The global Digital Lending Platform Market size is estimated to arrive at USD 26.08 billion by 2028. It is projected to develop by 24.0% CAGR from 2021 to 2028.

Mainly, the digitization of lending services is giving benefits to borrowers along with the lenders by way of suitable procedure of loan application and the payment.

The digitization of lending services, furthermore, permits financial organizations to create superior as well as well-versed decisions, about the loan management.

To download the sample pdf of Digital Lending Platform Market Report “Please” click here https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market/request-sample

The solid stress placed by the financial organizations on digitalizing their services, to attain good organization of the business in addition to enhanced results, is anticipated to power the enlargement of the digital lending platform market.

To make sure the trouble-free accessibility of credit for the businesses, positive plans are taken up by the diverse governments. These are likely to impel the implementation of digital lending platforms, during the forecast period.

The eruption of the Covid-19 pandemic is likely to contain an optimistic influence on the expansion of the market for digital lending platform. Even as a number of companies, globally, are in front of the challenges in getting credit following the eruption of the pandemic, digital lending platforms are permitting companies to conveniently and easily increase the admittance to credit and increase their scope of business.

To browse report summary & detailed TOC, "please" click the link below: https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market

Further key findings from the report suggest:

• In 2020, North America held the major share of the digital lending platform market. For a huge number of technology supplier companies, the region is a homeland. So it gives vast opening for the implementation of digital lending platforms

• The cloud segment is projected to record the maximum CAGR, during the forecast period. Cloud deployment assists in decreasing up-front expenses, mainly for fresh applicants, considering a venture into the lending business

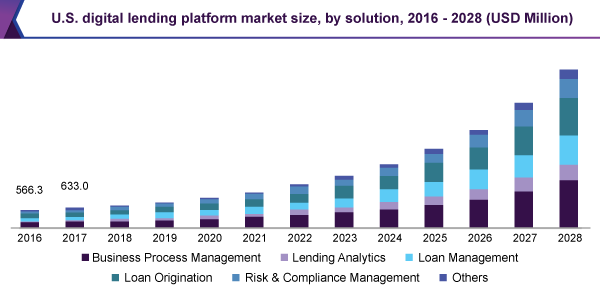

• The lending analytics section is expected to record the maximum CAGR, during the forecast period. The benefits given by the lending analytics solution for example, abridged operational expenditures, reduced risk of process, less work hours plus others, are pushing the enlargement of the section

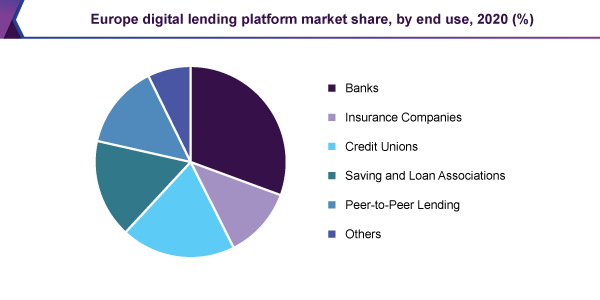

• The peer-to-peer lending sector is estimated to appear like the highest rising end-use sector, during the forecast period. As the digitally sense customer base goes on increasing, the implementation of the digital lending platforms is likely to increase grip

• The risk assessment section is expected to record the maximum CAGR, during the forecast period. The financial organizations are putting on solid stress, making it sure positive reaction to diverse cyber intimidation and return to normalcy in the incident of a cyber assault, is projected to propel the expansion of the risk assessment section.

Million Insights segmented the global digital lending platform market based on End Use, Deployment, Service, Solution, and Region.

Digital Lending Platform Solution Outlook (Revenue, USD Million, 2016 - 2028)

• Business Process Management

• Lending Analytics

• Loan Management

• Loan Origination

• Risk & Compliance Management

• Others

Digital Lending Platform Service Outlook (Revenue, USD Million, 2016 - 2028)

• Design & Implementation

• Training & Education

• Risk Assessment

• Consulting

• Support & Maintenance

Digital Lending Platform Deployment Outlook (Revenue, USD Million, 2016 - 2028)

• On-premise

• Cloud

Digital Lending Platform End-use Outlook (Revenue, USD Million, 2016 - 2028)

• Banks

• Insurance Companies

• Credit Unions

• Savings &Loan Associations

• Peer-to-Peer Lending

• Others

Digital Lending Platform Regional Outlook (Revenue, USD Million, 2016 - 2028)

• North America

• U.S.

• Canada

• Europe

• U.K.

• Germany

• Asia Pacific

• China

• India

• Japan

• Latin America

• Brazil

• Middle East & Africa

Companies

Various companies for digital lending platform market are:

• Tavant

• Roostify

• Nucleus Software

• Fiserv, Inc.

• Ellie Mae, Inc.

• Wizni, Inc.

• Sigma Infosolutions

• Pegasystems Inc.

• Newgen Software

• FIS

Read the Latest Press Releases by Million Insights:

• Sterilization Equipment Market: The global sterilization equipment market is estimated to arrive at USD 12.60 billion by 2028. It is projected to develop by 10.3% CAGR from 2021 to 2028.

• Waterproofing Membranes Market: As per the published report, the global waterproofing membranes market is estimated to arrive at USD 37.18 billion, by 2028. It is projected to develop by a 7.5% CAGR, from 2021 to 2028.

About Million Insights

Million Insights, is a distributor of market research reports, published by premium publishers only. We have a comprehensive market place that will enable you to compare data points, before you make a purchase. Enabling informed buying is our motto and we strive hard to ensure that our clients get to browse through multiple samples, prior to an investment. Service flexibility & the fastest response time are two pillars, on which our business model is founded. Our market research report store, includes in-depth reports, from across various industry verticals, such as healthcare, technology, chemicals, food & beverages, consumer goods, material science & automotive.

Media Contact

Company Name: Million Insights

Contact Person: Ryan Manuel

Email: Send Email

Phone: 91-20-65300184

Address:Office No. 302, 3rd Floor, Manikchand Galleria, Model Colony, Shivaji Nagar

City: Pune

State: Maharashtra

Country: India

Website: https://www.millioninsights.com/industry-reports/global-digital-lending-platform-market