as quickly as 45 seconds.

How Does E-Billing Work?

An e-billing system eliminates time-consuming manual invoicing and payment processing. The following breaks down the array of steps involved.

- Information gathering: The system collects the customer’s billing data from accounting or ERP software including the price of the product or service provided, date of purchase and payment terms.

- Bill generation: The data is poured into a bill template, and then the bill is generated.

- Bill delivery: The bill is sent to the customer electronically by SMS and email, via a secure Web portal

- +. The customer receives notification that the e-bill is available.

- Bill reminders: The system sends electronic reminders to the customer if they have not opened their bill, their payment date is nearing or they missed a payment.

- Bill payment: E-bills often include a link to an online portal where customers can enter bank or credit card information and authorize bill payment.

What’s in an E-Bill?

Any information that appears on a traditional printed invoice will be on an e-bill. That includes the date the bill was issued, the amount owed, the date payment is due, the goods or services that were provided and payment terms. An e-bill often contains a clickable link to a payment portal, where the customer can pay electronically using their bank account or credit card information. E-bills make payment easier and more convenient for customers, which in turn may result in faster payment and increased customer satisfaction. To wit, 69% of more than 3,000 U.S. consumers surveyed by Fiserv in 2021 about their billing preferences said receiving e-bills increases their satisfaction with the billing company, and 36% said it makes them less likely to switch to a competitor.

Top E-Billing Benefits

E-billing is a win-win for both companies and customers. Here are many ways both parties’ benefit.

- Enhanced visibility: E-billing provides businesses and customers with a fast, simple way to see. Customers can be automatically reminded about unopened e-bills or upcoming or past due payments.

For example, a company can review reports from its e-billing system that track monthly e-bills and identify which customers are paying on time or are late. It can combine sales, marketing and other operational data with historical billing information to help decide which products to keep in stock. It may also use this data to determine which clients they’d work with again or what pricing terms to offer to those who pay on time versus those who don’t.

- Speedy payments: No doubt, e-billing is far faster than the traditional paper-based billing process, which requires invoices to be printed, stuffed in stamped envelopes and sent by regular mail. Two weeks can easily pass from the time it takes for the bill to arrive at its destination (assuming it does) and then be opened, paid and mailed back. Another assumption is that the bill will be paid on time and won’t require the company to issue additional bills.

E-billing shrinks the time between when a bill is generated and when it’s paid, sometimes to one day. Consider the example of a utility company that automatically sends a monthly e-bill to customers who have payments automatically withdrawn from their bank accounts. E-billing can also be used for subscription renewals, such as for a digital news media site. The bigger point: The less friction in the invoice and payment process, the quicker a company gets paid, which can improve its cash flow metrics.

- Greater accuracy: When processed manually, billing is more prone to data-entry and mathematical errors; at times it can result in duplicate billing or the need to reissue invoices that originally contained mistakes. What’s more, manual billing can open the door to invoice fraud and theft. Software-generated e-billing can help cut down on or eliminate those issues, as well as shorten time spent on investigating problems.

- Reduced expenses: E-billing eliminates the costs associated with printing, stuffing and mailing paper invoices. It also decreases the number of people needed to process and track payments, which also cuts costs. Instead of spending time on monotonous, repetitive activities related to billing, skilled employees can focus on more strategic, value-creating tasks. An e-billing system that scales as a business grows may obviate the need to hire more employees.

- Improved customer relationships: Customers are likely to have greater trust in businesses that offer e-billing because every charge is displayed and all historical payment data is easily available. Customers may also appreciate payment reminders that help them avoid late payment fees, or resubscription reminders so they don’t face a gap in service.

- More efficient collections: Automated reminders that payments are near-due can reduce a company’s need to chase after customers to collect what’s owed. Companies can also track which customers frequently pay late and could increase credit risk. As with the preceding point, improved collections can help keep a company’s cash flowing.

- More flexibility: E-bills can be sent wherever customers would like them delivered. This flexibility, plus the ability to make payments electronically, has taken on added importance as more businesses operate remotely.

- Hipper and greener: E-billing requires less energy and resources than a paper bill — think: paper, printer, ink, outgoing and return envelopes and postage. E-billing benefits the environment, and environmentally conscious customers will appreciate it.

Who Uses E-Billing?

A variety of business functions rely on an e-billing system to improve their performance. They include:

- Bookkeeping: E-billing provides the accounting department with detailed visibility into the status of the company’s bills outstanding and payments received. E-billing helps them balance and reconcile the books, more accurately forecast cash flow and improve working capital by reducing outsatandings which is the average number of days it takes to collect payments from customers after the completion of a sale.

- Accounts receivable: A company’s account receivable teams which is typically part of the accounting department, uses e-billing. AR is responsible for invoicing the company’s customers for their purchases of goods and services and receiving their payments.

- Customer service: If a customer calls the company or initiates an online chat with a billing or payment question, a customer service rep can refer to the e-billing system to assist them.

Conclusion

Setting up an efficient and accurate e-billing system helps a business keep costs low and customers happy. Digitizing everything from invoice creation to payment processing can increase the odds that businesses will be paid on time and in full by their customers. Now is the time to sign-up and refer other businesses to Nimerex PAY.

Request for Demo/Callback via https://www.nimerex.com/home/request.html or Signup here:https://www.nimerex.com/nimerex/register

Refer a business, Get $500 for referral.

Keywords: Nimerex Pay – e-bills, e-invoice, payments, e-payments, account receivable software, collection software, electronic payments, electronic bills, electronic invoice, business payment, service payment, healthcare payments.

Media Contact

Company Name: Nimerex.com

Contact Person: Awwal Badru

Email: Send Email

Phone: 8005161014

State: TX

Country: United States

Website: http://www.nimerex.com/